Tsawwassen First Nation Final Agreement Implementation Report: 2011-2012

Table of contents

The Tsawwassen First Nation Final Agreement is British Columbia's first modern urban treaty and the first treaty completed under the British Columbia Treaty Commission. The governments of Canada, British Columbia, and Tsawwassen First Nation are partners in the Tsawwassen First Nation Final Agreement (the Treaty), which comprises a land claim and self-government agreement. The Treaty came into force on the Effective Date of April 3, 2009.

As required under the Final Agreement, the three responsible governments established a committee to provide a forum for the Parties to discuss and facilitate its implementation. This report summarizes the progress made in the third year of the Treaty, from April 1, 2011 to March 31, 2012.

PDF Version (2,679 Kb, 44 pages)

Tsawwassen: Land Facing the Sea

A Place

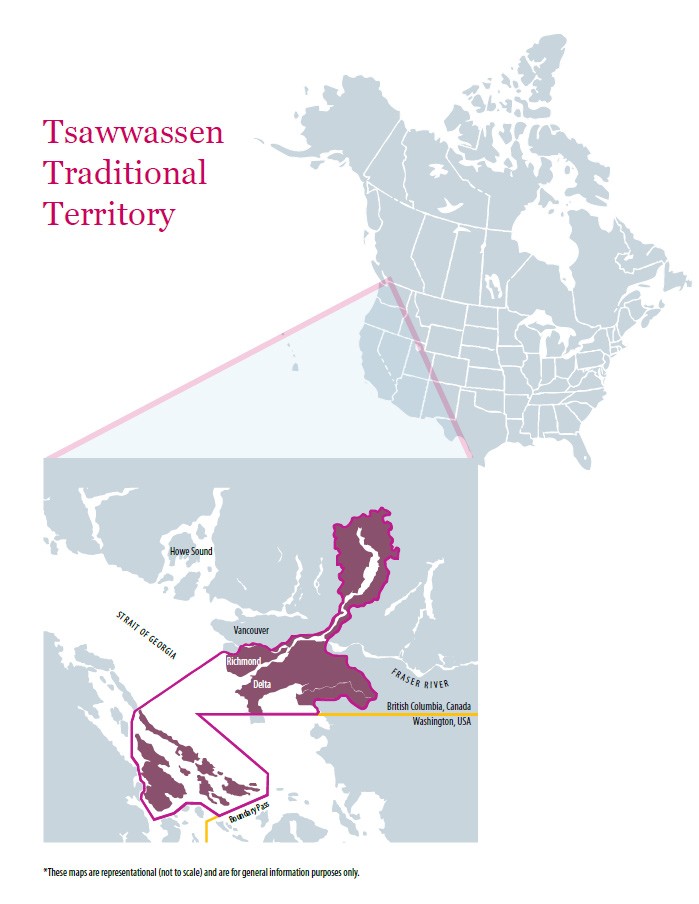

Since time immemorial, the Tsawwassen people have used and occupied a large coastal territory rich with fish, wildlife, and other natural resources. Tsawwassen traditional territory ranges across southern sections of what is now British Columbia – starting at the north end of Pitt Lake and following the Pitt River to the Fraser River and into the Strait of Georgia; as far east as New Westminster; south to the international border; and west to the southern Gulf Islands. Tsawwassen is a Hun'qum'i'num word that means "Land Facing the Sea." Tsawwassen First Nation's home and treaty lands are situated near Roberts Bank on the shore of the Salish Sea.

A People

The Tsawwassen people belong to the seafaring Coast Salish. Tsawwassen First Nation includes 435 Members. Approximately half live on Tsawwassen Lands and the rest reside in British Columbia's Lower Mainland, Whatcom County (Washington), the interior of British Columbia, and elsewhere in North America. The community is young and growing, with 40 percent of Members under the age of 18. Tsawwassen people are proud of their heritage, cultural traditions, and reputation as a welcoming, close-knit community.

A Vision

Prior to the realization of self-government under the Tsawwassen First Nation Final Agreement, Tsawwassen Members developed a strategic plan to set treaty implementation goals for their community and government. That plan is articulated in the following vision statement.

"What We Are Working Toward: Tsawwassen First Nation will be an ideal location to raise a family, and a working model of an environmentally sustainable, self-sufficient, and culturally proud First Nation community. Tsawwassen First Nation Government will, at all times, be oriented towards serving our Membership, and will exercise the selfgovernment powers of the Tsawwassen First Nation Final Agreement."

Tsawwassen First Nation Final Agreement

The governments of Canada, British Columbia, and Tsawwassen First Nation (the Parties) entered the B.C. Treaty Commission negotiation process with several objectives. These objectives included: enabling Tsawwassen First Nation (TFN) to evolve and flourish as a self-governing, self-sufficient, and sustainable community; achieving certainty in respect of land ownership and resource rights; and providing opportunity for Tsawwassen Members to participate more fully in the economic, political, and social life of British Columbia. The Parties sought a treaty that would herald a new government-to-government relationship based on mutual respect and reconciliation.

The result is the Tsawwassen First Nation Final Agreement. A historic achievement, the Treaty clarifies legal rights to lands and resources, and self-government for Tsawwassen First Nation. The Treaty provides certainty for residents and investors, benefiting all Canadians. It achieves true reconciliation—proving that a modern society can correct the mistakes of the past, while providing for differences in values and cultures.

A comprehensive land claim and self-government agreement, the Treaty provided for:

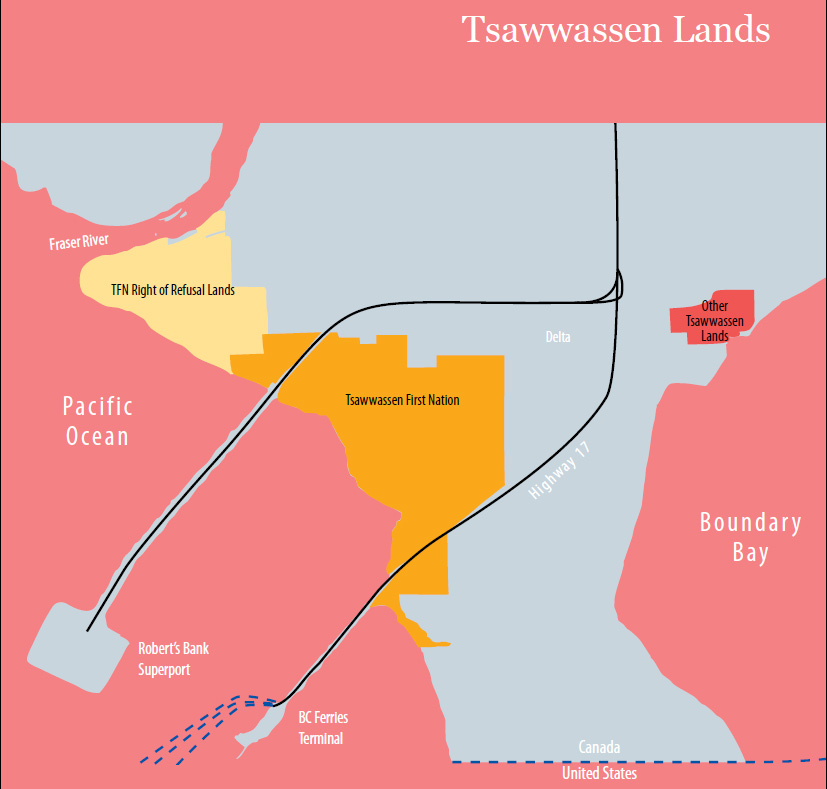

- transfer of over 724 hectares of land (Tsawwassen Land) previously held by Canada or British Columbia to TFN in fee simple;

- resolution of TFN's claims to over 10,000 square kilometres for land title and rights to harvest migratory birds, wildlife, and plants;

- an agreed-upon percentage of the total annual Fraser River sockeye catch and fishing opportunities for crab for non-commercial purposes;

- establishing, within the Canadian constitution, a democratically-elected TFN Government with the ability to make laws, deliver programs and services, and collect taxes; and

- tools for a new government-to-government relationship between Canada, British Columbia, and Tsawwassen First Nation.

