Evaluation of Petroleum and Minerals (PAA 4.3.1)

Final Report

January 2016

Project Number: 1570- 7/14095

Strategic Outcome: The North

PDF Version (479 Kb, 86 Pages)

Table of contents

- Glossary of Terms

- Executive Summary

- Management Response and Action Plan

- 1. Introduction

- 2. Evaluation Methodology

- 3. Evaluation Findings - Relevance

- 4. Evaluation Findings – Performance (Effectiveness / Success)

- 5. Efficiency and Economy

- 6. Evaluation Findings – 'Other Issues'

- 7. Conclusions and Recommendations

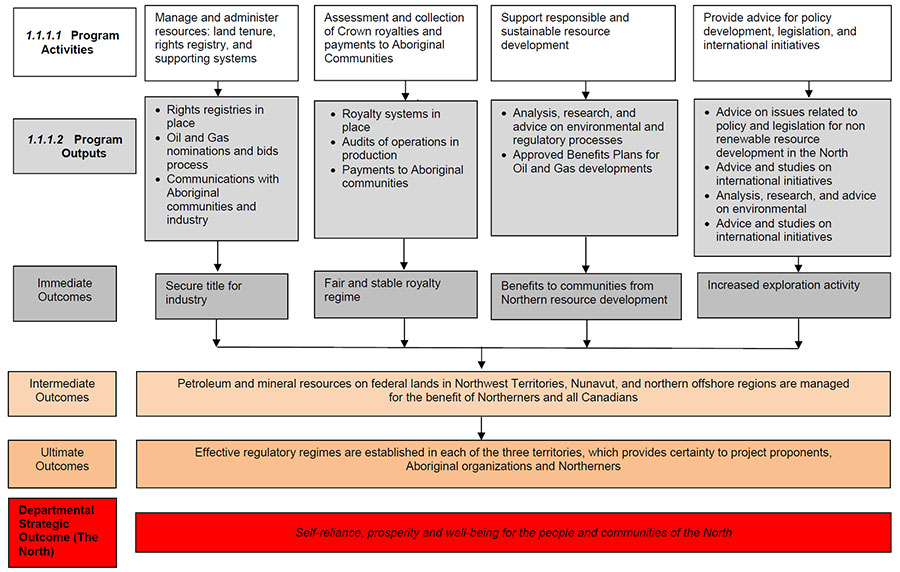

- Appendix A – Petroleum and Minerals Logic Model

- Appendix B – Description of Regulatory Regimes

- Appendix C – Relevant Organizations

- Appendix D - Mining in Nunavut

- Appendix E - Mining in the Northwest Territories

- Appendix F - Petroleum in Nunavut and the Northwest Territories

Glossary of Terms

Canadian Frontier Lands: Lands under federal jurisdiction in northern areas, offshore Newfoundland and Labrador, offshore Nova Scotia and other areas, such as the Gulf of St. Lawrence and Hudson Bay.

Community Readiness: The concept that communities have the resources such as financial literacy and mine skills training necessary to leverage the benefits associated with resource development.

Consultation: In this context, Canada's statutory obligation to ensure stakeholders engage in a meaningful dialogue with Aboriginal groups and ensure potential and established treaty rights are respected. For a more fulsome discussion of Indigenous and Northern Affairs Canada's (INAC) consultation duties see the June 2015 Evaluation of Consultation and Accommodation.

Crown Lands: Describes land owned by the federal or provincial government, with the authority of control over these public lands resting with the Crown.

Devolution: The transfer of responsibilities from the federal government to a provincial or territorial government. In this context the April 1, 2014, devolution of responsibilities from the federal government to the Government of the Northwest Territories is particularly relevant.

Environmental Stewardship: The responsible use and protection of the environment through conservation and sustainable development.

Geoscience: A strain of scientific study that focuses on the earth and geology. In this context geoscience is relevant as a means of identifying potential resource deposits.

Lands database (Land Information Management System- LIMS): An INAC database for land administration on Northern Crown lands, currently housed in Yellowknife. LIMS is often used in work relevant to mineral development such as environmental compliance activities.

Northern Offshore: Formally, as defined in sources such as INAC's 2013 Northern Oil and Gas Report pg. 4, the northern offshore includes "submarine areas, not within a province…the territorial sea of Canada or the continental shelf of Canada, but does not include the adjoining area, as defined in Section 2 of the Yukon Act."

Petroleum and Environmental Management Tool: An online, interactive geographic information system based on input from expert resources that generates maps on environmental and socio-economic sensitivity for different ecosystem components and areas of geological potential. It is used to support INAC consultations leading up to the Call for Nominations.

Royalty Management System: INAC's Information Technology platform for administering petroleum royalties by providing interest holders with a way to submit their required production and sales figures online.

Executive Summary

In accordance with the Treasury Board's Policy on Evaluation requirement to evaluate program spending every five years, the Evaluation, Performance Measurement and Review Branch (EPMRB) of Indigenous and Northern Affairs Canada (INAC) has conducted an evaluation of Petroleum and Minerals (sub-program 4.3.1) in fiscal year 2014-15 in order to meet Treasury Board requirements for program evaluation every five years. The scope of the evaluation includes reporting based on information from fiscal year 2009-10 to fiscal year 2013-14.

The Petroleum and Minerals sub-program is responsible for the petroleum and mineral resource interests of Northerners, Aboriginal peoples and Canadians generally on federal lands in the Northwest Territories, Nunavut, and the northern offshore. This includes four key program activities: managing and administering resources through oversight of land tenure, a rights registry and relevant supporting systems; assessing and collecting Crown royalties and payments to Aboriginal communities; supporting responsible and sustainable resource development; and providing advice for policy development, legislation and international initiatives.

The evaluation has found the following:

Relevance

The evaluation has found that the Government of Canada has clearly legislated roles under the Petroleum and Minerals sub-program through the Canadian Oil and Gas Operations Act, the Canada Petroleum Resources Act, and the Territorial Lands Act. The legislated roles and responsibilities of INAC and other federal departments and regulatory bodies were found to be clear.

However, in addition to the continued need for INAC's legislated responsibilities, the evaluation also found a clear and continued need for INAC's other roles such as facilitating consultation, sharing information and promoting resource development. As these additional roles are shared with other organizations, and the Northern Affairs Organization at INAC is adapting to recent changes as a result of Devolution and new legislation, it is important to clarify and coordinate roles and responsibilities with partners and stakeholders going forward.

Recommendation: It is recommended that the Northern Affairs Organization clarify and communicate their role in the context of petroleum and minerals development.

Performance

In each of its immediate outcomes of securing title for industry, managing a fair and stable royalty regime, ensuring benefits to communities and facilitating exploration, the sub-program has met its targets as per its 2014 performance measurement strategy. However, the evaluation has also found a number of external factors that affect performance, such as changes in commodity prices and a lack of infrastructure in the North. As such, performance-related recommendations are designed to maximize the sub-program's ability to achieve outcomes in light of these external factors.

Effectiveness

Generally, the program is providing secure title for industry. However, some sources suggested there is an opportunity to examine program design changes, such the length of time for which licences are issued, to ensure an appropriate balance in security for industry and other needs. While petroleum exploration remained stable over the evaluation period, minerals exploration declined, likely owing to external factors. Further investment in geoscience was identified as a way in which the Government could incentivize exploration in light of external factors.

Recommendation: It is recommended that INAC continue to work with partners to support geoscience research, while maximizing the value of other northern scientific research through coordination and dissemination.

The royalty regime was generally deemed to be fair and to provide a substantial contribution to the federal treasury. Sources proposed several options on how to further manage royalties that policy makers may wish to consider. These royalties, alongside tax revenue, jobs and business opportunities, demonstrate the ways in which northern regions benefits from northern resource development. However, there is an opportunity at a local level for more community readiness, and to further support communities in leveraging benefits from resource development.