Treaty Implementation Committee

The Parties view the Treaty as the start of a new government-to-government relationship. To oversee this relationship, the Treaty establishes an Implementation Committee consisting of one representative each from the governments of Canada, British Columbia, and TFN. Broadly stated, implementation means undertaking all the activities needed to comply with, or give effect to, all the provisions in the Treaty after its Effective Date. The Implementation Committee assists the Parties to meet their obligations under the Treaty, attempts to resolve government-to-government issues as they arise, and communicates on implementation activities with agencies that are internal to each government.

During the reporting period, the Implementation Committee met four times (in person or via teleconference), and engaged in tri-partite working groups to address specific issues in depth. The Parties maintained a constructive working relationship while attempting to establish new joint activities and reconcile differing views. The following are highlights of those discussions.

Overlap Parcel

Due to technical complications, Canada and British Columbia have been unable to register a small parcel of Tsawwassen Lands (Lot A plan BCP12879) in the BC Land Titles Office (LTO). The parcel of about 6,000 square metres on the Fraser River is registered as part of a federal water lot under Transport Canada, managed by Port Metro Vancouver. During the reporting period, Canada prepared a draft legal survey plan for the Parties' approval. The Parties discussed legal and technical solutions to register the property in the provincial system while ensuring the registration process respects the Treaty and applicable laws. TFN and British Columbia proposed a potential approach, which is under review by Transport Canada.

Access to Federal Programs

This issue was first raised in the previous reporting period when TFN applied for funding from the federal Professional and Institutional Development (P&ID) program, and was declined. TFN maintains that federal Fiscal Financing Agreement (FFA) payments do not fund professional and institutional development and do not preclude TFN's eligibility for this program. Canada maintains that TFN receives FFA payments in lieu of P&ID program funding. The Parties had a number of discussions exploring each other's interpretation, and continued working to develop a compromise.

Sewer & Water Works

During the reporting period, Canada discharged a pre-treaty commitment made in 2006 to provide capital for TFN physical works and infrastructure. Canada also provided a $1.36 million payment from the federal Infrastructure Stimulus Fund (IFS) to TFN for sewage treatment facilities and upgrades. TFN was the only First Nation in Canada to receive funding from the IFS, a portion of Canada's Economic Action Plan where eligibility was restricted to governments of the provinces, municipalities, and self-governing treaty First Nations.

Fiscal & Statistical Management Act

Tsawwassen First Nation has been working with Canada and British Columbia to access low-cost municipal type infrastructure financing under the framework set out by the First Nation Fiscal and Statistical Management Act (FNFSMA). This piece of federal legislation provides for low-cost loans to Indian Act First Nations. However, a provision in the FNFSMA allows self-governing First Nations to access the same financing by regulation. The Parties continued working to develop a functional structure in order to enable TFN to borrow under FNFSMA. British Columbia is participating because of its role in TFN property tax jurisdiction.

Own Source Revenue Reporting

The Parties have agreed that TFN should reduce its reliance on federal and provincial transfer payments as TFN becomes more self-sufficient over time. Under the tri-partite Own Source Revenue Agreement, TFN reports its own source revenue amounts each fiscal year. During the reporting period, TFN continued to refine its reporting methodology for the 2009/10 OSR report to address data gaps.

Impacts of McIvor

Canada and TFN discussed the impacts of federal Bill C-3, which enables more individuals to register as Status Indians as a result of McIvor v. Canada (2009). TFN is concerned that this is increasing the Status Indian membership at TFN, resulting in increased funding obligations for TFN, with no increase in funding under the current Fiscal Financing Agreement (FFA). Under the FFA, s. 8.1 says the Parties will discuss exceptional circumstances, which were not reasonably foreseeable, and which create financial pressures that would significantly impair the ability of TFN to meet its obligations under the FFA. TFN provided an analysis on the effects of Bill C-3 on TFN's ability to deliver programs and services. The Parties continue to discuss financial pressures on TFN that may result from the Bill. During the reporting period, Canada was engaged in a national analysis to determine whether there were financial pressures on programs and services arising from Bill C-3.

Taxation Matters

During the reporting period, TFN raised a proposal to amend federal taxation of pensions for Tsawwassen Members. Pensions earned on a federal reserve are not subject to income tax due to exemptions under the Indian Act. TFN is concerned that, when Indian Act tax exemptions are phased out under the Treaty, existing pensions of Tsawwassen Members will be subject to taxation at rates higher than those for which the pensions had been originally designed. The matter remained under consideration by Finance Canada.

In addition, British Columbia met with TFN to discuss payment of a Harmonised Sales Tax rebate to TFN, after the Province reversed its decision to implement the HST. Tsawwassen First Nation and British Columbia are working on draft agreements that provide for reimbursement.

Annual Reporting

The Implementation Committee is responsible under the treaty to provide for the preparation of an annual report on implementation. This is the third annual report, in both official languages, and it covers activities that took place between April 1, 2011 and March 31, 2012.

For more information, visit:

- Tsawwassen First Nation Final Agreement

- The complete Treaty Implementation Plan (PDF Version, 2.37 MB)

- The Government of Canada's Approach to Implementation of the Inherent Right and the Negotiation of Aboriginal Self-Government

- British Columbia Ministry of Aboriginal Relations and Reconciliation

- British Columbia Treaty Commission

Tsawwassen Lands

Located just 30 kilometres from both downtown Vancouver and the international border, adjacent to both the Tsawwassen Ferry Terminal and Port Metro Vancouver's Deltaport facility, Tsawwassen Lands are in an enviable position to take advantage of economic opportunities. As the Lower Mainland's population and economy continue to grow, Tsawwassen Members are able to realize benefits from the development of Tsawwassen Lands through the Treaty. At the same time, the Treaty equips Tsawwassen First Nation with the power to ensure that development proceeds in a manner that is both environmentally and culturally sustainable.

Land Registry

For the sake of consistency with the surrounding system, TFN chose to register Tsawwassen Lands in the BC Land Title Office (LTO). The LTO is based on the Torrens system of land registry, which provides certainty and security of title to interest holders. Registration in the LTO improves TFN's system of land tenure, provides investor confidence, and assists TFN in managing its land affairs. Provincial legislation was amended to accommodate the registration of Tsawwassen Lands in the LTO, to accommodate TFN fee simple title, and to ensure the integrity of TFN's unique Aboriginal interest in and relationship to its land base.

TFN Land Use Planning

The Tsawwassen First Nation Lands Department develops and administers land use planning and regulation on Tsawwassen Lands. This includes assisting with registering land interests; implementing and enforcing land related acts, regulations, and bylaws; issuing permits; and undertaking other municipal-like functions. TFN's Land Use Plan and Industrial Land Use Master Plan help guide land use on Tsawwassen Lands.

During the reporting period, TFN's Lands Department:

- continued to monitor the stability of English Bluff, undertook bluff inspections with North West Holding Society, and discussed interim management action plans through the Community Consultation Committee;

- began processing eight rezoning, development permit, and subdivision applications;

- continued to establish processes for managing land related transactions through implementation of a new records management system;

- finalized land related application forms and requirements;

- approved new soil regulations in order to streamline the permit process and continue to protect the environmental health of Tsawwassen Lands;

- planned land requirements and project scope for a new playing/sports field in advance of design and construction,

- coordinated the development of a plan respecting the draining of some Tsawwassen Lands and continued work on an inventory, modeling, analysis, and final report;

- continued the management and approvals process for a new subdivision, infrastructure services, and related permitting;

- completed an inventory of rental housing and related Agriculture Lands.

Provision of Local Services

TFN works with Canada, British Columbia, Metro Vancouver, and the Corporation of Delta to provide services on Tsawwassen Lands. This includes the provision of regional services, such as water and sewer, and local services, including police, parks, and drainage. Some of these services are provided as a result of TFN's membership in Metro Vancouver, some are provided through a series of service contracts with the Corporation of Delta, and others are provided directly by TFN.

Development Review & Consultation

The Treaty empowers TFN to evaluate all proposed developments on Tsawwassen Lands. In collaboration with TFN, British Columbia manages a custom process for development applications within Tsawwassen Lands. The Treaty also requires Canada and British Columbia to consult TFN on any proposed federal or provincial projects, respectively, that may adversely affect Tsawwassen Lands, residents of Tsawwassen Lands, or TFN Treaty rights. During the reporting period, the Parties consulted on the following projects:

- British Columbia consulted with TFN on the 41B overpass project. Work was substantially completed in December 2011 and the overpass is open to traffic.

- The Canadian Environmental Assessment Agency met with TFN regarding the comprehensive study-level environmental assessment of the proposed Burnco Aggregate Mine.

- Transport Canada and the Department of Fisheries and Oceans Canada (DFO) engaged in discussions with TFN regarding Fraser Wharves Ltd. Vehicle Storage Facility Expansion Project (environmental assessments started in April 2009) and the CN Rail Ewen Branch Extension Project (environmental assessment started in 2008).

- British Columbia and Port Metro Vancouver conducted a cooperative federal-provincial environmental assessment for the Vancouver Airport Fuel Delivery Project in accordance with the BC Environmental Assessment Act and Canadian Environmental Assessment Act.

- DFO and Environment Canada engaged in discussions with TFN in relation to the Tsawwassen Mills and Commons Project, and the TFN Industrial Lands Development. Screening-level environmental assessments commenced in November 2010, and March 2012, respectively, under the appropriate processes.

Natural Resources

For countless generations, Tsawwassen people have respected and protected the gifts of the land and sea. Increasing development and urbanization, however, have impacted the natural environment in Tsawwassen First Nation's traditional territory. Through the Tsawwassen First Nation Final Agreement, TFN exercises its rights to this natural bounty and manages these resources cooperatively with federal and provincial regulatory agencies.

TFN Natural Resources Department

The Natural Resources Department of Tsawwassen Government administers the Treaty agreement between TFN, British Columbia, and Canada on catch limits for crab, salmon, eulachon, other fisheries, and aquatic plants. In concert with the Joint Fisheries Committee, the department organizes, monitors, and enforces TFN activities and regulations in relation to the harvest and conservation of fish, wildlife, migratory birds and plants; reviews development proposals from proponents and referred from other governments ("referrals"); and, where possible, negotiates Impact Benefit Agreements. In addition, the department:

- implements the Tsawwassen Fisheries Plan;

- manages departmental staff (catch monitors, enforcement officers, etc.) to implement a fisheries program that complies with the terms and conditions of the Treaty and TFN's Fisheries, Wildlife, Migratory Birds and Renewable Resources Act;

- manages consultations for referrals relating to proposed projects on Tsawwassen Lands;

- compiles fisheries data and reports to DFO through the Joint Fisheries Committee;

- leads TFN participation in environmental assessments undertaken by other governments;

- has overall responsibility for archaeology and heritage.

Fisheries Management

For Tsawwassen First Nation, participation in the management of the fishery is vital for cultural as well as economic reasons. Subject to conservation measures, TFN encourages its Members to exercise their rights to fish, hunt, and gather. Under the Treaty, TFN issues licences that clearly show which Members have been designated by TFN to fish for the food, social, or ceremonial needs of the community. Designated Members must carry these licences when harvesting or transporting fish for domestic purposes. Designated fishing vessels must clearly display the TFN identification decal. This documentation helps fisheries regulatory staff of all Parties to respect the TFN Fishing Right.

Since the Effective Date, the Treaty obligates Canada to issue Harvest Documents for TFN to exercise its Fishing Right, guided by a Tsawwassen Annual Fishing Plan and recommendations of a Joint Fisheries Committee. The Parties are also obligated to develop, update, and maintain the Fisheries Operational Guidelines (FOG) that describe operating principles and procedures for a Joint Fisheries Committee, which makes recommendations on fisheries matters. During the reporting period, minor revisions were made to the FOG to reflect improvements in catch monitoring procedures.

Food, Social, & Ceremonial (FSC) Fishery

During the reporting period, Canada provided TFN with fishing opportunities to meet domestic needs, including species for which no pre-determined catch limit was set (see FSC Fisheries chart). Due to on-going conservation concerns, ceremonial fisheries for Fraser River eulachon were limited due to over harvest upstream of the Port Mann Bridge. Canada did not issue a Harvest Document license for groundfish (rockfish, lingcod, halibut, dogfish, and sole). TFN did not access its Intertidal Bivalve Fishing Area. TFN continued consultations with the Hul'quminum Treaty Group and other First Nations where their traditional territories overlap the non-exclusive TFN bivalve harvest area.

Although conservation constraints affected TFN's ability to achieve allocations for some species during the reporting period, Canada did not reduce TFN allocations for FSC purposes. TFN is up to date on all catch reporting requirements. Details are available in the Tsawwassen Post-Season Fisheries Report (2011).

TFN harvested less than its allocation for sockeye, chinook, pink, coho, and chum salmon. No underage will be carried forward for coho and chum. Pink underages were not carried forward. The remaining 42 chinook will not be carried forward as an underage for 2012. The shortfall resulted from self-imposed fishing restrictions by TFN to protect early-timed chinook stocks.

Tsawwassen Fisheries purchased a plumbed tank to hold live crab pending distribution. The Joint Fisheries Committee recommended the tank to address concerns of proper documentation for the distribution of crab to Tsawwassen members and other First Nations Communities for domestic consumption.

| Species | Harvest Total | ||

|---|---|---|---|

| 2009 | 2010 | 2011 | |

| Sockeye | 1,132 | 15,226 | 9,995 |

| Chinook | 995 | 338 | 583 |

| Pink | 72 | 2 | 84 |

| Coho | 57 | 3 | 43 |

| Chum | 1,320 | 2,019 | 2,414 |

| Eulachon | 49 lbs. | 50 lbs. | 39.3 lbs. |

| Dungeness crab | 24,712 | 21,588 | 20,327 |

| Red Rock crab | 0 | 2 | 0 |

Commercial Fishery

On the Effective Date, the Parties entered into a 25-year Harvest Agreement, which sets out commercial allocations of Fraser River sockeye, chum, and pink salmon, as well as crab license conditions in the lower Strait of Georgia and Boundary Bay. The agreement has requirements comparable to those governing general commercial fisheries.