Recommendation: It is recommended that Northern Affairs Organization clarify roles between Canadian Northern Economic Development Agency (CanNor) and INAC to further engage capacity development partners, ensuring a coordinated approach to leveraging opportunities.

Efficiency and Economy

The challenges of living in the climate and remoteness of the North cause northern regional offices to face challenges with recruitment and retention, which many sources noted results in turnover and potential impacts on program results. During the evaluation period, staff noted that Deficit Reduction activities, including additional human resources processes exacerbated these effects. Although not the intent of the policy, the new Treasury Board Directive on Travel, Hospitality, Conference, and Events Expenditures was perceived to affect staff's ability to connect with stakeholders and communities. Barriers to face-to-face communication add to confusion over roles and responsibilities among stakeholders in the post-devolution context of the sub-program.

While implementation and capacity-building necessary for the petroleum and minerals function is still ongoing in the first two years following devolution, devolution in the Northwest Territories is expected to increase efficiency and effectiveness of decision making going forward. It is also expected that, generally speaking, current and ongoing northern regulatory reforms will increase efficiency in the regulatory regimes across the Northwest Territories and Nunavut.

Regarding performance measurement, information management and information technology, opportunities for improvement were found. Specifically, there is an opportunity to revise performance measurement targets to better reflect what the sub-program has an ability to influence. It is important to review the sub-program's information management and information technology practices and capacity as well to ensure that it adequately captures, organizes and disseminates necessary information.

Recommendation: It is recommended that Northern Affairs Organization consider options for integrated information management and decision making regarding land, environmental management and resource claims.

Other Evaluation Issues

There are a number of unintended impacts from resource development, such as environmental risks, economic effects and social challenges. It is expected that the negative effects can be mitigated through an efficient regulatory regime and effective community readiness support.

Best practices found during the evaluation include land use planning, baseline data on environmental impacts, Regional Environmental Assessments and training programs such as the Mine Training Society.

Recommendations

It is recommended that:

- The Northern Affairs Organization clarify and communicate their role in the context of petroleum and mineral development.

- The Northern Affairs Organization clarify roles between CanNor and INAC to further engage capacity development partners, ensuring a coordinated approach to leveraging opportunities.

- The Northern Affairs Organization consider options for integrated information management and decision-making regarding land, environmental management and resource claims.

- INAC continue to work with partners to support geoscience research, while maximizing the value of other northern scientific research through coordination and dissemination.

Management Response and Action

Project Title: Evaluation of the Petroleum and Minerals Sub-Program (PAA 4.3.1)

Project #: 1570-14095

1. Management Response

The evaluation clearly identified where the sub-program has a legislative role and where its role is less well-defined but nevertheless important, such as in the area of resource development and industry support. The evaluation will be used to support the sub-program carrying out its legislative responsibilities in regard to royalties, mineral tenure and legislative improvements and to further define its role in facilitating resource development in the context of devolution and reassignment of economic development responsibilities to CanNor.

The sub-program will also continue to evaluate and refine its performance management indicators while recognizing that resource development activity is largely affected by external factors over which the sub-program has very little control. An examination of elements over which we have influence, including the length of time for which licences are issued (Exploration, Significant Discovery, and Production), the management of financial assurance for mine site remediation, and our contribution to geoscience that could facilitate resource development activity, will be undertaken.

The evaluation was also helpful in recognizing the importance of recruitment and retention of sub-program staff, their ability to communicate face-to-face with stakeholders and communities, and the need for the review of the sub-programs Information Management and Information Technology practices and capacity. However, the report lacked a clear recommendation on how to move forward to improve these aspects of the sub-program.

Web renewal and the review of management of financial assurance and implementation of online map selection system for Nunavut are ongoing and will address specific recommendations. The program will also initiate an examination of a collaborative management system for oil and gas resources in the Beaufort Sea and will establish a Northern Directors General's Forum (see Action Plan) in order to outline appropriate and realistic measures to address the evaluation's recommendations in a timely and effective manner, with the objective of managing petroleum and mineral resources in the North for the benefit of Northerners and all Canadians.

2. Action Plan

| Recommendations | Actions | Responsible Manager (Title / Sector) |

Planned Start and Completion Dates |

|---|---|---|---|

| 1. It is recommended that the Northern Affairs Organization clarify and communicate their role in the context of petroleum and mineral development. | We do concur. The Northern Affairs Organization will continue to clarify its role in the context of petroleum and mineral development through an outreach and education approach that includes:

|

Michel Chénier, Director of Petroleum and Mineral Resources Management, Natural Resources and Environment Branch / Northern Affairs Organization | Start Date: Completion: |

| 2. It is recommended that the Northern Affairs Organization clarify roles between CanNor and Indigenous and Northern Affairs Canada to further engage capacity development partners, ensuring a co-ordinated approach to leveraging opportunities. | We do concur. The Northern Affairs Organization will continue to clarify the role between CanNor and Indigenous and Northern Affairs Canada to ensure a coordinated approach to resource development by establishing a Northern Directors General's Forum that will be comprised of the Director General from the Natural Resources and Environment Branch, the three regional directors general from the Territories and the Major Projects Management Office Director General from CanNor, other directors general will be invited as necessary. It is envisioned that this forum would meet monthly to discuss initiatives and roles across the two organizations. |

Mark Hopkins, Director General, Natural Resources and Environment Branch, Northern Affairs Organization / Indigenous and Northern Affairs Canada | Start Date: Completion: |

| 3. It is recommended that the Northern Affairs Organization consider options for integrated information management and decision making regarding land, environmental management and resource claims. | We partially concur. The Northern Affairs Organization will continue to identify the shared information requirements for the management of lands, water resources, field operations and other resource management divisions. Further, the Northern Affairs Organization will pursue options (including platforms) to integrate the information across units to enable improved decision making. |

David Rochette, Regional Director General, Nunavut Region, Northern Affairs Organization / Indigenous and Northern Affairs Canada | Start Date: Completion: |

| 4. It is recommended that Indigenous and Northern Affairs Canada continue to work with partners to support geoscience research, while maximizing the value of other northern scientific research through coordination and dissemination. | We do concur. Indigenous and Northern Affairs Canada will continue to work with partners to support geoscience research and maximize the value of other northern scientific research by:

|

Michel Chénier, Director of Petroleum and Mineral Resources Management, Natural Resources and Environment Branch / Northern Affairs Organization Catherine Conrad, Senior Director, Environment and Renewable Resources, Natural Resources and Environment Branch / Northern Affairs Organization |

Start Date: Completion: |

I recommend this Management Response and Action Plan for approval by the Evaluation, Performance Measurement and Review Committee

Original signed by:

Michel Burrowes

Director, Evaluation, Performance Measurement and Review Branch

I approve the above Management Response and Action Plan

Original signed by:

Stephen M. Van Dine,

Assistant Deputy Minister, Northern Affairs Organization

1. Introduction

1.1 Overview

In accordance with the Treasury Board's Policy on Evaluation requirement to evaluate program spending every five years, the Evaluation, Performance Measurement and Review Branch (EPMRB) of Indigenous and Northern Affairs Canada (INAC) has conducted an evaluation of Petroleum and Minerals (sub-program 4.3.1) in fiscal year 2014-15.

The evaluation examines program activities between fiscal year 2009-10 and fiscal year 2013-14. Indicators from the sub-program's 2014 Performance Measurement Strategy were used to measure performance against stated outcomes.

The evaluation provides reliable evidence that will be used to support strategic policy and program decisions and, where required, expenditure management, decision making, and public reporting related to the Strategic Outcome 'The North' and any further programming in this area. The evaluation was conducted by EPMRB with some assistance from the consulting firm, Alderson-Gill and Associates.

The evaluation report presents findings and recommendations on the sub-program's relevance and performance, including issues related to effectiveness, and efficiency and economy, as well as best practices and lessons learned.