During the reporting period, TFN had a commercial sockeye allocation of 64,780 fish and harvested 45,098 (see Commercial Fisheries chart). TFN, along with the Matsqui First Nation, submitted a joint Selective Commercial Pink Proposal to DFO, which was approved. In addition, TFN submitted to DFO a Selective Commercial Chum Proposals, which was also approved. However, with the timing of the chum run, and the size of the allocation, the selective fishery method was not required.

| Species | Harvest Total | ||

|---|---|---|---|

| 2009 | 2010 | 2011 | |

| Chum | 98,315 | 45,098 | |

| Sockeye | 3,416 | 2,414 | |

| Pink | 5,337 | ||

| Dungeness crab | 1,364 | ||

Fisheries Enforcement

On the Effective Date, Canada and TFN entered into an agreement to facilitate cooperation on enforcement of both federal and Tsawwassen laws for Tsawwassen domestic fisheries. While the agreement does not cover prosecution, it aims to clarify the activities of enforcement officers of both Parties. These activities include education, issuing warnings and tickets, using restorative justice, seizing gear and catch, collecting fines, and making arrests for fisheries offences.

During the reporting period, only six infractions were noted. TFN experienced good compliance with fishers submitting harvest information.

Fisheries Investments

In 2006, Canada committed to provide $1.5 million for TFN to acquire commercial crab fishing licences from willing sellers, thereby increasing TFN participation in commercial crab fisheries. In 2009, Canada provided $540,000 to TFN in partial fulfillment of the total commitment. During the reporting period, Canada paid the remaining $960,000 balance. Adjusted for inflation, Canada made a payment of $1.1 million to TFN at the end of the reporting period.

Resource Management

As the need arises, TFN collaborates with Canada and British Columbia in the management of other fisheries, wildlife, migratory birds, renewable resources, and plants. TFN prepares harvesting plans, consults with appropriate federal or provincial agencies, then seeks approval of these plans. Resource use by Tsawwassen Members continues to evolve as rights are now clarified under the Treaty.

During the reporting period, TFN worked to establish a regime for licencing Members who wish to exercise their resource gathering rights under the Treaty.

National Parks

During the reporting period, Canada and TFN shared information on harvesting in the Gulf Islands National Park Reserve (GINPR). The Parties continued to work on an agreement for cooperation in planning and management in GINPR, and expect to conclude that agreement in 2012-13. Canada and British Columbia are undertaking a feasibility study for a proposed National Marine Conservation Area Reserve (NMCAR) in the southern Strait of Georgia. Parks Canada has engaged TFN in the feasibility study, and is committed to further consultations with TFN and other local First Nations on the proposed NMCAR in the upcoming reporting periods.

Provincial Parks

Similarly, the Treaty ensures Tsawwassen members the right to gather plants for food, social, or ceremonial purposes in areas set out in Appendix M-2 of the treaty, according to an approved gathering plan issued by British Columbia. The Treaty stipulates that any gathering plan that includes provincial Crown land within Burns Bog be consistent with the Burns Bog Management Agreement. During the reporting period, British Columbia and TFN established new gathering plans for provincial parks and continued discussions on establishing gathering plans for Burns Bog.

Governance

The self-government provisions of the Treaty have transformed how Tsawwassen First Nation is governed. A Strategic Plan, and annual service plans and reports, help guide the evolution and management of Tsawwassen self-government. Under the Treaty, Tsawwassen First Nation has designed a government that ensures democracy, transparency, accountability to Tsawwassen Members, and protections for non-Members living on Tsawwassen Lands. Tsawwassen First Nation has the following governing bodies.

Tsawwassen Legislature: 12 elected Tsawwassen Members plus an elected Chief. The Legislature discusses and makes laws, and approves an annual budget. During the reporting period, the Legislature held its Fall Session November 1 - 23, 2011 and Spring Session February 15 - March 15, 2012. The Legislature approved the 2012-2013 budget and passed the following legislation:

- Land Amendment Act

- 2011-2012 Appropriations Act

- Education, Health and Social Services Amendment Act

- Land Use Planning and Development Act (amendment)

- 2011-2012 Appropriations Act (amendment)

- Appropriations Act (2010) (amendment).

Updated on a regular basis, a full list of Tsawwassen laws and regulations is available to the public on TFN's website.

Executive Council: the Chief and the four Tsawwassen Members elected to the Tsawwassen Legislature with the highest number of votes. The Executive Council is the Tsawwassen Government that establishes policy and strategic direction. Summaries of those meetings can be found in the Quarterly Issues of Council's Corner and the 2011-2012 TFN Annual Report.

Advisory Council: established under the Tsawwassen Constitution, this council has six Tsawwassen Members elected by all Tsawwassen Members present at the Annual General Meeting. The Advisory Council ensures that proposed laws, regulations, and other actions of government are considered by the Tsawwassen Membership before being passed or approved by the Legislature.

Judicial Council: a mix of Tsawwassen Members and non-Members with significant legal and judicial experience. The Judicial Council hears challenges to Tsawwassen laws, resolves disputes between Members and elected officials, makes recommendations on sentencing of Members where requested by the courts, and other duties assigned by Executive Council.

Consultation Committee: a group of non-Member leaseholders on Tsawwassen Lands. The committee is established by the Executive Council to consult on issues that significantly and directly affect leaseholder interests, such as regulatory structures and economic development plans.

Property Tax Authority: a committee of Executive Council Members and non-Member ratepayers, responsible for approving tax rates and expenditures in respect of residential property taxes.

Tsawwassen Government Services

The Treaty revolutionized the structure of TFN government. New governing bodies were created under the Tsawwassen Constitution. Instead of the Indian Act, TFN rearranged its financial structure to ensure accountability to Tsawwassen Members for revenue and spending decisions made by the elected Tsawwassen Government. A new Tsawwassen Government Services Department was created to work effectively with Canada and British Columbia on the Implementation Committee to apply treaty provisions and meet obligations. Tsawwassen Government Services supports the day-to-day operations of Tsawwassen Government, liaises with other levels of government and First Nations organizations, and is responsible for keeping Tsawwassen Members and the general public informed about Tsawwassen Government activities.

In addition to the treaty activities previously noted, during the reporting period Tsawwassen Government:

- consulted Members on a number of implementation issues, regulatory and policy changes, and land development proposals;

- continued to develop a Financial Plan to assist in the evaluation of economic development proposals;

- reviewed all committee and board agendas for Metro Vancouver and Translink, providing comments and policy advice;

- delivered the TFN 2010-2011 Annual Report;

- presented an update of TFN's progress and challenges at the British Columbia Assembly of First Nations AGM and participated in building the assembly's Governance Toolkit.

Tsawwassen First Nation's Chief also occupies a seat at the table of the Metro Vancouver Board of Directors, and on Translink's Mayor's Council. TFN's Chief regularly accepts invitations to speak at events and conferences that ensure TFN's profile is enhanced and respected in the region and abroad. During the reporting period, the Chief spoke at the Vancouver Board of Trade, the Crown-First Nations Gathering, the United Nations Permanent Forum on Indigenous Issues, and the World Indigenous Housing Conference. Other TFN representatives took part in numerous forums and events hosted by business, arts, and education institutions.