1.2 Program Profile

1.2.1 Background and Description

In accordance with its 2014-2015 Program Alignment Architecture, Petroleum and Minerals operates as one of three sub-programs under the Northern Land, Resources and Environmental Management program:

- Petroleum and Minerals (4.3.1)

- Contaminated Sites (4.3.2)

- Land and Water Management (4.3.3)

This sub-program is responsible for the management of rights issuance for new petroleum exploration rights, terms and conditions of exploration, production licences, and maintains a rights registry that is open to the public. Specific projects managed by this sub-program include the Beaufort Regional Environmental Assessment, the Department's federal lead responsibility for the Mackenzie Gas Project and the Mineral and Energy Resource Assessments for National Park establishment.

The Petroleum and Minerals sub-program is carried out by the Petroleum and Minerals Resources Management Directorate of the Northern Resources and Environment Branch, Northern Affairs Sector of Indigenous and Northern Affairs Canada.

The Petroleum and Minerals sub-program is responsible for the petroleum and mineral resource interests for Northerners, Aboriginal peoples and Canadians generally on federal lands in the Northwest Territories, Nunavut, and the northern offshore.Footnote 1

On April 1, 2014, the new Northwest Territories Act gave effect to the Northwest Territories Devolution Agreement by transferring the administration and control of public lands, resources and rights in respect of waters in the Northwest Territories to the Commissioner of the Northwest Territories.Footnote 2 The territorial government has now become responsible for the management of onshore lands, the issuance of rights and interests with respect to onshore minerals and oil and gas, and collecting royalties. The devolution of responsibility from the federal government to the territorial government has decreased, from INAC's perspective, jurisdiction and materiality of the Petroleum and Minerals sub-program, particularly in respect to the management of oil and gas.

The authority for the sub-program Petroleum and Minerals rests in separate pieces of legislation, governing separate activities related to petroleum and mines and minerals:

Oil and Gas Authority

The management of northern oil and gas is exercised under the following federal legislation:

- The Canada Petroleum Resources Act and its associated regulations govern the granting and administration of Crown exploration and production rights. Under this legislation, the Government has to give permission for oil and gas exploration to occur through a transfer of rights process, which enables the Minister to attach conditions to the agreement, such as restrictions that protect the environment.Footnote 3 Additionally, the Canadian Petroleum Resources Act establishes a royalty regime, where industry is issued rights during a "public call for bids" and must pay a royalty to the federal government for resources extracted.Footnote 4 Supporting this legislation, the Frontier Lands Petroleum Royalty Regulations prescribe the royalty rates, the calculation, reporting and associated interests or penalties.

- The Canada Oil and Gas Operations Act promotes safety, environmental protection, conservation of oil and gas resources and joint production agreements through its governance of oil and gas exploration, production, processing and transportation in federally controlled marine areas.Footnote 5 The Canada Oil and Gas Operations Act governs the authorization and regulation of petroleum operations and the requirement for Canada Benefits Plans. In a Canada Benefits Plan, a company proposing an oil and gas activity is required to describe the principles, strategies and procedures that ensure Canadians and Canadian businesses are provided full and fair opportunity to participate in the project.Footnote 6 Rights, royalty and benefit matters are managed by the Department on behalf of the Minister while the National Energy Board takes the lead role in the authorization and regulation of operations.

Mines and Minerals Authority

Minerals resource management in the northern territories sub-surface lands include hard-rock minerals, precious gems and coal. The rights to these substances are administered through the Territorial Lands Act and its related regulations, such as the Territorial Coal Regulations. During the evaluation period, the Territorial Mining Regulations were split into the Nunavut Mining Regulations and the Northwest Territories Mining Regulations to account for changes as a result of Northwest Territories devolution. The territorial government's new Mining Regulations substantially mirror the federal regulations, which will continue to apply to certain specific parcels of lands in the Northwest Territories.Footnote 7

1.2.2 Royalty Administration

Royalty rates in the North start at one percent in the first year of production and rising every 18 months by one percent to a maximum of five percent until the project payout.Footnote 8 Royalties on project payout cap at the greater of either five percent of gross or 30 percent of net.Footnote 9

A web-based Royalty Management System was launched in April 2010 and is used by interest holders to submit the required production and sales figures. The Royalty Management System assists the Department to administer petroleum royalties efficiently.

Mineral royalties in the Northwest Territories and in mines in Nunavut established prior to the Nunavut Land Claim Agreement are subject to terms of Northwest Territories and Nunavut Mining Regulations where 13 percent of net value of mine production and the sum of the marginal royalty rates (see table 1) must be paid to the federal government annually.Footnote 10 In the Northwest Territories, there are three settled land claim agreements that govern royalty revenue sharing with Aboriginal groups: the Gwich'in Comprehensive Land Claim Agreement, Sahtu Dene and Metis Comprehensive Land Claim Agreement, Inuvialuit Final Agreement.Footnote 11,Footnote 12

| Bracket | n Value of Mine's Output (Mine Profit) | Marginal Royalty Rate |

|---|---|---|

| 1 | ≤ $10 000 | 0 |

| 2 | $10 000 < n ≤ $5 million | 5% |

| 3 | $5 million < n ≤ $10 million | 6% |

| 4 | $10 million < n ≤ $15 million | 7% |

| 5 | $15 million < n ≤ $20 million | 8% |

| 6 | $20 million < n ≤ $25 million | 9% |

| 7 | $25 million < n ≤ $30 million | 10% |

| 8 | $30 million < n ≤ $35 million | 11% |

| 9 | $35 million < n ≤ $40 million | 12% |

| 10 | $40 million < n ≤ $45 million | 13% |

| 11 | $45 million < n | 14% |

The Nunavut Land Claim Agreement established royalty rates under Article 25, which guarantees that 100 percent of royalties from development on Inuit Owned Lands where Inuit own mineral rights go directly to Nunavut Tunngavik Incorporated on behalf of Inuit.Footnote 14 Nunavut Tunngavik Inc. is responsible for distributing royalties to Regional Inuit Associations who then use the funds in the interests of Inuit beneficiaries.Footnote 15 Nunavut Tunngavik Inc. has created a trust for royalties that will be distributed to Regional Inuit Associations when it has reached a certain level deemed sustainable, the minimum being $100 million.Footnote 16 In an effort to reduce redundancies in service provision, the Regional Inuit Associations are intending to not use the royalties on services already covered by the Government of Nunavut through taxes.Footnote 17

1.2.3 Objectives and Expected Outcomes

For program logic, please see the logic model in Appendix A

The Northern Land, Resources and Environmental Management program (4.3) supports The North Strategic Outcome:

- "Self-reliance, prosperity and well-being for the people and communities in the North."

The Petroleum and Minerals sub-program is one of three that supports the Northern Land, Resources and Environmental Management Program with the program expected result, identified by the 2014-2015 Performance Measurement Framework, of:

- Effective regulatory regimes are established in each of the three territories, which provide certainty to project proponents, Aboriginal organizations and Northerners.

The objective and expected result of the Petroleum and Minerals sub-program is:

- Petroleum and mineral resources on Crown lands in Northwest Territories, Nunavut and northern offshore regions are managed for the benefit of Northerners and all Canadians.

The Petroleum and Minerals sub-program is supported by the following immediate outcomes:

- Secure title for industry

- Fair and stable royalty regime

- Benefits to communities from Northern Resource Development

- Increased exploration activity

The activities undertaken by INAC through the Petroleum and Minerals program are:

- Manage and administer resources

- Assessment and collection of Crown royalties and payments to Aboriginal communities

- Support responsible and sustainable resource development

- Provide advice for policy development, legislation and international initiatives

Under these activities, according to the 2015 – 2016 Report on Plans and Priorities for INAC, Petroleum and Minerals contributes to that expected result by:

- Managing Crown lands for oil and gas exploration and development through the administration of lands and allocation of rights.