Quality of Life Survey

TFN is developing a survey tool, in collaboration with the University of British Columbia, to measure the quality of life and community well-being at TFN post-Treaty. During the reporting period, the survey design was finalized, and a plan to administer the survey was put in place for the next reporting period.

Legal Services

In order to provide comprehensive legal services to Tsawwassen Government and Members, TFN has a Legal Services Department tasked with the following responsibilities:

- managing the complaints resolution process;

- managing logistical operations of, and liaising with, the Judicial Council, TFN prosecutors, and TFN Government;

- supporting TFN participation in the provincial or supreme courts;

- assisting with the enforcement of TFN laws and regulations.

During the reporting period, TFN Legal Services:

- continued to participate in the Commission of Inquiry into the Decline of Sockeye Salmon in the Fraser River (the Cohen Commission);

- undertook a comprehensive review of the enforcement provisions, with particular reference to the Fisheries, Wildlife, Migratory Birds, and Renewable Resources Act (Tsawwassen First Nation) and numerous regulations;

- developed changes to the Fisheries, Wildlife, Migratory Birds, and Renewable Resources Act Enforcement Regulations.

Provincial Legislation

Under the Treaty, British Columbia is required to provide written notice to TFN of the proposed introduction of, or changes to, provincial legislation or regulation that may affect Tsawwassen Government law-making, except in circumstances of emergency or confidentiality. During the reporting period, British Columbia notified TFN regarding the repeal and replacement of Section 12 of the Tsawwassen First Nation Final Agreement Act, which was made through the Yale First Nation Final Agreement Act. Section 12 of the Tsawwassen First Nation Final Agreement Act, when brought into force by a regulation, will provide for a revised process respecting how the TFN Tax Treatment Agreement (TTA) is given effect and how it may be amended. When the Tsawwassen First Nation Final Agreement Act was introduced in 2007, the TTA was defined as that version tabled in the Legislature at First Reading of that bill. The 2007 provision did not provide for a means for amending the TTA, which was the impetus for the change.

In addition, British Columbia notified TFN regarding the following statutes:

- adoption of the Miscellaneous Statutes Amendment Act enabling the TFN to join the Greater Vancouver Sewerage and Drainage District;

- proposal to amend the Wildlife Act to address dangerous wildlife attractants;

- Bill 12, the Teachers Act.

Risk Management

In order to minimize strategic risk, TFN took steps to ensure that appropriate due diligence is undertaken in advance of the making of decisions – especially decisions involving the land development. Strong legal and research analysis on major decisions is a general aspect of this category of risk management. Specifically, during the reporting period TFN developed a risk management framework to evaluate industrial land development proposals. This framework was built with support from the TFN Economic Development Corporation and Partnerships B.C., and presented to TFN's Legislature. Executive Council also undertook an exploration of TFN's ability to limit liability risks that could arise from activities on Tsawwassen Lands.

Programs and Services

The Treaty enables Tsawwassen Government to assume responsibility for delivering agreed-upon government programs and services previously provided by Canada or British Columbia. At the same time, Tsawwassen First Nation remains eligible for government programs and services for which it has not assumed responsibility through the Fiscal Financing Agreement (FFA). Tsawwassen Members, the Tsawwassen Government, or Tsawwassen public institutions on behalf of Tsawwassen Members may apply for funding from such programs, subject to program eligibility criteria. In some instances, TFN has broadened programs or eligibility beyond the requirements in the FFA.

Health and Social Services

TFN's Health and Social Services Department works to support the health and well-being of Tsawwassen Members. In pursuit of this goal, the department delivers the following programs and services:

- Community Health Program (offering prenatal, drug, and alcohol counseling);

- Adult Care Program (assisting Members with functional limitations to maintain their independence);

- Home Care Services (providing nursing and in-home care attendants);

- Elders' Program (providing social and recreational activities).

To help strengthen and support Tsawwassen families, TFN provides the Family Empowerment program, which offers:

- counseling services to families with a goal of reducing the number of contacts between British Columbia's Ministry of Children and Family Development and Tsawwassen children, drug and alcohol prevention services, one-to-one parenting services, group activities for youth, and family violence prevention services;

- Aboriginal Family Resources on the Go (AFROG), a mobile family services program (funded by British Columbia);

- the Family Support program, which provides assistance to children who are in care of the provincial government and their families.

TFN provides social assistance to TFN Members and Aboriginal people living on Tsawwassen Lands. Under the Treaty, the provision of service by TFN to non-Aboriginals ceased on the Effective Date. Non-Aboriginals living on Tsawwassen Lands now access social assistance from provincial offices. Social assistance program components cover basic needs, guardian financial assistance, shelter, and National Child Benefit reinvestment. Funding for social assistance is provided through the federal block funding negotiated under the Treaty. The new funding model and the transfer of jurisdiction from Canada to TFN provides increased flexibility in the use of this funding. British Columbia reports that its Ministry of Social Development staff have built a positive liaison relationship with TFN's Health and Social Services Department, and hold bi-annual meetings to discuss common concerns, changes, and updates.

The TFN Social Services department is also responsible for the Cultural Purposes Fund. This fund is used to advance the Hun'qum'i'num language, TFN history, traditions, symbols, storytelling, song, and dance, and to help Members engage in other practices of Tsawwassen culture.

During the reporting period TFN's Health & Social Services Department:

- assisted Members with various health issues from Health Canada forms, dental requests, prescription costs, physiotherapy, and nutrition;

- provided Members with transportation to and from health care appointments;

- continued to advocate for members who are involved in the health care system;

- organized the Annual Health Fair, which included a variety of health care professionals and provided diabetic information and informal glucose testing;

- organized and facilitated diabetic workshops as well and monthly educations seminars at the Elders Centre;

- provided all vaccines to TFN Members through the Fraser Health Authority public health nurse;

- continued to develop a comprehensive, on-going drug and alcohol strategy (in partnership with neighbouring services providers).

During the reporting period, TFN recognized that its delivery of social services had fallen short of its goals and launched plans to reform some services and deliver Members better service across a range of programs. To that end, Executive Council called for an Organizational Efficiency Review. The review recommended changes, including to management structures, that will help to address staffing issues and other shortfalls. TFN is moving forward with the implementation of this review and expects to see significant progress in this area.

Social Housing

TFN maintains and operates a Social Housing program on Tsawwassen Lands. During the reporting period, TFN:

- repaired and maintained housing units as required, and funded the replacement reserve;

- provided insurance coverage on the physical structure of the housing units;

- provided training for management and staff to ensure the housing program is well-managed.

Child & Family Services

On the Effective Date, Tsawwassen Government passed the Tsawwassen Child and Families Act, which delegates all protective duties regarding children and families to British Columbia. During the reporting period, British Columbia and TFN continued to develop a protocol agreement setting out a renewed relationship in respect of the delivery of Child and Family Services. Once complete, this agreement will establish greater clarity of roles between the Parties—with the goal of protecting, supporting, and offering a brighter future to Tsawwassen children in need of care.

During the reporting period, British Columbia and TFN were nearing completion of the Ministry of Child and Family Development/TFN operational protocol that will formalize how these governments will work together to support the use of TFN child welfare legislation. Although no time frame for completion has been identified, the Parties report the working relationship remains positive without the formalized agreement.

Education & Skills Development

TFN's Education and Skills Development Department delivers the following programs and services:

- Smuyuq'wa' Lelum Early Childhood Development Centre (infant/toddler program, preschool, and group daycare program);

- support programs for K-12 education;

- administration of a Local Education Agreement for the delivery of K-12 education by Delta School District;

- post-secondary funding for Tsawwassen Members;

- HeadStart (outreach services to parents with children aged 0-6);

- Youth Program (offering outings such as fieldtrips, activities which encourage sportsmanship and teamwork, computer access for educational purposes, and counseling).

During the reporting period, 35 students were enrolled in kindergarten, primary, and secondary programs, and eight were enrolled in post-secondary programs. TFN's Education and Skills Development Department:

- offered an increased range of programming for children (birth through 6 years) through the Early Childhood Development (ECD) Centre;

- reached out to the broader community (non-TFN Members), attracting children to the infant and toddlers program, the age 3-5 program, and the preschool program;

- chose to make its Post-Secondary Education program funding available to both status and non-status Members;

- met with the Delta School District staff on a regular basis throughout the year to ensure education goals and objectives are met;

- assisted Members in obtaining their high school diplomas;

- worked to develop a Dogwood Policy to assist community members over the age of 19 now returning to Dogwood (British Columbia's high school graduation certificate) or GED programs;

- supported members over the age of 19 that have returned to the Delta School District to receive their Dogwood certificate;

- approved applications for post-secondary funding;

- helped students during tutoring and homework sessions through the Homework Club (TFN staff members and tutors from Cliff Drive Elementary);

- sent all TFN parents living on and off TFN lands an annual school supplies cheque;

- awarded youth grants to TFN Members;

- entered into and completed a six-month agreement with the First Nations Employment Society to offer Members employment training.

TFN saw a substantial increase in post-secondary applications during the reporting period. Accordingly, TFN amended its budget to increase post-secondary funding and will be examining its budget allocation for future years. The increased interest in post-secondary applications is evidence of a renewed interest and optimism in the future by Tsawwassen Members.

Cultural Programming

TFN is developing cultural programming to encourage use of the Hun'qum'i'num language, cultural transfer opportunities, and traditional knowledge sharing. In addition, a Standing Committee on Language and Culture was formed to encourage, monitor, and support Tsawwassen Government's efforts to make its systems culturally relevant.

During the reporting period, TFN:

- hired a new Language and Culture Coordinator;

- co-hosted the 36th Annual Elders Gathering;

- continued to host Elders twice weekly for lunch;

- collaborated with Delta Police staff to deliver a child and family retreat;

- designed and delivered cultural and artisanal workshops on cedar weaving, drum making, headband weaving, and leggings weaving;

- facilitated the participation of Tsawwassen Members in the 2012 Canoe Journey.

Public Works

Upon achieving self-government, TFN chose local government processes similar to a municipal government. These functions include land use planning, public works and infrastructure, environmental management, and economic development.

TFN's Public Works Department provides reliable and safe infrastructure along with community surroundings that contribute to Tsawwassen Members' quality of life. The department has a major role in the community's health, safety, and emergency preparedness. Other responsibilities include:

- operating TFN's sewage plant;

- maintaining social housing, TFN-owned housing and buildings, grounds, and infrastructure;

- contracting for public safety (police, fire, ambulance), road maintenance, street lighting, snow removal, garbage collection, and recycling;

- liaising with utility companies (i.e. Terasen, Telus, BC Hydro, Delta Cable);

- managing TFN's compliance with provincial water quality standards.

During the reporting period, TFN's Public Works Department:

- established and implemented an inspection and remediation/repair program for TFN community buildings, including ongoing repairs to the longhouse, administration building, and furnace maintenance;

- established a program to include maintenance of roads and landscaping in the industrial lands (contractor replaced dead landscaping);

- inspected, operated, and maintained both a clean water supply and a safe, clean sanitary system;

- launched a water and sewer study for new development areas;

- investigated Metro Vancouver water system connection issues;

- met with Tsatsu Shores Strata Council to discuss completed Metro Vancouver water system report;

- attended conferences on water and waste water management, back flow prevention, and confined space entry;

- led two community-wide cleanups (Fall and Spring) with Members.

Infrastructure

In order to begin the first phase of an industrial lands site servicing project, TFN applied to British Columbia and Canada for funding under the Infrastructure Stimulus Fund, a part of Canada's Economic Action Plan (CEAP). Many Aboriginal Canadians benefited from programs administered by Aboriginal Affairs and Northern Development Canada under CEAP. However, due to its municipal-like status, TFN was the only First Nation in Canada to receive funding from the $4 billion Infrastructure Stimulus Fund. TFN received $3 million from Canada, $3 million from British Columbia, and contributed an equal amount, for a total project value of $9 million. These funds are allocated for the installation of road, sewer, and water infrastructure for Phase 1 of TFN's Industrial Lands development project.

During the reporting period, the following projects were being planned, or were underway, on TFN Lands:

- Smart Meters: BC Hydro engaged in consultation with TFN on its capital projects and customer connections in accordance to the terms and conditions set out in the Treaty. In addition, a recent installation of more than 300 smart meters on Tsawwassen Land provided the foundation for a more modernized grid, leading to benefits such as faster outage notification and conservation tools to help community members better manage their electricity use.

- DTRRIP: Port Metro Vancouver led consultation with TFN, on behalf of British Columbia, in connection with the Deltaport Terminal, Road, and Rail Improvement Project (DTRRIP). Port Metro Vancouver has provided project related materials to TFN, including a Project Description, Discussion Guide, and an archaeological overview assessment.

- Mufford/64th Road Rail Grade Separation Project: British Columbia consulted with TFN on this project through the Roberts Bank Rail Corridor Program (RBRC). Updated conceptual alignment maps were provided and TFN was also informed of upcoming Archaeological Impact Assessment work.

- Combo Project: Through the RBRC Program, TFN were consulted on the design work for the 196th Street Overpass, the 192nd Street Overpass, and the 54th Avenue Overpass projects being delivered by the City of Surrey.

- Commercial/Industrial/Residential Development: British Columbia worked with TFN on its major development application for Tsawwassen Lands off Highway 17. The provincial Ministry of Transportation and Infrastructure was in the final stages of approving a temporary construction access permit, and reviewing TFN's traffic impact study. This work continued through the reporting period.

Economic Development

Tsawwassen Government operates the TFN Economic Development Corporation (TEDC) to support a healthy economy by providing jobs, business opportunities, and profits to TFN, and to contribute to an enhanced quality of life for Tsawwassen Members. During the reporting period, TEDC secured a preliminary agreement on rents and member benefits with Ivanhoe Cambridge and Property Development Group, TFN's partners in the development of a major commercial district on Tsawwassen Lands. TFN Members voted 97 percent in favour of a term and area extension—an important endorsement of TFN Government's plans to proceed with this project.

Finance

Through the Tsawwassen First Nation Final Agreement, Canada, British Columbia, and Tsawwassen First Nation have established an on-going government-to-government relationship. The Parties report that Tsawwassen Government was managed in a financially responsible manner during its third year of post-treaty operation.

Finance & Administration

TFN's Finance Department provided the following services:

- budgeting (annual and 3-year budgets) in connection with other departments and the Finance and Audit Committee;

- annual audit of TFN financial statements;

- accounts payable and payroll;

- contract administration;

- collection of revenues;

- tax administration;

- maintenance and enforcement of the Financial Administration Act and regulations, financial policy, and procedures;

- ensuring TFN's staff are supported with technology, meeting and office space, reception support, and other office requirements necessary for an efficient administration.