- Developing an agreement with the governments of Northwest Territories and Yukon and the Inuvialuit for the collaborative management of oil and gas resources in the Beaufort Sea.

- Assessing Benefits Plans for proposed new oil and gas projects against requirements in new Benefits Plan Guidelines for the North.

- Administering the royalty regime and ensuring the correct amount of royalties and Crown revenues are collected by INAC from oil and gas and mining companies.

- Developing a modernized online map selection system for Nunavut mineral exploration and mining companies.

- Strengthening the management of environmental securities for mineral projects by working with Regional Inuit Association and project proponents on terms around managing security.

The 2014 – 2015 Report on Plans and Priorities for INAC outlines several other roles for the Petroleum and Minerals sub-program, including:

- Working through the Arctic Council, maintain a dialogue on important northern issues and collaborate on key initiatives that will contribute to safe, sustainable, and environmentally conscious practices related to oil and gas development and shipping in the Arctic.

- Advancing environmental and social studies pertaining to oil and gas operations on frontier lands through the Environmental Studies Research Fund and other funding avenues.

- Completing Beaufort Regional Environmental Assessment research projects, working group activities and Final Report (26 research projects and six working group activities).

- Implementing a modernized online map selection system for Nunavut mineral exploration and mining companies.

- Helping to strengthen the management of environmental securities for mineral projects to ensure that appropriate securities are maintained at all times and to reduce the liability of the Department.

1.2.4 Program Management, Key Stakeholders and Beneficiaries

The Petroleum and Minerals Program is managed by the Department of Indigenous and Northern Affairs Canada in partnership with Aboriginal organizations and territorial governments.

The program staff located at INAC Headquarters administers the overall delivery of Petroleum and Minerals. To accomplish this, the Petroleum and Minerals Directorate at headquarters does the following:

- Assures the collection and assessment of royalties, including implementing risk-based royalty audit framework.

- Manages the rights of existing license holders, modernize historical permits and terms and conditions for issuance.

- Implements Beaufort Regional Environmental Assessment Initiative through a targeted regional approach.

- Provides expert advice and policy/economic analysis on petroleum and mineral resource issues in the North to support senior-level decision-making processes

- Contributes to legislative and policy development activities, such as:

- Revisions to Territorial Coal Regulations;

- Advice to the Minister with respect to Canada Benefits Plans;

- Participation in the National Energy Board Arctic Drilling Review;

- Advancement of efficient and effective oil and gas management policies internationally, inter-departmentally and at Arctic Council; and

- Provision of advice to land claim and devolution negotiation tables.

The program staff located at INAC Nunavut regional office supports Headquarters activities related to Northern oil, gas, mining and mineral development. Their responsibilities include:

- Providing advice to land claim negotiation tables.

- Organizing and participating in information sharing.

- Providing support and advice to Aboriginal communities and industries on an as needed basis.

- Providing region specific representation and support.

- Review mineral claim and prospecting permit holder reports.

- Engaging in information sharing with businesses, the public, and land and resource management partners to stimulate investment in the territories.

- Managing rapid growth in petroleum and mineral exploration sector.

- Consults with northern communities and engages and advises northern communities/industry on mutual requirements for petroleum and mineral exploration and development to sufficiently support a viable northern economy.

- Collaborate with Headquarters on regulatory reform, and revisions to regulations.

Industry stakeholders include industry associations such as the Canadian Association of Petroleum Producers and the Northwest Territories and Nunavut Chamber of Mines, petroleum and mining production and exploration companies, and a wide range of companies and professionals providing support services to these non-renewable resource industries.

1.2.5 Other Partners

Federal responsibility for the management of Crown petroleum and minerals resources is divided at the sixtieth parallel. INAC is responsible for management in the North, and Natural Resources Canada is responsible for management in the South. However, INAC does not have sole responsibility for the management and regulation of Petroleum and Minerals in the North, and instead shares these responsibilities with a number of other federal departments:

- The Canadian Environmental Assessment Agency administers the Canadian Environmental Assessment Act guidelines;

- Environment Canada is responsible for preserving the quality of the environment in Northern Canada;

- Fisheries and Oceans is responsible for the protection of inland and oceanic fisheries;

- National Energy Board regulates frontier oil and gas, as well a pipelines;

- Transport Canada oversees the safety of marine transportation; and

- INAC's Land and Water Management sub-program (4.3.3) is responsible for surface minerals, and the implementation of statutory and comprehensive land claim agreement obligations in the North.

The Northern Project Management Office, situated in the Canadian Northern Economic Development Agency (CanNor) is responsible for the following:

- Coordinating partners for environmental assessments and regulatory processes;

- Facilitating issues management with exploration and active mines;

- Preparing project specific agreements to facilitate project planning and tracking timelines;

- Coordinating all federal Crown consultations and maintaining the Crown record; and

- Coordinating federal input into assessments.

CanNor is also responsible for supporting community readiness efforts to facilitate participation of northern communities in the regulatory process and maximization of their participation in the benefits from major resource development projects. CanNor contributes to assessing and analyzing the socio-economic impacts and benefits of major resource development projects to support the environmental process and community readiness planning.

For a complete description of the regulatory regime in each territory and a list of organizations responsible for Petroleum and Minerals regulation in the North please see Appendix B and Appendix C.

1.2.6 Program Resources

INAC invested approximately $89 million in the Petroleum and Minerals sub-program during the five years covered by the evaluation. The following tables provide a historic breakdown.

| 2009-2010 | 2010-2011 | 2011-2012 | 2012-2013 | 2013-2014 | |

|---|---|---|---|---|---|

| Vote 1 | $13,557,230.20 | $6,473,058.98 | $5,964,364.74 | $6,361,202.04 | $5,766,095.29 |

| Vote 10 | $2,179,785.00 | $1,022,950.00 | $2,807,089.00 | $2,937,114.00 | $2,538,407.00 |

| Total | $15,735,747 | $7,496,009 | $8,771,454 | $9,298,316 | $8,304,502 |

| Grand Total | $49,606,02 | ||||

Source: INAC, Chief Financial Officer Sector, August 28, 2014 |

|||||

| 2009-2010 | 2010-2011 | 2011-2012 | 2012-2013 | 2013-2014 | |

|---|---|---|---|---|---|

| Vote 1 | $9,308,225.31 | $10,228,695.20 | $7,775,533.32 | $7,787,055.64 | $9,071,795.79 |

| Vote 10 | $0.00 | $0.00 | $0.00 | $0.00 | $13,512.00 |

| Total | $9,308,225 | $10,228,695 | $7,775,533 | $7,787,056 | $9,085,308 |

| Grand Total | $44,184,817 | ||||

Source: INAC, Chief Financial Officer Sector, August 28, 2014 |

|||||

The program's work is not supported by any Transfer Payment Authorities.

2. Evaluation Methodology

2.1 Evaluation Scope and Timing

The evaluation includes reporting based on information from fiscal year 2009-10 to fiscal year 2013-14 and focuses on INAC's commitments as per the sub-program's logic model and Performance Measurement Strategy dated March 20, 2014. As per Treasury Board guidelines, it examines the relevance, effectiveness, efficiency and economy, and design and delivery of program activities, outputs and outcomes.

The evaluation considered multiple factors, including changes to the current context and climate of the petroleum industry during the latter part of the period under evaluation, as well as changes to the sub-program's scope and materiality resulting from Deficit Reduction Activities Implementation and Northwest Territories Devolution, which took effect on April 1, 2014. As an example of how this context had an impact on the scope of the evaluation, as a result of Deficit Reduction Action Plan, the Petroleum and Minerals sub-program was consolidated under a single directorate. Furthermore, as a result of Devolution, the acreage under the jurisdiction of the sub-program was diminished when authority was transferred to the Government of the Northwest Territories.

The Evaluation Terms of Reference were approved by INAC's Evaluation, Performance Measurement and Review Committee (EPMRC) on September 25, 2014, and the evaluation was subsequently conducted between September 2014 and December 2015.

The following evaluations and reviews of activities pertaining to Petroleum and Minerals were considered in the scoping of this evaluation:

- Program Review of the Northern Oil and Gas Program: Phase 1, 2010

- Audit of Northern Oil and Gas, 2014

- Program Review of the Beaufort Regional Environmental Assessment, 2014

- Revenue Management and Guaranteed Deposit Process Assessment, 2014

- Program Review of the Devolution in Northwest Territories, 2015

2.2 Evaluation Issues and Questions

The evaluation issues and indicators were developed based on the commitments as per the sub-program's Performance Measurement Strategy dated March 20, 2014. In keeping with Treasury Board requirements, the evaluation focused on the following issues:

Relevance - Continued Need

- To what extent has there been a need for providing support and guidance with respect to Petroleum and Minerals? How responsive has INAC been to that need?

Relevance – Alignment with Government Priorities

- To what extent has the sub-program been consistent with the objectives and priorities of the federal government?

Relevance - Alignment with Federal Roles and Responsibilities

- To what extent has the sub-program been consistent with the objectives and priorities of the federal government? To what extent does the sub-program contribute to INAC's strategic outcomes and the goals associated under the Petroleum and Minerals

Performance - Effectiveness

- In what ways does the sub-program create the conditions for the achievement of the following immediate outcomes:

- Securing title for industry (immediate outcome no.1)

- Fair and stable royalty regime (immediate outcome no. 2)

- Benefits to communities from northern resource development (immediate outcome no. 3)

- Increased exploration activity (immediate outcome no. 4)

- To what extent have petroleum and mineral resources on Crown lands in Northwest Territories, Nunavut and northern offshore regions been managed for the benefit of Northerners and all Canadians? (Intermediate/Ultimate Outcome/Objective)

- Have there been any unintended positive or negative impacts around Petroleum and Minerals?

Demonstrations of Efficiency and Economy

- What are the costs to engaging in the program activities areas related to 4.3.1 and related outputs, and are there opportunities for increasing program efficiencies?

- To what extent do INAC activities complement – or do they unnecessarily duplicate related activities undertaken? Are appropriate linkages being made with existing programs?

- What factors (internal and external) have helped or hindered the achievement of expected results?

Design and Delivery

- The Deficit Reduction Action Plan and Devolution has led to significant organizational and program changes. To what extent these factors had an impact on the design and the delivery of the program?

- How have legislated process and resulting policies had an impact on the performance of the program?

- To what extent does the newly revised 4.3.1 Performance Measurement Strategy contributes to performance measurement, management and reporting (e.g., can the strategy support the assessment of results?

Other Evaluation Issue(s)

- To what extent is gender-based analysis being considered?

- To what extent do Petroleum and Minerals activities support INAC's responsibilities under the Federal Sustainable Development Strategy?

- Are there opportunities (ie. notable best practices and lessons learned) for altering the design and/or delivery of the program in order to improve its performance?

The evaluation report was written based on the issues as identified by the Treasury Board Policy on Evaluation. Analysis of each of the evaluation questions was triangulated through multiple lines of evidence and integrated into a discussion of the Treasury Board Core Evaluation Issues of Relevance and Performance.

2.3 Evaluation Methodology

The evaluation was conducted by EPMRB with assistance from the consulting firm, Alderson-Gill and Associates on the methodology report and data review.

Planning and Development of Methodology

In order to develop the Terms of Reference, a preliminary meeting was held to inform the scope of the evaluation with representatives from the Northern Land, Resources and Environment Program and the Petroleum and Minerals sub-program. Additional meetings were held with respect to the sub-program's expenditure and business planning.

An Evaluation Working Group/Advisory Group was established subsequent to the approval of the Terms of Reference. The purpose of the Working Group/Advisory Group, consisting of program management representatives from Headquarters and the regions, was to assist the Evaluation team at various stages of the evaluation process, providing feedback on a detailed Methodology Report, Preliminary Findings, and Draft Report.

2.3.1 Data Sources

The evaluation's findings and conclusions were based on the analysis and triangulation of the following lines of evidence:

- Literature Review

A review of domestic and international literature was conducted to examine issues of relevance, lessons learned, and best practices. Relevance was examined in the context of key issues related to Petroleum and Minerals and Northern Land, Resources and Environmental Management program. The evaluation focused on factors related to the ongoing need for management of petroleum and minerals (demographic and socio-economic information, community benefits, economic and social impacts), and unintended and intended impacts of resource development on Northern communities. The review included four sub-topics: (1) INAC's Petroleum and Minerals program; (2) effective resource development regulatory regimes; (3) effective resource management consultation and benefit agreements; and (4) infrastructure and economic development in northern Canada.

The literature review began with a systematic scan of reports, documents, and articles using key words and phrases related to the program. Key documents were identified for review and an index of documents with bibliographic information was created. The list of documents was assessed to verify that there were no gaps, ensuring the literature review did not duplicate previous research. Previous departmental evaluation or review research was included in this analysis. - Document and file review

A document and file review was conducted to find information related to the program's relevance and performance. Approximately 45 key documents and files were reviewed, including:- Program and policy related documentation: including Memoranda of Understanding, legislation, Canada's Northern Strategy, Speeches from the Throne, Reports on Plans and Priorities, related program evaluation and audit reports, departmental performance reports, performance management strategies and documents related to natural resource development (such as the Northern Oil Gas Annual Report and the Exploration and Mining Guide for Aboriginal Communities); and

- Petroleum and Minerals internal documents: acts and regulations, progress and annual reports, benefits plans, maps, meeting minutes, management and business plans documents related to land and exploration, royalty administration files, and Oil and Gas revenue sharing documentation.

Documents from both the literature review and document review were analyzed against the evaluation questions, and themes and insights were identified in a findings template. Findings were triangulated with other lines of evidence.

- Data Analysis

A quantitative data analysis was also conducted for the purposes of providing a complete understanding of the performance and the impacts of the Petroleum and Minerals sub-program. This analysis focused primarily on performance, administrative, and financial data from existing INAC databases and relevant census data as well as INAC reviews, audits and evaluation data. The data covered the evaluation period from 2009-10 to 2013-2014. Findings from the technical report were triangulated with other lines of evidence.

The program's 2014 Performance Measurement Strategy draws upon data from the Fraser Institute, a Canadian research institute, which studies public policy.Footnote 18 Specifically, the Fraser Institute conducts an annual Global Petroleum Survey and Survey of Mining Companies to measure companies' perceptions of administrative regimes for petroleum and for minerals respectively. The studies rank jurisdictions on factors such as tax conditions, royalty regimes and environmental requirements. As will be discussed in Section 4 of this report, the surveys have been used in addition to other data and lines of evidence to measure program performance. - Key informant interviews

Key informant interviews were used to gain a better understanding of the perceptions and opinions of individuals who have had a significant role in the Petroleum and Minerals sub-program, and who have a key stake in it.

A list of interviewees was developed based on input from program management, the Working Group, and the Advisory Group. Interview guides were developed to address all evaluation issues and questions, and were tailored to the different interview respondent groups within each interview group and region. In doing so, the knowledge and expertise of the key informants was targeted specifically and was able to be used more effectively. Common questions were applied across the guides to strengthen the evaluation. Key informants with specific regional knowledge were also interviewed to inform the case studies.

Interviews were semi-structured and interview guides were sent to the interviewees by e-mail in advance of the interview to allow for preparation. Interviews were in person when possible and by telephone when necessary. Key informants' responses where typed and analyzed individually after each interview. A key informant interview technical report analyzed key themes and insights across all interviewees. Findings from the technical report were triangulated with other lines of evidence.