During the reporting period, TFN managed the nation's financial accounts in accordance with its legal standards and obligations, and achieved an unqualified audit for the fiscal year. All legal standards and obligations were met. The Finance and Audit Committee met quarterly to ensure that operations maintained alignment with budgets.

Capital Transfer & Fiscal Relations

Canada and TFN are obliged to make various one-time and ongoing scheduled payments to each other as Treaty settlement costs. These include a capital transfer from Canada to TFN, and negotiation loan repayments from TFN to Canada. The Treaty provides for TFN a capital transfer of $13.9 million, less outstanding loans of $5.6 million taken to negotiate the Treaty. The capital transfer and negotiation loan repayments are paid in ten annual installments that started on the Effective Date. During the reporting period, the capital transfer amounts and negotiation loan repayments were paid on time.

Fiscal Financing Agreement

The Treaty requires the Parties to negotiate, and attempt to reach agreement on, a Fiscal Financing Agreement (FFA) describing the financial relationship among the Parties. The FFA sets out funding amounts from Canada and British Columbia to TFN for supporting agreed-upon government programs and services, and for supporting Treaty implementation activities.

Canada agreed to pay TFN $14.6 million as an income-generating fund managed by TFN, to support on-going TFN Government activities related to fisheries, parks, migratory birds, and other government functions. During the reporting period, Canada paid the second of three equal payments for this one-time funding.

Canada also contributes approximately $2.8 million each year for federally-supported government programs and services including education, social development, health, and physical works. The payment is made annually on April 1, and is approximately the same level of funding as provided to Tsawwassen pre-treaty under the Indian Act. However, post-treaty, TFN has budgetary discretion on how to spend the funds, and reporting requirements have been reduced to a minimum. TFN provides statistical information to ensure there are no data gaps in the records of federal and provincial agencies that generally administer government programs and services outside of Tsawwassen Lands.

Under the FFA, British Columbia pays $100,000 annually for the provision of a Local Government Programs and Services Liaison Officer. All federal and provincial transfers were completed on time.

Own Source Revenue Agreement

On the Effective Date, the Parties entered into a 20-year Own Source Revenue Agreement (OSRA), which calculates the contribution TFN will make from its own source revenue for the agreed-upon programs and services in the FFA. As part of the transition to self-government, Canada and British Columbia agreed that TFN's contribution for the first five years will be zero, after which contributions will increase over a defined period. The intent of the OSRA is to decrease TFN's reliance on financial transfers from Canada and British Columbia as TFN becomes more self-sufficient over time.

Investment & Borrowing Risk

During the reporting period, Tsawwassen Government managed its long-term investment risk in partnership with Greystone Financial Management, and within an established risk profile. TFN continued to identify low-cost borrowing alternatives, including participation in the First Nations Finance Authority (FNFA) borrowing pool – a federal institution established to provide a low-cost financing option for municipal-type infrastructures. TFN staff worked with the FNFA, and the governments of Canada and British Columbia, to resolve outstanding issues to permit TFN participation in the pool.

Taxation

The Treaty provides for the Parties, either together or separately, to negotiate on Tsawwassen Government taxation powers. While Canada remains willing to negotiate other taxation powers agreements (e.g., First Nations GST or Personal Income Tax), TFN currently has no plans to exercise its powers in these taxation fields.

The Tax Treatment Agreement, a tri-partite side agreement signed concurrently with the Treaty, commits British Columbia to refund Social Service Tax (PST) paid by Tsawwassen Government bodies while performing government functions on Tsawwassen Lands. During the reporting period, TFN and British Columbia worked on an agreement to cover the provincial portion of HST during the period July 2010 to March 2013.

Under the bilateral Real Property Tax Co-ordination Agreement, British Columbia committed to enabling TFN to use property tax revenues as security when borrowing for a capital purpose. TFN, British Columbia, Canada, and the institutions established under the First Nations Fiscal and Statistical Management Act (Canada) undertook collaborative policy work on this objective.

Property Tax Authority

A body established under the Tsawwassen First Nation Property Taxation Act, TFN's Property Tax Authority is comprised of members of Executive Council and non-Member ratepayers, and is responsible for approving the tax rates and expenditures in respect of residential property taxation in every tax year. It is also responsible for approving residential exemptions and grants. In 2010, the authority approved the rate of residential property tax, the residential property tax budget, and specific exemptions for non-profit entities operating on Tsawwassen Lands.

During the reporting period, tax rates were approved by TFN's Executive Council. Assessments, notices and the collection process all proceeded efficiently.

Twawwassen First Nation Audit Information

For the year ended March 31, 2012

Operational Budgets

Each year the Tsawwassen Legislature provides each of the individual departments of the Government with the authority to spend resources on approved programs and services. It is important that these resources are well managed, and that the delivery of programs and services does not exceed the approved expenditure amounts. Over the reporting period, TFN staff were successful in managing the delivery of programs and services within their approved budgets.

Capital Budgets

There were also a number of significant capital projects that were under construction during the reporting period, which added to TFN's capital asset base and provided much needed infrastructure. Each of these projects proceeded on schedule, and within budget. The projects include the Industrial Lands Infrastructure project, which included the construction of roads and a sewer line project to connect Tsawwassen Lands to a major Corporation of Delta sewer main. This project was completed in the fiscal year ended March 31, 2012.

Note: The tables on the following pages show the consolidated statement of financial activity and the consolidated schedule of capital assets, both of which are taken from the 2011-2012 audit. Taken together, these tables show a complete picture of TFN's operational expenditures, activities relating to TFN's capital asset base, and activity relating to various Treaty Funds. Full copies of the audit are available upon request.

Independent Auditor's Report

To the Executive Council of the Tsawwassen Government

We have audited the accompanying consolidated financial statements of Tsawwassen Government, which comprise the consolidated statements of financial position as at March 31, 2012, and the consolidated statements of operations and accumulated surplus, changes in net financial assets and cash flows for the year then ended, and the notes to the consolidated financial statements.

Management's Responsibility for the Consolidated Financial Statements

Management is responsible for the preparation and fair presentation of these consolidated financial statements in accordance with Canadian public sector accounting standards, and for such internal control as management determines is necessary to enable the preparation of consolidated financial statemetns that are free from material misstatement, whether due to fraud or error.

Auditor's Responsibility

Our responsibility is to express an opinion on these consolidated financial statements based on our audit. We conducted our audit in accordance with Canadian public sector accounting standards. Those standards require that we comply with ethical requirements and plan and perform the audit to obtain reasonable assurance about whether the consolidated financial statements are free from material misstatement.

An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the consolidated financial statements. The procedures selected depend on the auditor's judgment, including the assessment of the risks of material misstatement of the consolidated financial statements, whether due to fraud or error. In making those risk assessments, the auditor considers internal control relevant to the entity's preparation and fair representation of the consolidated financial statements in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the entity's internal control. An audit also includes evaluating the appropriateness of accounting policies used and the reasonableness of accounting estimates made by management, as well as evaluating the overall presentation of the consolidated financial statements.

We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion.

Opinion

In our opinion, the consolidated financial statements present fairly, in all material respects, the financial position of Tsawwassen Government as at March 31, 2012, and the results of its operations, changes in its net financial assets and its cash flows for the year then ended in accordance with Canadian public sector accounting standards.