A total of 16 interviews were conducted with:- Program officials (Headquarters and regional offices)[n=8]

- Stakeholders[n=5]

- Experts[n=3]

- Case Studies

A set of three case studies was conducted across the northern territories to examine differences in impacts across these areas. Issues related to the relevance, design and delivery, and performance of the Petroleum and Minerals sub-program were examined from a regional perspective. Additionally, the case studies provided insight into factors, which have facilitated or hindered the program at the regional level, and allowed the examination of best practices and lessons learned from front-line representatives and stakeholders.

As part of the case study for Nunavut, a site visit was conducted in Iqaluit. For the case study of Northwest Territories, a site visit was conducted in Yellowknife. The case study on Yukon was conducted remotely, given that the case study was conducted for comparative reasons only and INAC's Petroleum and Minerals sub-program has limited jurisdiction there.

The following methods were used to conduct the case studies:

- A review of documents: This was conducted primarily in Ottawa, drawing on INAC, the territorial governments, industry and academic documents. The review was used to develop a preliminary set of key factors in each of the three territories. These documents were also used to identify issues for discussion with interview respondents.

- Case study interviews: Interviews were conducted primarily in person, but also via telephone, in order to obtain information about the factors influencing exploration and development in the three territories. A total of 37 interviews were conducted with INAC program officials (eight), territorial government officials (18), industry associations and resource development companies (four), and other groups (seven).

- A review of available data: The rates of exploration and development in each of the three territories were identified through analysis of Statistics Canada, INAC and other data, and formed the basis for studying the factors affecting performance.

2.3.2 Considerations, Strengths and Limitations

Strengths

Due to the recently completed audit of INAC management of Northern Oil and Gas, EPMRB made efforts to coordinate information requests with those made by Audit in order to reduce duplication of work and increased reporting burden on program representatives. Additionally, the evaluation followed up on the audit's findings, which noted that there was an opportunity to reassess program design.

Furthermore, the evaluation was able to leverage valuable information from two lessons learned case studies, which did not require additional expense or travel for the evaluation team:

- Findings from a review of the Beaufort Regional Environmental Assessment, an initiative which funded environmental research to facilitate resource development preparedness, were integrated into the final report.

- The evaluation team conducted a best practices and lessons learned case study of the Yukon through phone interviews and literature review. This allowed for a helpful comparison of a jurisdiction operating under alternate design and delivery, but with similar contextual factors such as climate and availability of infrastructure.

Considerations and Limitations

The timing of several events complicated the analysis of program design and delivery and performance:

- Recent fluctuations in commodity prices have had an impact on several key performance indicators such as the number of exploration licenses issued over the evaluation period. As is discussed throughout the report, while commodity price fluctuations affect performance measurement, they are not within the program's control and so should not be taken as an indication of actual performance.

- Devolution and ongoing northern regulatory reforms occurred toward the end of the period under review for the evaluation. As such, there has been a limited observation period with which to assess the impact of these changes. In one case, interviewee opinions on the impact of a new piece of legislation changed significantly between the time in which evaluators undertook a case study and the writing of the final report.

2.4 Roles, Responsibilities and Quality Assurance

EPMRB of INAC's Audit and Evaluation Sector was the project authority for the evaluation, and managed the evaluation in line with EPMRB's Engagement Policy and Quality Assurance Process.

The evaluation was assisted by the consulting firm Alderson-Gill and Associates, who participated in the Evaluation Working Group/Advisory Group and who validated the development of the detailed methodology, including tools, review and input related to the literature review. Additionally, the consultants assisted in the undertaking of data analysis and key informant interviews, the analysis of findings and in the drafting of preliminary findings.

An Evaluation Working Group/Advisory Group, consisting of the evaluation team and program representatives from Headquarters and the regions, provided feedback on the methodology, preliminary findings, and draft report, and validated the evaluation's findings.

EPMRB requested input from the EPMRC to support the development of an appropriate methodology to guide the evaluation. The EPMRC also reviewed key findings from all lines of evidence, as well as the final report

3. Evaluation Findings - Relevance

The following sections examine issues related to relevance, including:

- Continued need for the program;

- Extent to which program objectives are aligned with government-wide priorities and link to INAC's strategic outcomes;

- Extent to which objectives of the program are consistent with the role and responsibilities of the federal government; and

- Duplication or overlap with other programs, policies or initiatives.

3.1 Continuing Need

All lines of evidence indicate that there is a strong need for the program. Industry interest in northern petroleum and minerals leads to a need for federal oversight of petroleum and minerals development to ensure title is secure for industry, to leverage royalties for the Crown, to support benefits to communities and to facilitate exploration of Canada's frontier lands.

3.1.1 Setting the context – Northern resource potential

A large proportion of Canada's exploitable oil, gas and minerals are on frontier (government-owned) lands in northern Canada. For example, 38 percent of Canada's remaining marketable resources in conventional fields are in the North, including 35 percent of Canada's light crude.Footnote 19 Furthermore, it is estimated that Nunavut has 1/3 of Canada's total petroleum reserves.Footnote 20

There is immense economic potential for these northern resources. In 2010, there was a reported $30 billion worth of proposed and actual oil and gas projects in the North.Footnote 21 The mining sector is expected to grow from $1.6 billion to $10.5 billion in the next 15 years as well.Footnote 22 While there is a large amount of potential for development, since 2014 commodity prices have drastically reduced exploration and development interest and activities. While commodity prices and the markets will continue to affect petroleum and minerals exploration and development, there is likely to be continued interest in northern petroleum and minerals in the future.

3.1.2 A need for INAC's involvement

The vast majority of key informant interviewees responded that there is a need for INAC's ongoing involvement in the management of these petroleum and minerals resources, as resource development potential in the North on government land necessitates effective and sustainable management. One key informant stated that it is important to ensure companies who are awarded licenses for petroleum and minerals, for example, have their rights protected. As such, it is important to have a program in place to ensure secure title for industry. Several key informant interviewees noted as well that INAC's oversight is needed to ensure resource development occurs in an environmentally safe manner.

In addition to providing secure title for industry, INAC's involvement in issuing licenses contributes to the public good of exploration on frontier lands. The rights tenure provisions under the Canadian Petroleum Resources Act and the Canadian Oil and Gas Operations Act stem from a 1985 policy known as Canada's Energy Frontiers: A Framework for Investment and Jobs. The policy established the criterion that exploration licences are issued based on the value of exploration spending a company proposes to put forward for a given parcel of land.Footnote 23 One key informant suggested that the system was established in this way because incentivizing exploration of Canada lands and collecting information on their geological potential is of value to all Canadians. As such, it is logical that increased exploration activity is an immediate outcome of the Petroleum and Minerals program.

Given the economic potential described above, there is also an opportunity to leverage royalties to support government programs and to leverage opportunities for communities as well. Mining is one of Canada's most developed industries, employing 330,000 workers and making up 3.9 percent of the nation's gross domestic product in 2012.Footnote 24 Petroleum is also one of Canada's primary industries, employing 0.6% of the nation's labour force and representing 6.8 percent of Canada's gross domestic product in 2010.Footnote 25 Both sectors are significant employers in Aboriginal communities, with Aboriginal people making up five percent of Canada's oil and gas labour force from 2007 to 2012.Footnote 26 As of 2012, 24 advanced projects in the North had the possibility of creating $38 billion in investment, with the development of these projects leading to 8,000 fulltime jobs.Footnote 27 Moreover, through exploration, it is possible that the number of operating projects will expand. Resource royalties are also a large source of revenue not just for communities but for the federal, provincial and territorial governments, with $2.3 billion in royalties and taxes being paid to the provinces and territories in the 2011-12 fiscal year.Footnote 28

In Nunavut, the only territory where the federal government continues to manage land, water and resources, mining is a particularly important industry for economic development. Currently, the Government of Nunavut's funding is 90 percent federal government transfers and 10 percent Nunavummiut taxes.Footnote 29 Royalties and taxation have the potential to change the funding structure of the Government of Nunavut, further developing its self-reliance. Nunavut's gross domestic product is expected to have the second highest growth rate in Canada, with 4.4 percent growth in 2014 and 7.8 percent in 2015.Footnote 30 Short term economic growth will be due to growth in Nunavut's mining sector.Footnote 31

Non-Inuit people's employment rate is much higher than Inuit in Nunavut (95 percent and 46 percent respectively).Footnote 32 The territorial government is Nunavut's primary employer, and 88 percent of the workers in Nunavut are employed in the services sector more generally.Footnote 33 By 2025, it is expected that the services sector will employ the majority of workers, primarily services in the territorial government.Footnote 34 Growth in the mining and construction industries are anticipated to be drivers of growth in employment as well, with an expected annual growth in the labour market at a rate of 1.7 percent from 2013 to 2015 and a 1.8 percent annual employment growth rate.Footnote 35

As such, several interviewees noted that INAC's involvement in petroleum and minerals is needed both to administer a royalty regime and as a facilitator to ensure the needs of both communities and industry are satisfied.

3.2 Alignment with Government Priorities

The Petroleum and Minerals sub-program is aligned with government priorities, including Canada's Northern Strategy, the 2013-2015 budgets and recent Speeches from the Throne. Moreover, the Government has committed to program improvements in order to achieve these priorities.

Canada's Northern Strategy identified the North as a fundamental part of Canada's heritage, future and identity. Through Canada's Northern Strategy, commitments were made toward several priority areas including exercising Arctic sovereignty, protecting environmental heritage, promoting social and economic development, and improving and devolving Northern governance.Footnote 36 The Petroleum and Minerals sub-program contributes to these goals and INAC's strategic outcome the North by managing petroleum and mineral resources on federal lands in Northwest Territories, Nunavut and northern offshore regions for the benefit of Northerners and all Canadians. Responsible resource development is a key pillar of Canada's Northern Strategy.

The Government has demonstrated its commitment to advancing resource development in Canada. Industry, territorial governments, institutions of governance, Aboriginal governments and organizations have expressed concern about the northern Regulatory regime. As such, the 2015 Economic Action Plan dedicated $135 million over five years to improve the efficiency and effectiveness of resource development project proposals and $34 million over five years to support the consultations necessary under the Canadian Environmental Assessment Act.Footnote 37

Document review and key informant interviews found that the sub-program is consistent with the objectives and the priorities of the federal government. All key informant interviewees that responded to the question affirmed that the Petroleum and Minerals sub-program supports the priorities of the government. Specifically, the sub-program is aligned with the 2013, 2014, and 2015 Economic Action Plans. These documents call for helping Northerners "benefit from local employment opportunities and rapid economic growth"Footnote 38 through northern oil, gas and minerals development. Moreover, they note that this sector is "one of the leading private employers of Aboriginal people."Footnote 39 In order to promote economic development in the North, the Government has recognized the challenges faced by mining, oil and gas companies in resource exploration and is committed to reducing exploration costs. In 2010, the Government of Canada also committed $21.8 million to support the Beaufort Regional Environmental Assessment to facilitate understanding of environmental factors in the Beaufort Sea.Footnote 40 This was done with the expectation that the research would facilitate exploration and development by filling in gaps in key information necessary for project approvals.Footnote 41

Overall, the sub-program clearly links to the broader government priority in two major ways: (1) an effective and efficient regulatory and management regime supports and provides certainty to interested mineral, oil and gas companies that their investments will be protected; and (2) effectively managed petroleum and mineral resources enable Aboriginal organizations and Northerners to more easily access and benefit from consequent opportunities. As such, the Government has a stated priority of improving regulatory efficiency.

3.3 Alignment with Federal Roles and Responsibilities

The Petroleum and Minerals sub-program is legislated as a responsibility for the Government of Canada through the Canadian Oil and Gas Operations Act, the Canada Petroleum Resources Act, and the Territorial Lands Act. The legislated roles and responsibilities of INAC and other federal regulatory bodies are clear.

For a detailed description of the program's legislative mandate, see Section 1.2.

Key informant interviews and case studies found that INAC's legislated roles and responsibilities are clear. When asked whether INAC is fulfilling its mandate, all key informant interviewees that responded said that INAC is following the statutory mandate set out in the legislation discussion in Section 1.2.

While there is a clear legislative mandate for the Petroleum and Minerals sub-program, INAC also has a variety of other roles that support the sub-program's intended outcomes, including facilitating relationships, information-sharing, and ongoing statutory obligations. There is an opportunity to clarify and communicate these additional roles to partners and stakeholders.

As can be seen in the program profile in Section 1.2., while the program conducts its core activities to meet the outcome of securing title for industry, ensuring a fair and stable royalty regime, overseeing benefits to communities and facilitating exploration at Headquarters, there are a number of additional activities conducted particularly through the regional office that are essential to supporting Petroleum and Minerals.

Case studies highlighted a number of roles that INAC should continue to play. For example, the Northwest Territories Case Study found that INAC has a significant role in settling land claims, given their impact on resource development. Furthermore, INAC still supports institutions of public government, such as land and water boards in the Northwest Territories. INAC will continue to have a role managing residual lands and contaminated sites post-devolution.

Interviewees noted that INAC is an effective facilitator of consultation and engagement with communities, territorial governments, and industry as INAC has historically been the face of the federal government to northern communities, developers, and stakeholder. Case studies and key informant interviews noted that this is a key role that INAC plays in providing information to all parties to facilitate decision making on resource development. Key informant interviews and regional case studies indicated that INAC continues to have intimate relationships with those groups. As such, some key informants noted that INAC has an opportunity to do more to facilitate decision making for major northern projects.

INAC also plays a key role supporting northern geoscience and environmental research, scientific research infrastructure, including the Canadian High Arctic Research Centre, and socio-economic baseline data collection. Case studies emphasized the importance of having the Petroleum and Minerals program represented in the region to support continued relationship building and information sharing. In this regard, the Beaufort Regional Environmental Assessment was deemed to be a best practice as INAC played a lead role in facilitating research into environmental baseline data as well as socioeconomic research to support community readiness.Footnote 42

In the context of devolution and the creation of CanNor, some roles for INAC are unclear.

CanNor and INAC appear to have complementary mandates, as the Petroleum and Minerals sub-program facilitates resource development, while the role of CanNor is to facilitate northern economic development. In the case studies of Nunavut and the Northwest Territories, key informant interviewees stressed the interconnected nature of CanNor programming and INAC's Petroleum and Minerals sub-program. For example, CanNor's Strategic Investments in Northern Economic Development provides crucial support to geoscience projects that advance potential for petroleum and mineral exploration. However, interviewees expressed concern that in some cases these roles overlap. The following roles were identified as areas of shared responsibility and potential duplication between INAC and CanNor:

- Community readiness - While community readiness is within the mandate of CanNor, the Northwest Territories case study found that INAC could also play an on-going role in supporting community governance and readiness for resource development. For example, INAC's Strategic Partnerships Initiative program, could continue to support readiness for jobs, business, and growth in northern communities.

- Socio-economic data - Case studies in Nunavut and Northwest Territories found that both CanNor and INAC collect baseline socio-economic data. These roles were found to be complementary, and a more closely co-ordinated approach to collecting that data was recommended. The evaluation found that there is a need to collect further baseline socio-economic data to assess the impacts of petroleum and minerals development on communities.

- Support for major projects - While CanNor is responsible for coordinating partners through the Northern Project Management Office, the case studies and key informant interviews noted that INAC continues to play a role in major northern projects. For example, INAC continues to be the lead on the Canadian High Arctic Research Centre in Cambridge Bay. The Mackenzie Valley Gas Project was also lead by INAC. Some key informant suggested that even after devolution, the federal government should have a role in projects of national importance and large 'nation-building' infrastructure projects like the Inuvik to Tuktoyaktuk highway.

INAC is adapting to recent changes as a result of Northwest Territories devolution.

Devolution grants territories more control over land and resources, giving Northerners more agency over their economic and political futures. As such, the devolution of Northern Governance is a key pillar of Canada's Northern Strategy, with the goal of providing Northerners with more control over their economic and political affairs. The Yukon was the first territorial recipient of devolution, a process that started in 1986 and ended in 2003, with the transfer of responsibility for lands, water, forestry and mineral resources.Footnote 43

The Northwest Territories experienced a gradual transition to devolution, with some services being devolved in 1986. The final Northwest Territories Devolution Agreement came into force on April 1st, 2014,Footnote 44 transferring control over land and resources to the territory and marking the final step in its devolution process.Footnote 45

Although the geographic extent of INAC's land, water and resource responsibilities in post-devolution Northwest Territories is reduced, the Department will retain its authority for the following areas:

- Intergovernmental relations;

- Negotiation and implementation of land claim and self-government agreements;

- Indian and Inuit programs and services;

- Management of federal obligations related to contaminated sites; and

- Regulation of petroleum and mineral resources on federal lands in the Northwest Territories, Nunavut and Arctic offshore regions.

While rights issuance and royalty collection clearly rest with Government of Northwest Territories, other responsibilities such as facilitating consultation, advocacy and provision of information, strategic research and infrastructure support are all unclear, and there is an opportunity to clarify roles and responsibilities of all stakeholders. As a best practice, the Client Services and Community Liaison unit at Government of Northwest Territories has been directing inquiries to the relevant stakeholders.

In particular, it was noted that INAC maintains control over resources on contaminated lands in the Northwest Territories. However, interviewees were generally under the impression that once these lands are cleaned, they will be transferred under the authority of the Government of Northwest Territories. However, it is unclear which parcels of land will be partially remediated and re-opened for resource development and which parcels will be turned into park space. Interviewees felt that INAC should have a comprehensive strategy for remediating and transferring these lands, but that one does not exist currently.

Key informant interviews, case studies, and the document review found that INAC's role has changed over the evaluation period given devolution of petroleum and minerals management to the Government of the Northwest Territories on April 1, 2014. While the evaluation found the transition has been relatively smooth, in some cases roles and responsibilities still need to be clarified as the Government of Northwest Territories settles into its role. Key informants and case studies found that INAC will need to ensure its role is clear post-devolution in light of progress towards Nunavut devolution.

Finally, it should be noted that in October 2014, a Chief Federal Negotiator was appointed to begin formal negotiations on a devolution Agreement-in-Principle for Nunavut, once signed this document will service as a guide for the final devolution agreement but no timeline for Nunavut devolution has been established.

4. Evaluation Findings – Performance (Effectiveness / Success)

The following sections examine issues related to performance. The effectiveness of the sub-program was assessed based on the intended outcomes as stated in the Performance Measurement Strategy. Those outcomes include:

- Securing title for industry;

- Fair and stable royalty regime;

- Benefits to communities from northern resource development; and

- Increased exploration activity

Generally, the program is meeting its performance targets; however, some external factors have been found to have an impact on the program. As such, recommendations are designed to compensate for some of these factors, which are detailed in Section 4.5.

4.1 Securing Title for Industry

Generally, the program is providing secure title for industry. However, some sources suggest there is an opportunity to examine program design changes to ensure an appropriate balance in security for industry and other needs.

4.1.1 Program meeting Performance Measurement targets

The program's 2014 Performance Measurement Strategy lists 'number of new exploration licences' and 'committed work expenditures by petroleum companies on new exploration licences' as indicators for oil and gas under this immediate outcome, and 'percentage of total land area with titles in good standing' for minerals.

Regarding oil and gas, the target for new exploration licences to demonstrate secure title for industry is one per year. A full breakdown on number of licences issued can be seen in Table 14 in Section 4.4 on facilitating exploration, and demonstrates that the program is well above its targets in this area. There is no target identified for expenditure commitments given that this is conducted through a confidential bidding process; however, Table 4 below demonstrates that expenditures on oil and gas exploration licences has been relatively stable during the evaluation period (although they have declined slightly, perhaps due to commodity price fluctuations).Footnote 46

| Exploration | |

|---|---|

| 2013 | $96 600 000 |

| 2102 | $77 800 000 |

| 2011 | $77 900 000 |

| 2010 | $113 900 000 |

Source: Northwest Territories Bureau of Statistics, with data from Statistics Canada |

|

Similarly, minerals title was found to be secure. While the percentage of overall land in good standing was unavailable, tables 5 and 6 indicate the number of claims, permits and leases that are in good standing in the Northwest Territories and Nunavut:

| 2010-11 | 2011-12 | 2012-13 | 2013-14 | |

|---|---|---|---|---|

| # of Claims in good standing | 4,075 | 4,158 | 3,036 | 2,256 |

| # of Prospecting Permits in good standing | 111 | 101 | 89 | 28 |

| # of Leases in good standing | 1,273 | 1,337 | 1,339 | 1,374 |

Source: Northwest Territories Mining Recorder's Office |

||||

| 2010 | 2011 | 2012 | 2013 | 2014 | |

|---|---|---|---|---|---|

| # of Claims in good standing | 7,178 | 6,777 | 6,066 | 5,562 | 4,278 |

| # of Prospecting Permits in good standing | 477 | 314 | 259 | 196 | 110 |

| # of Leases in good standing | 631 | 567 | 627 | 701 | 492 |

Source: Canada-Nunavut Geoscience Office, Nunavut Mineral Exploration, Mining and Geoscience Overview (2014) |

|||||

As can be seen, the leases in good standing in the Northwest Territories grew during the evaluation period; while it fluctuated but ultimately declined in Nunavut, this is likely due to low commodity prices, and therefore low activity levels rather than insecurity in title. In fact, there were only four disputes related to minerals title over the entire evaluation period, indicating a fair and well-managed title security process. Note that claims related to exploration are discussed separately in Section 4.4.

4.1.2 Fluctuating Industry Perceptions of Title Security

Although security of title is deemed strong as per the indicators set out in the Performance Measurement Strategy, industry has indicated that there are concerns in its security of title as managed by the Petroleum and Minerals program. Tables 7 and 8 show the results of a Fraser Institute survey of industry on perceptions of regulatory regimes for Petroleum and Minerals respectively:

| Year (sample size) |

Regulatory Climate Index | |

|---|---|---|

| Overall | Strong | |

| 2014 (n=156) |

52% | 8% |

| 2013 (n=157) |

41% | 17% |

| 2012 (n=147) |

38% | 6% |

| 2011 (n=135) |

78% | 34% |

| 2010 (n=133) |

45% | 21% |

1. The overall percentages can include a small percentage (ranging from zero percent to four percent) or respondents who would not pursue investment due to the factors in the index. |

||

| Year (# of jurisdictions) |

Nunavut - Regulatory uncertainty | Northwest Territories – Regulatory uncertainty | ||

|---|---|---|---|---|

| Overall | Strong | Overall | Strong | |

| 2014 (n=122) |

41% | 2% | 46% | 6% |

| 2013 (n=112) |

34% | 6% | 47% | 19% |

| 2012 (n=96) |

37% | 9% | 38% | 17% |

| 2011 (n=93) |

29% | 8% | 49% | 26% |

| 2010 (n=72) |

45% | 10% | 63% | 39% |

2. The percentages can include a small percentage of respondents who would not pursue investment due to this factor. |

||||

In these surveys, industry representatives were asked the extent to which regulatory climates were a deterrent to investing in various jurisdictions. As can be seen, industry concerns have fluctuated regarding regulatory certainty in both territories. One should use caution interpreting these data, as they do not give a clear picture of the extent to which 'deterrent' means 'would invest' or 'would not invest.' That being said, industry and program representatives explained to evaluators which issues specifically affected their confidence in security for industry for potential improvement, which are detailed below.