Chartered Accountants

Vancouver, British Columbia

July 25, 2012

Tsawwassen Government

ConsOlidated Schedule of Segment Disclosure

Year ended March 31, 2012

Schedule 2

| General Fund $ | Tangible Capital Assets Reserve $ | Local Revenue Fund $ | Economic Development Fund $ | Members Business Development Fund $ | Cultural Purposes Fund $ | Commercial Fish Fund $ | Commercial Crab Fund $ | Reconciliation Fund $ | Implementation Fund $ | 2011 Consolidated $ | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | |||||||||||

Aboriginal Affairs and Northern Development Canada |

|||||||||||

Implementation Fund |

5,023,198 | 5,023,198 | |||||||||

Block |

2,752,819 | 259,160 | 3,011,979 | ||||||||

Commercial Crab Fund |

1,091,194 | 1,091,194 | |||||||||

Contributions |

328,876 | 328,876 | |||||||||

Province of British Columbia |

1,974,927 | 1,974,927 | |||||||||

Vancouver Port Authority |

811,738 | 811,738 | |||||||||

Investment Income |

40,413 | 8,324 | 4,057 | 2,194 | 54,988 | ||||||

Property taxes |

674,715 | 674,715 | |||||||||

Other |

1,012,589 | 157,540 | 1,170,129 | ||||||||

Permit and registry fees |

367,471 | 367,471 | |||||||||

Share of business enterprise income (Note 7) |

354,378 | 354,378 | |||||||||

Lease and rental |

311,015 | 311,015 | |||||||||

Interest on Final Agreement receivable |

288,809 | 288,809 | |||||||||

Economic Development |

161,630 | 161,630 | |||||||||

Housing Program |

129,395 | 129,395 | |||||||||

Utilities |

77,289 | 77,289 | |||||||||

First Nations Employment Society |

20,024 | 20,024 | |||||||||

| Total Revenues | 7,819,635 | 267,484 | 674,715 | 815,795 | 1,248,734 | 2,194 | 15,851,755 | ||||

| Expenses (Note 15) | |||||||||||

Lands and municipal |

2,886,788 | 2,886,788 | |||||||||

Administration |

2,695,009 | 1,987 | 2,696,996 | ||||||||

Amortization |

1,257,722 | 1,257,722 | |||||||||

Community services - |

|||||||||||

Education |

1,035,281 | 1,035,281 | |||||||||

Social development |

418,154 | 418,154 | |||||||||

Health |

311,964 | 311,964 | |||||||||

Economic development |

898,451 | 898,451 | |||||||||

Taxation |

424,280 | 424,280 | |||||||||

Distribution |

262,500 | 262,500 | |||||||||

Interest on final agreement debt payable |

125,653 | 125,653 | |||||||||

Housing program |

106,952 | 106,952 | |||||||||

| Total Expenses | 9,998,474 | 424,280 | 1,987 | 10,424,741 | |||||||

(Deficiency) excess of revenues over expenses |

(2,178,839) | 267,484 | 250,435 | 813,808 | 1,248,734 | 2,194 | 5,023,198 | 5,427,014 | |||

Transfer of funds to Treaty Settlement |

(596,668) | (596,668) | |||||||||

Interfund transfers |

2,582,067 | 443,476 | (250,435) | (440,108) | (125,000) | (2,210,000) | |||||

| Accumulated surplus, beginning of year | 11,571,038 | 287,456,190 | 440,108 | 1,100,582 | 1,096,723 | 479,766 | 230,458 | 6,796,549 | 309,171,414 | ||

| Accumulated surplus, end of year | 11,377,598 | 288,167,150 | 813,808 | 975,582 | 1,096,723 | 1,728,500 | 232,652 | 9,609,747 | 314,001,760 | ||

Tsawwassen Government

ConsOlidated Schedule of Segment Disclosure

Year ended March 31, 2011

Schedule 3

| General Fund $ | Tangible Capital Assets Reserve $ | Local Revenue Fund $ | Members Business Development Fund $ | Cultural Purposes Fund $ | Commercial Fish Fund $ | Commercial Crab Fund $ | Reconciliation Fund $ | Implementation Fund $ | 2012 Consolidated $ | |

|---|---|---|---|---|---|---|---|---|---|---|

| Revenues | ||||||||||

Aboriginal Affairs and Northern Development Canada - |

||||||||||

Implementation Fund |

5,023,198 | 5,023,198 | ||||||||

Block |

4,690,041 | 4,690,041 | ||||||||

Commercial Crab Fund |

3,100,065 | 3,100,065 | ||||||||

Contributions |

180,726 | 180,726 | ||||||||

Province of British Columbia |

1,373,357 | 250,565 | 1,623,922 | |||||||

Vancouver Port Authority |

324,461 | 324,461 | ||||||||

Investment Income |

684,421 | 3,769 | 306 | 1,946 | 7,302 | 697,744 | ||||

Property taxes |

684,204 | 684,204 | ||||||||

Other |

680,623 | 680,623 | ||||||||

Permit and registry fees |

80,855 | 80,855 | ||||||||

Share of business enterprise income (Note 6) |

607,632 | 607,632 | ||||||||

Lease and rental |

367,457 | 367,457 | ||||||||

Interest on Final Agreement receivable |

322,198 | 322,198 | ||||||||

Economic Development |

295,011 | 295,011 | ||||||||

Housing program |

147,373 | 147,373 | ||||||||

Utilities |

106,313 | 106,313 | ||||||||

First Nations Employment Society |

70,183 | 70,183 | ||||||||

| Total Revenues | 13,034,297 | 254,334 | 680,623 | 306 | 1,946 | 5,030,500 | 19,002,006 | |||

| Expenses (Note 15) | ||||||||||

Lands and municipal |

2,595,932 | 13,738 | 2,609,670 | |||||||

Administration |

874,129 | 41,500 | 1,576,397 | 2,492,026 | ||||||

Amortization |

1,274,986 | 1,274,986 | ||||||||

Community services - |

||||||||||

Education |

566,048 | 506,717 | 1,072,765 | |||||||

Social development |

224,118 | 135,500 | 25,778 | 385,396 | ||||||

Health |

306,039 | 306,039 | ||||||||

Economic development |

807,809 | 807,809 | ||||||||

Taxation |

680,623 | 680,623 | ||||||||

Distribution |

273,280 | 273,280 | ||||||||

Interest on final agreement debt payable |

157,678 | 157,678 | ||||||||

Housing program |

140,600 | 140,600 | ||||||||

| Total Expenses | 7,220,619 | 680,623 | 177,000 | 2,122,630 | 10,200,872 | |||||

Excess of revenues over expenses |

5,813,678 | 254,334 | 306 | (177,000) | 1,946 | 2,907,870 | 8,801,134 | |||

Transfer of funds to Treaty Settlement |

(4,401,047) | (4,401,047) | ||||||||

Transfer of funds to Treaty Fisheries Stewardship |

(1,116,776) | (1,116,776) | ||||||||

Interfund transfer |

38,466 | 61,418 | (98,884) | 1,000 | ||||||

| Accumulated surplus, beginning of year | 10,119,941 | 287,140,438 | 539,686 | 1,277,582 | 2,213,499 | 479,766 | 228,512 | 3,888,679 | 305,888,103 | |

| Accumulated surplus, end of year | 11,571,038 | 287,456,190 | 441,108 | 1,100,582 | 1,096,723 | 479,766 | 230,458 | 6,796,549 | 309,172,414 | |

"Page details"

- Date modified: