Evaluation of Business Capital and Support Services

January 2016

Project Number: 1570-7/14087

PDF Version (371 Kb, 43 Pages)

Table of contents

- List of Acronyms

- Executive Summary

- Management Response and Action Plan

- 1. Introduction

- 2. Evaluation Methodology

- 3. Evaluation Findings - Relevance

- 4. Evaluation Findings – Performance

- 5. Efficiency and Economy

- 6. Evaluation Findings – Other Issues

- 7. Conclusions and Recommendations

- Appendix A – Interview Guide

List of Acronyms

| AFI |

Aboriginal Financial Institution |

|---|---|

| DPR |

Departmental Performance Report |

| EPMRB |

Evaluation, Performance Measurement and Review Branch |

| INAC |

Indigenous and Northern Affairs Canada |

| NACCA |

National Aboriginal Capital Corporations Association |

Executive Summary

The Business Capital and Support Services sub-programFootnote 1 is designed to contribute to meeting the Federal Framework for Aboriginal Economic Development's strategic priorities of strengthening Aboriginal entrepreneurship and forging new and effective partnerships by improving access to capital. Specifically, the sub-program supports a network of Aboriginal Financial Institutions (AFIs) that act as developmental lenders and that offer business advisory services. Provision of access to capital for Aboriginal entrepreneurs is further facilitated by the Aboriginal Development Loan Allocation, Aboriginal Business Financing Program, Interest Rate Buy-down, the Enhanced Access Loan Fund, and the Aboriginal Capacity Development Program.

This evaluation covers all activities under this sub-program for the period between 2009-10 and 2014-15, and is being completed in advance of program renewal, and in accordance with the Treasury Board Policy on Evaluation.

This sub-program aims to increase the capacity of AFIs to deliver business capital and support services, and to expand and diversify capital pools for Aboriginal business development. This is intended to support a sustainable network of AFIs, and ultimately to contribute to the participation of First Nations, Métis, Non-Status Indians and Inuit individuals and communities in the economy.

With respect to relevance, the evaluation found that:

- Legislative and market-based barriers create a gap that prevents Aboriginal people from accessing capital via traditional/mainstream financial institutions. Therefore, given the need to support better Aboriginal representation in the economy, and specifically in entrepreneurship, there is a continued need to provide access to capital and business support services;

- Support for accessing business capital and support services is a legitimate and appropriate function for the federal government given the need for increased economic participation amongst prospective and established Aboriginal entrepreneurs; and

- Indigenous and Northern Affairs Canada's (INAC) current role in providing financial supports for business capital and support is appropriate, and direct delivery should continue to be implemented by Aboriginal agencies with key expertise in Aboriginal entrepreneurship.

With respect to performance, the evaluation found that:

- Capital pools for Aboriginal businesses are established, but it is difficult to determine the extent of expansion and diversification, and what degree of impact that has on current or prospective Aboriginal businesses accessing capital;

- There is considerable variability between Aboriginal Financial Institutions in their capacity to deliver business capital and support services. However, many Aboriginal Financial Institutions have demonstrated capacity through the provision of loans, which are also generating employment;

- INAC has successfully worked with program partners to establish a network of Aboriginal Financial Institutions that provide prospective and existing Aboriginal entrepreneurs and businesses with access to capital. However, it is not reasonable to expect Aboriginal Financial Institutions to continue to be sustainable in the absence of continued government funding or private sector support; particularly in the context of the small and high-risk markets in which they operate;

- Business Capital and Support Services is effectively contributing to the creation and/or expansion of Aboriginal businesses through the provision of contributions and loans and as evidenced by the current repayment efficiency; and

- Activities and expenditures under the Business Capital and Support Services sub-program are operating efficiently insofar as the new program delivery structure and the expenditures of contributions relative to total expenditures. Further, there is a demonstration of economy respecting the economic and potential social impacts relative to current expenditures.

Respecting other evaluation issues, the evaluation found that:

- With the recent transition of program delivery to the National Aboriginal Capital Corporations Association (NACCA), there is a need for stronger communication between NACCA, AFIs and INAC regarding the program's operational structure and of the roles and responsibilities of all stakeholders; and

- AFIs are essentially unregulated. While no specific concerns or occurrences related to their lack of regulation were raised, there will be a need to consider the implications of regulation and oversight where AFIs expand their portfolios into areas with existing regulations, such as insurance and mortgages.

It is therefore recommended that INAC:

- Ensure that in its Terms and Conditions, NACCA collects appropriate performance data from the AFI network.

- Establish incentives to attract interest and investment from the private and other sectors to leverage additional capital and diversify the portfolios of AFIs.

- Re-assess the intended outcomes of the program considering the recent program changes and the findings of this evaluation.

- Given the transition of program delivery to NACCA, INAC should:

- Ensure clarity of the respective roles and responsibilities with respect to business capital and support services; and

- Work with NACCA and the AFI network to strengthen communication in order to improve clarity of the program's operational structure and of the roles and responsibilities of all stakeholders.

- Provide sufficient oversight of program activities to ensure accountability of program contributions, and work with NACCA to ensure AFIs are equipped to meet the requirements of existing regulatory bodies should they expand into other industries such as mortgages or insurance.

Management Response and Action Plan

Project Title: Evaluation of Business Capital and Support Services

Project #: 1570-7/14087

1. Management Response

The national network of Aboriginal Financial Institutions (AFIs) plays an important role in increasing the participation of First Nations, Inuit and Métis peoples in the Canadian economy. The strong performance of the AFIs precipitated the recent introduction of new program elements and the transfer of most program delivery responsibilities to the National Aboriginal Capital Corporations Association. Given these recent program renovation activities the Sector was keenly interested in the results of this evaluation.

The Sector is pleased to receive confirmation of the continued need for the programming, the appropriateness of our current role and the notable success that the Aboriginal Financial Institutions have achieved in developing and expanding Aboriginal business. Your research confirms our long-held belief that the AFI network is performing well by many measures.

A number of the recommendations relate to the recent change in the delivery of the program. Recommendations such as: ensuring that AFIs continue to collect appropriate performance data, that the new roles and responsibilities are clearly articulated to and that we strengthen communications with all stakeholders in the delivery of programming and services to advance Aboriginal business development.

The sector recognizes the considerable variability in the capacity of the AFIs across the network. Moving forward, the sector will attempt to balance the needs of the network and remain mindful of the need to consider the impact of regulations should some institutions expand operations into a regulated space.

The AFI network is an efficient and effective system that is capable of achieving even greater results. Given the inherent cost of developmental lending and the trends in demand for AFI services, the current level of public investment in the network is perceived by many to be insufficient. Incremental public or private investment will be required to address the erosion of capital and meet future demand.

The recommendations and findings in this evaluation have provided the Lands and Economic Development Sector with a considerable set of information that will help will help to focus the efforts of program managers. The action plan, presented in the next section, is an appropriate and realistic plan for addressing the recommendations.

2. Action Plan

| Recommendations | Actions | Responsible Manager (Title / Sector) |

Planned Start and Completion Dates |

|---|---|---|---|

| 1. Establish incentives to attract interest and investment from the private and other sectors to leverage additional capital and diversify the portfolios of AFIs. | We DO concur. | Assistant Deputy Minister, Lands and Economic Development |

Start Date: |

| A broad spectrum of stakeholders (AFIs, NACCA, National Aboriginal Economic Development Board, private and social finance sector) have expressed a desire to create new financial partnerships that will facilitate access to new and innovative sources of capital to address developmental business lending and other financing needs in the Aboriginal community. Additional research and consultation is needed to develop financial instruments that will enable the development of a new partnership between AFIs and private/social finance sector. It is expected this research will create the evidence to seek out additional funding for the AFI network from the public, private and social finance sectors that allows AFIs to meet a variety of capital for both Aboriginal communities and entrepreneurs. Funding for further research and consultation has been allocated to the National Aboriginal Capital Corporations Association in the 2015-17 funding agreement and a research committee has been established between NACCA and INAC to undertake and direct relevant research. | Completion: Status: On Track Update/Rationale Discussions with NACCA on the establishment of a Working Group to investigate and implement the adoption of a new financial instrument are on-going. This work will also provide additional lines of evidence for supporting public investment in the AFI network. AES: Underway: INAC has initiatives underway to attract investment, leverage capital and diversify portfolios of AFIs. Good progress to date, report back at the Q4 2016-2017 EPMRC meeting (April 2017). |

||

| 2. Ensure that in its Terms and Conditions, NACCA collects appropriate performance data. | We DO concur. | Assistant Deputy Minister, Lands and Economic Development |

Start Date: |

INAC will work with NACCA, the AFI network and other potential stakeholders with the objective of developing both quantitative and qualitative indicators, which can be used to measure economic and social impact by the network, allow for comparison where possible with other government economic development programs and provide information on economic and social impact to potential social finance investors who look for these types of metrics in addition to the traditional financial risk/return analysis. The AFI network and NACCA have an extensive data base of financial and project results that spans more than 10 years and use this data to create more timely and useful performance indicators for both private and public sectors. NACCA in conjunction with INAC has also created and implemented a robust electronic reporting template for use by all AFIs when delivering government supported financial services to Aboriginal entrepreneurs. Preliminary data collected to date has been thorough and useful for the continued administration of programs and the documentation of performance results. The development and implementation of a comprehensive Data Collection and Reporting Framework and allocation of the appropriate resources is a deliverable in the 2015-17 funding agreement with NACCA. |

Completion: Update/Rationale: NACCA has established an information management committee to guide the adoption of the appropriate technology to permit the more effective sharing and analysis of data amongst stakeholders, initial meeting held Q-1. INAC has and will continue to communicate its data and access requirements for the new IT platform. AES: Underway: Initiatives are underway to facilitate the collection of appropriate performance data by NACCA. Good progress to date, report back at the Q4 2016-2017 EPMRC meeting (April 2017). |

||

| 3. Re-assess the intended outcomes of the program considering the recent program changes and the findings of the evaluation. | We DO concur. | Assistant Deputy Minister, Lands and Economic Development |

Start Date: |

Guided by comments provided by Treasury Board Secretariat and as part of the 2016-17 Performance Management Framework review:

|

Completion: a) Status: Completed Update/Rationale: The Aboriginal Entrepreneurship Program has adopted use of the increase in value of the AFI gross loan portfolio which is reported in the annual Departmental Performance Report. AES: Completed – INAC has revised its performance measurement metrics. Recommend to close. Closed. Status: On Track Update/Rationale: Discussions with NACCA and other stakeholders on the adoption social impact indicators are on-going. As social impact indicators are an emerging field, the timeline to establish standards and reach consensus among stakeholders has been re-evaluated to the end of the 2016 calendar year. AES: Underway: INAC is currently working with NACCA regarding the use of social impact indicators. Good progress to date, report back at the Q3 2016-2017 EPMRC meeting (January 2017). |

||

4. Given the transition of program delivery to NACCA, INAC should:

|

We DO concur. | Assistant Deputy Minister, Lands and Economic Development |

Start Date: |

|

Completion: a) Status: Behind Schedule Update/Rationale: Current organizational changes at NACCA and recruitment of a new CEO (CEO released June 22) have not allowed for the discussion and development of a formal communications protocol. Discussions with NACCA on the subject are scheduled for Q-2. AES: Underway: The Creation of communications protocols will be undertaken in Q2. b) Status: Completed Update/Rationale: TAG is established and regular meetings occur, including one meeting in Q-1. AES: Completed: A technical advisory group has been established as a venue for communications – recommend to close. Closed. |

||

| 5. Ensure sufficient oversight of program activities to ensure accountability of program contributions, and work with NACCA to ensure AFIs are equipped to meet the requirements of existing regulatory bodies should they expand into other industries such as mortgages or insurance. | We DO concur. | Lands and Economic Development |

a) Completed b) Start Date: Completion: |

|

|

I recommend this Management Response and Action Plan for approval by the Evaluation, Performance Measurement and Review Committee

Original signed on January 11, 2016, by:

Michel Burrowes

Senior Director, Evaluation, Performance Measurement and Review Branch

I approve the above Management Response and Action Plan

Original signed on January 12, 2016, by:

Sheilagh Murphy

Assistant Deputy Minister, Lands and Economic Development Sector

1. Introduction

1.1 Overview

The evaluation of Business Capital and Support Services was conducted between March and October 2015 by the Evaluation, Performance Measurement and Review Branch, as set out in its five year evaluation plan. Business Capital and Support Services is funded through two authorities: Contributions to Support Land Management and Economic Development; and Contributions for the Purpose of Consultation and Policy Development. The purpose of the evaluation was to examine the relevance (continued need, alignment with government priorities and alignment of roles and responsibilities) and performance (effectiveness and efficiency) of the program, and to inform program and policy considerations going forward. The evaluation fulfills the requirements of the Treasury Board Policy on Evaluation, requiring the evaluation of all direct program spending on a five-year cycle.

1.2 Program Profile

1.2.1 Background and Description

Business Capital and Support Services (formerly the Aboriginal Business Development Program), is a sub-program of the Aboriginal Entrepreneurship Program. As a component of the Federal Framework for Aboriginal Economic Development, its intent is to provide a focused, government-wide approach, including improved alignment of federal investments to target opportunities; to respond to new and changing conditions; and to lever partnerships in order to address persistent barriers that impede the full participation of Aboriginal people in the Canadian economy.

Business Capital and Support Services is designed to contribute to the Framework's strategic priorities of Strengthening Aboriginal entrepreneurship and Forging new and effective partnerships by improving access to capital. The program included the Loan Loss Reserve (discontinued in 2012), which was intended to assist First Nation businesses in addressing the constraints of Section 89 of the Indian Act (which prevents the pledging of assets as collateral to secure debt financing.

The program supports access to debt and equity financing by Aboriginal businesses through a network of Aboriginal Financial Institutions (AFIs). These institutions provide entrepreneurs with a range of services such as financial assistance, advice for business operations, and referrals to other sources of financing and advice. The program is open to Aboriginal entrepreneurs, whether on- or off-reserve, and in urban, rural and remote areas. The program supports youth entrepreneurs, business expansions and new businesses. Throughout the existence of the program, there have been between 55 and 60 Aboriginal Financial Institutions that act as developmental lenders (i.e., for enterprises that are not ready to secure business loans from banks) and that offer business advisory services.

Access to capital is further supported by a number of mechanisms, including:

- Aboriginal Business Financing Program: to provide a mechanism for the delivery of non-repayable contributions to a maximum of $99,999 for Aboriginal entrepreneurs and $250,000 for community owned Aboriginal businesses.

- Aboriginal Developmental Loan Allocation; to provide a consistent and reliable mechanism to compensate AFIs for qualified developmental loan losses and the high cost of developmental loan administration.

- Interest Rate Buy-Down - an interest rate subsidy for qualifying Aboriginal Financial Institutions that wish to increase their loan capital pools by securing credit lines with mainstream financial institutions. These credit lines provide a top up to capital. AFIs must pay the unsubsidized component of the interest rate to the lending financial institution.

- Enhanced Access Loan Fund - provides additional loan capital to an AFI in order to allow it to expand outside its normal catchment area in order to service unserved or under-served areas. As a loan fund, capital must be repaid to replenish the fund as loans are paid out.

- Aboriginal Capacity Development Program - This component funds products and services to help improve the management practices of AFIs.

1.2.2 Objectives and Expected Outcomes

The Aboriginal Entrepreneurship Program supports the achievement of the Land and Economy Strategic Outcome of Full Participation of First Nations, Métis, Non-Status Indians and Inuit individuals and communities in the economy. The sub-program outcome for the Business Capital and Support Services is a sustainable network of Aboriginal Financial Institutions. The immediate outcomes of the Business Capital and Support Services sub-program are: increased capacity of Aboriginal Financial Institutions to deliver business capital and support services; and the expansion and diversification of capital pools for Aboriginal business development. The ultimate program outcome for Aboriginal Entrepreneurship is the creation and/or expansion of Aboriginal business.

1.2.3 Program Management, Key Stakeholders and Beneficiaries

INAC regional offices are responsible for supporting economic development and business opportunities by:

- gathering business, market and industry research intelligence from open sources and providing needs and gaps assessment on economic initiatives in order to identify potential Aboriginal business opportunities;

- supporting the development of frameworks and partnerships to provide access to both public and private sector driven major business opportunities;

- providing advice to Aboriginal communities on major business projects proposals; and

- providing analysis and recommendation on major business projects.

In 2013, INAC devolved program delivery to 14 of the AFIs, referred to as Program Delivery Partners. The remaining AFIs are responsible for referring clients to an appropriate regional Program Delivery Partner for business financing and support services where applicable. Program Delivery Partners offer developmental loans and non-repayable contributions (up to $99,000 for individuals and up to $250,000 for communities) in support of business development. AFIs also provide developmental loans. Loan amounts are decided based on various variables (e.g., percentage of loan portfolio), and may reach values between $250,000 and $350,000. Above this amount, businesses would have to seek additional loans from traditional banks.

On April 1, 2015, responsibility for the administration of programming was transferred to the National Aboriginal Capital Corporations Association (NACCA), which is now responsible for the delivery and administration of the following programs until 2016-17:

- Aboriginal Developmental Loan Allocation: to provide a consistent and reliable mechanism to compensate AFIs for qualified developmental loan losses and the high cost of developmental loan administration.

- Aboriginal Business Financing Program: to provide a mechanism for the delivery of non-repayable contributions to a maximum of $99,999 for Aboriginal entrepreneurs and $250,000 for community owned Aboriginal businesses.

- Enhanced Access: to provide funding for AFIs to serve territories that were not specifically defined in government funding agreements or the legal charter under which they were established as an AFI.

- Interest Rate Buy-down: to encourage an increase in developmental lending by providing funding to qualified AFIs to secure additional loan funds from sources of commercial capital: e.g., banks, trust companies and other arms-length private lenders of capital.

- Aboriginal Capacity Development Program: to offer a modern and valuable training for AFIs by focussing educational support on the effective and consistent delivery of developmental lending across the AFI network.

1.2.4 Program Resources

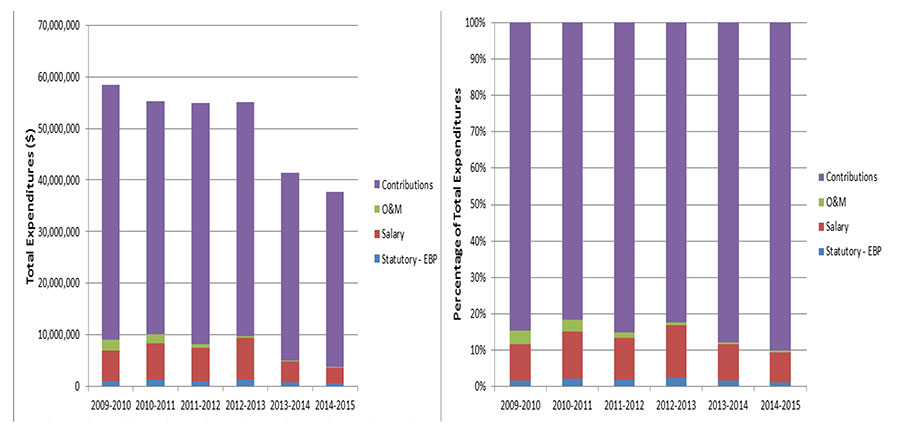

From 2009-10 to 2015-16, the total planned investment for Business Capital and Support Services and its related activities was $323 million. Specifically, this included $251 million to be expended from 2009-10 to 2013-14; $36.4 million for 2014-15; and $35.6 million for 2015-16. Actual expenditures from fiscal year 2009-10 to 2014-15 are noted in the table below. From 2009-10 to 2014-15, actual expenditures have decreased by 36 percent. Additionally, as a result of the shift in the program delivery model to NACCA, there was not ongoing need for comprehensive full-time equivalent support, which explains the significant decrease in actual salary expenditures between 2012-13 and 2014-15.

| Actuals | 2009-2010 | 2010-2011 | 2011-2012 | 2012-2013 | 2013-2014 | 2014-2015 | 6 Year Total |

|---|---|---|---|---|---|---|---|

| Statutory - EBP | 966,456 | 1,179,170 | 988,481 | 1,299,908 | 660,834 | 468,751 | 5,563,600 |

| Salary | 5,890,891 | 7,128,455 | 6,369,616 | 8,018,811 | 4,102,263 | 3,063,330 | 31,510,036 |

| Operation and Maintenance | 2,136,286 | 1,836,399 | 794,877 | 356,570 | 234,461 | 201,978 | 5,560,571 |

| Contributions | 49,429,832 | 45,164,314 | 46,802,355 | 45,355,135 | 36,342,985 | 33,933,630 | 257,028,251 |

| Grand Total | 58,423,465 | 55,308,338 | 54,955,328 | 55,030,424 | 41,340,543 | 37,667,689 | 302,725,787 |

Source: Chief Financial Officer |

|||||||

2. Evaluation Methodology

2.1 Evaluation Scope and Timing

The evaluation covers activities under the Business Capital and Support Services sub-program (3.1.1) (described in Section 1.2) from fiscal years 2009-10 to 2014-15, with a total of $302.7 million in actual expenditures, and was conducted between March and October 2015. The Terms of Reference for this evaluation were approved in September 2014.

2.2 Evaluation Issues and Questions

The following evaluation questions were posed in the Terms of Reference:

Relevance

Continued Need

1) Does the Access to Capital and Business Services still address an existing and demonstrable need in Aboriginal communities?

2) Is the Access to Capital and Business Services responsive to the Aboriginal businesses capital needs?

Alignment with Government Priorities

3) To what extent is the Access to Capital and Business Services consistent with: (1) federal government priorities; and (2) departmental strategic outcomes?

Alignment with Federal Roles and Responsibilities

4) Is there a legitimate, appropriate and necessary role for the federal government in the Access to Capital and Business Services?

Performance

Effectiveness

5) To what extent has the Access to Capital and Business Services achieved its stated immediate, intermediate, and if possible, ultimate outcomes using the previous delivery model?

6) Have there been positive or negative unintended outcomes? If so, were any actions taken?

Efficiency and Economy

7) Is the new delivery approach the most economic and efficient means of achieving the intended objectives?

Design and Delivery

8) To what extent has the design and delivery of the programming facilitated the achievement of outcomes and overall effectiveness?

9) Has the new delivery model been implemented as planned?

10) What are the factors (both internal and external) that will facilitate or hinder the implementation of the new delivery model?

Other Issues

Lessons learned/Best Practices

11) Did the Access to Capital and Business Services take into account lessons learned from the previous internal evaluation recommendations? Are there any lessons learned/best practices that could be used for the improvement of the Access to Capital and Business Services Program?

Performance Measurement

12) To what extent has the umbrella Performance Measurement Strategy of the Aboriginal Entrepreneurship Program: i) contributed to performance measurement? ii) has the strategy been implemented as expected; and iii) has it supported the evaluation's assessment of results)?

2.3 Evaluation Methodology

This evaluation takes into consideration information gathered from several lines of evidence in order to ensure a comprehensive assessment of the program's relevance and performance, including data directly related to outcomes. These are briefly described below.

2.3.1 Data Sources

- Literature and Document Review:

The literature review included an extensive review and summary of some 60 articles related to access to capital, Aboriginal business and entrepreneurship, and Aboriginal economic and social issues relevant to the program. These included peer-reviewed journal articles, government and non-government commissioned studies, and other articles cited throughout this evaluation report. Other internal and government documents were examined where applicable, for program background, as well as other assessments of the Business Capital and Support Services or related programs. - Data Analysis:

Summary data obtained from Program Delivery Partners included: application data and the results of applications; the number of businesses supported; the dollar value and proportion of total available funds committed; and the amount leveraged. The data largely focuses on the Program Delivery Partners themselves rather than on Aboriginal businesses. Their funding distributions are broken down by: client contribution; program equity; Aboriginal Financial Institution debt financing; commercial financing, and other government contributions. - Key informant interviews:

Semi-structured key-informant interviews were conducted with eleven INAC employees at headquarters and regional offices. Further, three additional interviews were conducted with other Aboriginal business experts, including a member of the National Aboriginal Economic Development Board, the Louis Riel Capital Corporation and the Métis Voyageur Development Fund. A group interview was also conducted with three representatives of the NACCA. - Site Visits:

Site visits to four Aboriginal Financial Institutions (three of which were Program Delivery Partners) included interviews with ten business owners and eleven business specialists and employees (Chief Executive Officer, General Managers, and loan managers). Site visits included analyses of administrative documents and data, interviews with key respondents and focus groups and on-site observations. These analyses provided quantitative and qualitative insights into the extent to which the intended outcomes of business capital and support services are occurring.

2.3.2 Considerations, Strengths and Limitations

Due to limited resources for this evaluation, its start time was delayed by six months and it faced further challenges of resource turn-over, which contributed to further delay. The program has also recently undergone significant change in program delivery. In some ways, this may impact the relevance of some of the findings, as recent changes may mitigate some of the issues raised, or could ameliorate some of the successes or limitations going forward. To the extent possible, however, every effort was made to contextualize observations in light of the new delivery model under NACCA.

2.4 Roles, Responsibilities and Quality Assurance

The Evaluation, Performance Measurement and Review Branch (EPMRB) was responsible for conducting all lines of evidence and writing the final report. Prairie Research Associates were hired to assist with the conduct of two site visits associated with the key informant interviews with Aboriginal Financial Institutions.

A working group comprised of INAC representatives, as well as representatives from the National Aboriginal Economic Development Board, the Métis Voyageur Development Fund and the Louis Riel Capital Corporation, was developed to help inform the evaluation questions and provide insights on methodology and interpretation of findings.

The draft evaluation report also underwent a peer review in the EPMRB .

3. Evaluation Findings - Relevance

3.1 Continued Need

Finding 1: Legislative and market-based barriers create a gap that prevents Aboriginal people from accessing capital via traditional/mainstream financial institutions. Therefore, given the need to support better Aboriginal representation in the economy, and specifically in entrepreneurship, there is a continued need to provide access to capital and business support services.

Due to legislative and market-based barriers that impact Aboriginal entrepreneurial activity, there is a clear and demonstrable need to continue supporting business capital and support services. The main legislative barrier is Section 89 of the Indian Act, which prevents the use of land on-reserve as security and also prevents the seizure of real property (i.e. land, home) located on-reserve by a lender - meaning that the value of such assets cannot be leveraged to secure financing.

The more common barriers, facing Aboriginal entrepreneurs both on- and off-reserve, however, are market size and risk. In particular, the remoteness and small size of many First Nation communities, coupled with the fact that many off-reserve Aboriginal businesses are small-scale and operate in rural, remote and northern communities, limits the incentive of mainstream financial institutions to provide access to capital (equity and debt financing) given that business markets are considerably smaller and potentially of higher risk. This limits the ability of Aboriginal entrepreneurs to start, grow or acquire a new business, and in turn, limits opportunities for community economic development. This may explain, at least in part, the significant underrepresentation of Aboriginal small and medium business ownership in Canada at only 1.6 percent as of the most recently available national data.Footnote 2

"[Without the AFI], I would have never been able to expand; I would have remained a house-based business."

- Business supported by the

Louis Riel Capital Corporation

In an effort to address the under-representation of Aboriginal people in the economy (specifically in entrepreneurial activities) and to overcome legislative barriers, AFIs act as an alternative to mainstream financial institutions while at the same time advancing their collective interest by providing Aboriginal people with business creation and expansion support services. Whereas there are some conventional banks, such as the First Nations Bank of Canada, that offer similar services to Aboriginal people, AFIs provide business capital and support services to Aboriginal people who face notable barriers, such as a lack of credit or poor credit, lack of sufficient collateral, or lack of business experience. Entrepreneurs need to be seen by AFIs as having reasonable risk and viability, but the threshold is lower than traditional institutions, thus aiming to bridge a gap between many Aboriginal entrepreneurs and access to capital. The additional business support services provide the opportunity for Aboriginal entrepreneurs to receive guidance and support that is not the norm for mainstream financial institutions.

Business Capital and Support Services is one clear avenue to strengthen Aboriginal representation in the economy. Critically, the 2011 unemployment rate for Aboriginal peoples was more than double (13 percent) that of the non-Aboriginal population (six percent),Footnote 3 and is 17 percent for Status Indians living off-reserve and 22 percent living on-reserve.Footnote 4 Moreover, 2012-13 dependency rates for income assistance was higher for Aboriginal people living on-reserve (33.6 percent), compared to five percent for the general Canadian population and has remained relatively unchanged over the past decade.Footnote 5 In 2011, the dependency rate for Aboriginal people living off-reserve was 11 percent.Footnote 6 With support to start and expand business, the Government is supporting Aboriginal participation in the economy in the sense that, at least indirectly, the existence of business and economic development has considerable potential to decrease unemployment rates and increase participation and employment rates.

Participants interviewed for this evaluation unanimously agreed that the absence of federal support would severely limit the ability of AFIs to provide adequate access to capital and to provide strong supportive services consistent with the outcomes of this sub-program. Additionally, in many cases, it would limit the viability and in some cases the very existence of some AFIs. They also agreed that without AFIs, many businesses would not be created and expanded. In other words, there is a clear need to support Business Capital and Support Services programming since AFIs operate in a lending space that mainstream financial institutions do not.

3.2 Alignment with Government Priorities

Finding 2: Support for accessing business capital and support services is a legitimate and appropriate function for the federal government given the need for increased economic participation amongst Aboriginal prospective and established Aboriginal entrepreneurs.

INAC is mandated to support the economic prosperity of Aboriginal people and to support improvement in their participation in Canada's economic development. The activities that INAC supports though business capital and support services are strongly aligned with the federal government's priorities. In the past two years, the Government of Canada reinforced its commitment in this respect by contributing $7.8 million in 2014, followed by an announcement in 2015 of an additional two-year contribution of $62 million in order to increase NACCA's role and that of the AFI network. This was committed in order to strengthen Aboriginal entrepreneurship and to increase Aboriginal participation in the economy through financial consulting, business planning, developmental loans and non-repayable contributions.Footnote 7

Furthermore, Business Capital and Support Services aligns with INAC's Federal Framework for Aboriginal Economic Development (2009), specifically in terms of its commitment to increase access to debt and equity capital in order to ensure there are viable Aboriginal businesses that can compete in the current market. One of the four strategic priorities of the Federal Framework is to "Strengthen Aboriginal Entrepreneurship." In an effort to support this priority, the federal government is committed to: removing legislative and regulatory barriers that deter business development; increase access to debt and equity capital; improve procurement opportunities; strengthen the capacity of entrepreneurs; and accommodate the real needs, conditions and opportunities facing different communities in all regions of the country.Footnote 8

Business Capital and Support Services is also aligned with INAC's strategic outcome of "Full participation of First Nations, Metis, Non-Status Indians and Inuit individuals and communities in the economy". This is achieved via the initiative's outcomes, as expressed in the performance measurement strategy for Aboriginal Entrepreneurship:

- Capital pools for Aboriginal business development are established, expanded and diversified;

- Aboriginal Institutions have the capacity to deliver business capital and support services;

- A sustainable network of Aboriginal Financial Institutions; and

- Creation and/or expansion of viable Aboriginal businesses.

According to INAC's Report on Plans and Priorities for 2014-15, the Department is committed to aligning its actions with the expected result of "a sustainable network of Aboriginal Financial Institutions" by pursuing the Program Delivery Partnership Initiative; continuing to refine and implement a new suite of financial instruments; and researching the implementation and design of a Capital Attraction Tool.Footnote 9 Additionally, the federal government recognizes that "[t]he contribution of Canada's Aboriginal peoples will be important to our future prosperity. Concerted action is needed to address the barriers to social and economic participation that many Aboriginal Canadians face."Footnote 10

3.3 Alignment with Federal Roles and Responsibilities

Finding 3: INAC's current role in providing financial supports for business capital and support is appropriate, and direct delivery should continue to be implemented by Aboriginal agencies with key expertise in Aboriginal entrepreneurship.

Interviewees and site visit participants unanimously agreed that the role of the federal government in providing support for business capital and support services is appropriate. Whereas INAC had, in the past, been responsible for program delivery, the recent change to devolving this to NACCA is reflective of the fact that such an initiative should be directly managed by Aboriginal agencies that have key expertise in Aboriginal entrepreneurship. NACCA not only has a considerable history and applicable expertise in this regard, but also most AFIs are already members of NACCA and therefore share a common set of goals and vision for the future. At the same time, NACCA's mandate of "stimulating economic growth for Canada's Aboriginal peoples by promoting and underwriting Aboriginal business development" is aligned with the initiative's objectives of ultimately creating and/or expanding viable Aboriginal businesses. In addition to having a knowledgeable board and support staff to administer the initiative, NACCA also has a longstanding and established relationship with the AFI network and with INAC.

As the transition from INAC to AFI delivery was made during the evaluation's data collection period, some uncertainty was expressed by interviewees and site visit participants about centralizing the Program Delivery Partners through NACCA. This was primarily related to a lack of understanding among Program Delivery Partners regarding NACCA's roles and responsibilities during the course of the initiative's transition, and how it would affect the AFI network moving forward. However, it should be expected that some uncertainty may be present in the early stages of any program in transition (see further discussion in the Performance Section on 'Other Findings'). With respect to business capital and support services, the transition involved a significant administrative shift. From April 2012 to March 2015, it was delivered by the 14 Program Delivery Partners, to being delivered by NACCA by April 1, 2015. This means that funding which was once channelled from INAC to the Program Delivery Partners for the initiative's delivery is now being re-directed to NACCA. Interviewees and site visit participants expressed that the most significant implication of this shift was uncertainty about how NACCA will be allocating resources to the AFIs (i.e. will funding be based on an AFI's performance, will it be proposal-based, etc?). As the initiative moves forward and continues to be delivered by NACCA, it is important to explore the extent to which controls are present, such as the establishment of an independent oversight body and one that produces and distributes an independent annual report at year-end. The Institute on Governance recommended that INAC implement one oversight structure to deliver all components of the Aboriginal Entrepreneurship Program, however, it is unclear the extent to which this would directly implicate the governance structure and oversight of NACCA and AFIs.

4. Evaluation Findings – Performance

4.1 Achievement of Expected Outcomes

4.1.1 Immediate Outcome 1: Capital pools for Aboriginal businesses are established, expanded and diversified.

Finding 4: Capital pools for Aboriginal businesses are established, but it is difficult to determine the extent of expansion and diversification, and what degree of impact that has on current or prospective Aboriginal businesses accessing capital.

Since the initial creation of AFIs in the 1980s, they have achieved notable success in terms of supporting the development and expansion of Aboriginal businesses on- and off-reserve. For instance, since their inception, AFIs have provided over $2 billion in financing to Aboriginal businesses, representing over 38,000 loans. More recently, NACCA's latest Aboriginal Financial Institutions Portrait for fiscal year 2014 shows that AFIs provided 1,361 loans to Aboriginal businesses, totaling $110 million.Footnote 11 Of these, 480 loans were for starting businesses and 727 new loan advances were provided to existing businesses for expansion purposes.Footnote 12

Some of these achievements can be attributed to the establishment of various capital tools, which have, in turn, established capital pools to help support the start-up and expansion of Aboriginal businesses. Such tools include: repayable loans; non-repayable contributions; loan-loss guarantee, interest rate buy-down; and the Aboriginal Business Developmental Lending Allocation. These capital tools are discussed in further detail in Section 1.2.3.

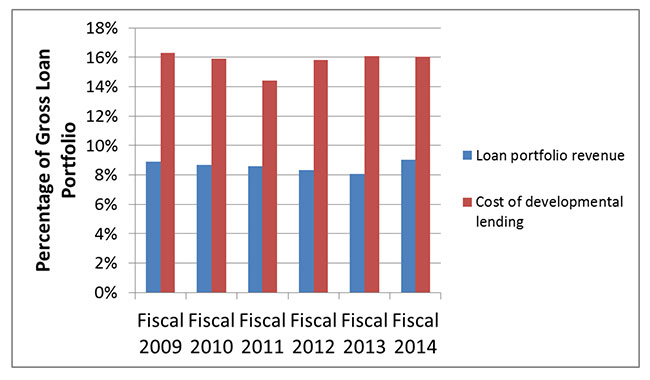

Site visit and interview participants unanimously agreed that these tools have enabled AFIs to continue supporting developmental loans to Aboriginal entrepreneurs that would be seen as higher risk by mainstream financial institutions. In particular, participants expressed that the Aboriginal Developmental Loan Allocation has encouraged AFIs to engage in higher risk developmental lending by compensating for potential loan losses. Non-repayable loans have also helped reduce the risk of developmental lending, hence enabling AFIs to be less risk adverse. However, despite such tools, AFIs have not been able to generate sufficient loan portfolio revenue from 2009 to 2014 (the latest years for which data is available) to recover their cost of capital.Footnote 13 Even though the Aboriginal Developmental Loan Allocation was established to provide a revenue source for the loan portfolio, there was no obvious impact (as shown in Figure 1). The 'cost of capital' is measured by the following four elements:

- Administrative expenses (AE) - the amount of administrative expense expressed as a percentage of the loan;

- Loan losses (LL) – the amount of loan loss expected, based on probability of default expressed as a percentage of the loan;

- Cost of funds (COF) - the amount of interest paid to a senior lender expressed as a percentage of the principal of the loan; and

- Desired capitalization rate (CR) – the amount allowed for profit and growth expressed as a percentage of the loan.Footnote 14

The cost of capital is therefore calculated as:

AE + LL + COF + CR / Gross loan portfolio = Interest rate charged.Footnote 15

From 2009 to 2014, the AFI network experienced a shortfall in the ability to recover the cost of developmental lending, representing an average of seven percent (see Figure 1).

Figure 1: Cost of developmental lending relative to loan portfolio revenue (2009-2014)Footnote 16

Text alternative for Figure 1: Cost of developmental lending relative to loan portfolio revenue (2009-2014)

This is a bar graph with the x axis containing fiscal years 2009 to 2014, and the y axis being the percentage gross loan portfolio. Each fiscal year has two bars, one representing loan portfolio revenue, and the other representing cost of developmental lending. The bar representing loan portfolio revenue varies slightly between 8 and 9 percent over the six fiscal years. The bar representing cost of developmental lending is approximately 16 percent in 2009 and 2010; approximately 14 percent in 2011; and 16 percent from 2012 to 2014.

While it is clear that the shortfall has eroded the capital base of AFIs on average, some have taken certain measures to address this issue by reducing risk tolerance levels, improving risk management practices and developing other revenue streams. The concern with this approach is that providing loans to lower-risk projects defeats the initiative's purpose of providing an avenue for higher-risk lenders who may have less access to traditional financial institutions, or who may need more direct support not provided by traditional institutions. In an effort to expand the capital pool, many site visit and interview participants cited the need to promote capital attraction that is specifically directed at attaining private capital for AFIs to better support the needs of their clients.

The extent to which capital pools have been expanded or diversified, however, is less clear, as INAC does not systematically collect data that would speak to the expansion or diversification of portfolios. An internal audit conducted in 2014Footnote 17 supported the notion raised by interview participants in this evaluation, who stressed the need for a more systematic and national approach to outcome and data collection. In particular, and as discussed further in Section 5.2, while this program shows positive results with respect to economic benefits, measurement of these results should better account for the incremental benefit of government investment in the AFI network respecting economic impacts and social impacts. Particular attention should be focused on the rapidly developing field of metrics for social return on investment and the indicators that can potentially be used by government and the private sector in assessing both the quantitative and qualitative benefits from investing in the AFI network.

In this respect, INAC should work with NACCA, the AFI network and other potential stakeholders with the objective of developing both quantitative and qualitative indicators, which can be used to measure economic and social impact by the network, allow for comparison where possible with other government economic development programs and provide information on economic and social impact to potential social finance investors who look for these types of metrics in addition to the traditional financial risk/return analysis.

Recommendation 1: Ensure that in its Terms and Conditions, NACCA collects appropriate performance data from the AFI network.

Ultimately, however, as pointed out by interviewees, where economic potential exists, there is a potential for higher profit by investors and lenders. While government investment in capital is critical, there is also room to work to attract private investment as well as investment from other levels of government. INAC's current role with respect to policy and direction of Business Capital and Support Services, enables it to focus on incentivising investment from other sources, which in turn has the potential to address some of the limitations presented by existing capital shortfalls.

Recommendation 2: Establish incentives to attract interest and investment from the private and other sectors to leverage additional capital and diversify the portfolios of AFIs.

4.1.2 Immediate Outcome 2: Aboriginal Institutions have the capacity to deliver business capital and support services

Finding 5: There is considerable variability between Aboriginal Financial Institutions in their capacity to deliver business capital and support services. However, many Aboriginal Financial Institutions have demonstrated capacity through the provision of loans, which are also generating employment.

"The AFI was very quick, organized and open about what information was required for the grant."

- business supported by a Program Delivery Partner

Site visit and interview participants indicated that while the initiative supports the capacity of AFIs to deliver business capital and support services, not all AFIs have the necessary capacity to deliver the initiative. "Capacity" is interpreted as: (a) AFI staff having the appropriate knowledge to deliver the initiative; and (b) AFIs having the appropriate level of capital to continue operations and meet demand.

Loans are generating employment (2014):

- 2.5 jobs were created for each loan that was provided to a start-up business

- 4.2 jobs were created/maintained for each loan that was provided to an existing business

AFIs assist clients in gaining access to capital through equity financing, and business services by providing them with continued support in the form of before and after care services (i.e. working with clients to help find financing options that suits their needs, establishing business plans, offering advice/mentoring for growing businesses, supporting marketing initiatives, etc.). In doing so, AFIs manage a significant number of loans while also creating and maintaining jobs each year. For instance, for each start-up loan that was provided in 2014, an average of 2.5 jobs were created and for each loan that was provided to an existing business supported created or maintained an average of 4.2 jobs.Footnote 18 These represent positive impacts and while it would be helpful to understand the impact they have on dependency rates for income assistance and employment rates, they are difficult to measure.

NACCA specifically indicates that between fiscal years 2009 and 2014, the annual average value of loans was $109.4 million and an annual average of 1306 loans was provided. See Table 2 for a detailed breakdown.

| Year | Aboriginal Capital Corporations |

|---|---|

| 2009 | -1,613,925 |

| 2010 | -1,966,110 |

| 2011 | 353,432 |

| 2012 | -1,066,667 |

| 2013 | 823,205 |

| 2014 | 638,366 |

Site visits and interview participants suggest that much of the success of AFIs is attributed to a dedicated and strong staff with a mix of professional experience in the public and private sectors, including traditional banks, credit unions, and the federal government. Strong human resources has also led to some AFIs, such as Ulnooweg Development Group Inc. and the All Nations Trust Company, to diversify their business activities to include mortgage lending, and providing trust and administrative services in order to generate alternative sources of income. Others have been recognized for their notable achievements, such as the Tribal Wi-Chi-Way-Win Capital Corporation in Manitoba that received the 2012 Manitoba Chambers of Commerce award for the most outstanding medium-business for its contributions to supporting Aboriginal business development.

While these represent significant achievements, it is difficult to specifically ascertain the extent to which how many AFIs are operating at a high and low capacity due to a lack of data. Some AFIs have struggled to continue operations. For instance, some AFIs have had to claim bankruptcy while others (45.5 percent) have recorded unprofitability from fiscal years 2010 to 2014.Footnote 20 Aboriginal Capital Corporations, in particular, have been profitable three times out of the past six years; from 2009 to 2014 (see Table 3). Additionally, NACCA cites that as of March 2014, 18 AFIs had less than the minimum required six month loan supply on hand to meet demand where business capital and equity needs currently exceed AFI capacity.Footnote 21 Some possible explanations for such cases include erosion of capital base for lending due to covering operating costs when revenue from interest rates are not sufficient; limited access to other sources for capital; and of the capacity to discern strong from weak investment opportunities.

| Fiscal year | Number of loans | Total Value of loans (millions) |

|---|---|---|

| 2009 | 1,252 | $100.3 |

| 2010 | 1,242 | $98.4 |

| 2011 | 1,307 | $99.9 |

| 2012 | 1,395 | $121.7 |

| 2013 | 1,281 | $125.9 |

| 2014 | 1,361 | $110.3 |

The Aboriginal Capital Corporation model, developed in the 1980s, was designed to be self-sustaining. It was projected that loan portfolio revenue would be 12 percent, administrative costs at six percent, loan losses at five percent and a profit of one percent was projected to support growth.Footnote 23 However, data from 2008 to 2012 shows that on average, loan portfolio revenue is 8.7 percent, administrative expenses are 9.8 percent, and loan losses are 5.8 percent, which created a cost of developmental lending shortfall at 7.5 percent.Footnote 24 The concern with this model is that its assumptions are based on trends of 30 years ago, and thus, does not consider the significant change in interest revenue norms, administrative costs, and inflation since that time.

Furthermore, site visit and interview participants, in addition to documentation and studies from the National Aboriginal Economic Development Board, an equity market demand study, and a study by Hammond KetilsonFootnote 25 indicate that AFIs must be sufficiently capitalized in order to provide appropriate support to clients and to meet the growing demand for their services. This has become more difficult to achieve in recent years as expenditures for contributions have decreased by 32 percent from fiscal years 2009-10 – 2014-15 (see Section 1.2.4). In addition, according to the 2013-14 Departmental Performance Report (DPR), only $33.1 million of a total of $45 million was accessed due in part to internal reallocation processes in which almost $5 million was provided to support First Nation Land Management and nearly $10 million was provided for the consolidation of INAC's economic authorities.Footnote 26 According to the DPR, "[t]he demand for resources is actually exceeding the current resources provided and, if available, additional resources could be utilized by the Aboriginal Financial Institutions."Footnote 27 According to the National Aboriginal Economic Development Board, there is a need to invest an additional $70 million over five years to replenish the capital base of AFIs and to support their operating costs.Footnote 28 The 2014 AFI Portrait suggests that in order to better position the 18 AFIs with a loan capital shortage to be able to utilize a Capital Attraction Tool instrument to gain access to private capital, capital top-ups in the range of $78 million are required to provide private investors with reasonable liquidity comfort.

These issues have placed a considerable strain on the AFI network to continue providing appropriate business capital and support services to clients. With respect to Aboriginal Capital Corporations in particular, this has added concern since they do not receive ongoing operational funding (Aboriginal Community Futures receive annual funding to support operational costs). This has negatively impacted their ability to maintain staff and facilities, and to adequately meet demand for their services. With an absence of operational dollars, the expectation was that Aboriginal Capital Corporations would finance their operations through returns on their lending. The higher interest rate environment of the 1990s provided opportunities for these returns for many Aboriginal Capital Corporations. However, as interest rates fell over the years, many lowered their interest rates in order to continue lending with reasonably competitive rates. As a result, some saw the size of their capital pool diminish, thereby impacting the degree to which they are able to serve current and prospective clients.

Due to such challenges, capacity building will be an ongoing need for some AFIs in terms of having the appropriate human resources to deliver Business Capital and Support Services programming and to having the appropriate level of capital to continue operations and to meet demand.

4.1.3 Intermediate Outcome: The establishment of a sustainable network of Aboriginal Financial Institutions

Finding 6: INAC has successfully worked with program partners to establish a network of Aboriginal Financial Institutions that provide prospective and existing Aboriginal entrepreneurs and businesses with access to capital. However, it is not reasonable to expect Aboriginal Financial Institutions to continue to be sustainable in the absence of continued government funding and private sector support; particularly in the context of the small and high-risk markets in which they operate.

Many Aboriginal Financial Institutions have considerable expertise and have clearly demonstrated capacity to work with Aboriginal businesses and entrepreneurs in advisory and mentorship roles. Additionally, there is a clear demonstration that Aboriginal Financial Institutions provide essential capital and support services. Many lack sufficient capital, however, to fully meet the level of demand, and the small pool and limited portfolio of businesses covering a small and higher-risk market means that most Aboriginal Financial Institutions are highly reliant on government support for continued operations.

In 2014, Aboriginal Financial Institutions generated 480 start-up business loans and 727 expansion loans, with a total consolidated loan portfolio of 4,377 loans worth $311 million,Footnote 29 and 6.64 percent average interest yield on the consolidated loan portfolio of the 54 active Aboriginal Financial Institutions at that time.Footnote 30 Contractual delinquency data from 43 of those Aboriginal Financial Institutions indicates that approximately 12.4 percent of loans in 2014 were in arrears (delinquent), a decrease of almost eight percent from 2010.Footnote 31 The corresponding consolidated loan loss reserve was 8.91 percent in 2014, representing a decrease from 2010 levels (15.01 percent).Footnote 32

The most recent performance measure examining the effectiveness of Aboriginal Financial Institutions comprises the CAMEL rating system, which measures the financial managerial performance of Aboriginal Financial Institutions. The five areas of managerial and financial performance are: Capital adequacy; Asset quality; Management; Earnings; and Liquidity. Research undertaken by INAC and NACCA has resulted in a modified CAMEL rating system resulting in a highest possible rating of "A" and a lowest possible rating of "Not Rated". "A" signifies an overall achievement of 85 percent or more of benchmark; "B" represents an overall achievement of 70 percent to 84.9 percent of benchmark; "C" indicates an overall achievement of 60 percent to 69.9 percent of benchmark; and "D" signifies an overall achievement of less than 60 percent of benchmark.Footnote 33 Of the 39 Aboriginal Financial Institutions with available data in 2014, data are presented in Table 4.

| A | B | C | D | Not rated | Total | |

|---|---|---|---|---|---|---|

| # of AFIs | 8 | 5 | 10 | 8 | 8 | 39 |

| % of AFIs | 20.5% | 12.8% | 25.6% | 20.5% | 20.5% | 100% |

The average Aboriginal Financial Institution repayment efficiency rate for the 54 active Aboriginal Financial Institutions in 2014 was 94.7 percent.Footnote 34 The sustainability of Aboriginal Financial Institutions, however, is such that despite contributions from INAC for Business Service Officer funding of $2.5 million per year, according to the 2012 AFI portfolio, their profitability from 2007 to 2011 was in fact a loss of approximately seven percent (with a five-year rolling average loan portfolio revenue at nine percent, administrative expenses at 10 percent and loan loss rate at six percent).Footnote 35 54.5 percent of AFIs were profitable from 2010 to 2014.Footnote 36

There was a general consensus among interviewees that without ongoing funding, few Aboriginal Financial Institutions would be able to continue their operations. The Aboriginal Developmental Loan Allocation has helped to stabilize operations of some AFIs, and one AFI in particular had Aboriginal Developmental Loan Allocation revenues of $750,000. However, generally speaking, given the high-risk portfolio and the smaller loan market, the non-repayable contributions are largely part of the key to success for the current system. Without access to those contributions provided by the Government, it was suggested by almost all interviewees that the program would no longer be able to reach smaller markets and more remote areas. As it stands, interviewees suggested that many Aboriginal Financial Institutions are currently able to absorb less than the total demand of viable proposals due to insufficient capital. According to NACCA figures, from 2008 to 2012, the loan capital to gross loan portfolio ratio was close to 1:1, suggesting little flexibility to absorb additional opportunities.

These observations do not suggest a failure on the part of the program to create a sustainable network of Aboriginal Financial Institutions; rather, they suggest that the aim itself may be inappropriate given that the target market is a small one, and one designed to facilitate participation of Aboriginal people in the economy. To address the underrepresentation and bridge the gap caused by smaller markets with higher risk, as well as Section 89 of the Indian Act in the case of on-reserve businesses, it would be reasonable to expect that some level of support would be necessary for the foreseeable future. Given the clear success of the program in creating and expanding Aboriginal businesses, consideration should be given to revising this stated outcome to reflect the extent to which prospective Aboriginal businesses and entrepreneurs have sufficient access to capital and receive appropriate direction and guidance on business creation and expansion, and the extent to which additional capital can be leveraged.

Recommendation 3: Re-assess the intended outcomes of the program considering the recent program changes and the findings of this evaluation.

4.1.4 Ultimate outcome: Creation and/or expansion of viable Aboriginal businesses

Finding 7: Business Capital and Support Services is effectively contributing to the creation and/or expansion of Aboriginal businesses through the provision of contributions and loans and as evidenced by the current repayment efficiency.

INAC's Departmental Performance Reports show that between fiscal years 2009-10 and 2013-14, Business Capital and Support Services exceeded it targets with respect to the creation and/or expansion of Aboriginal businesses, with the exception of fiscal year 2012-13:

- 2013-14 exceeded target: In 2013-14, Business Capital and Support Services supported the creation or expansion of total of 686 Aboriginal businesses, exceeding its target of 650 by nine percent.Footnote 37 According to the DPR, this success was in part due to the initiative's transition to third party delivery, "[t]hrough the decentralized PDP delivery model, AFIs are better suited to respond to the local needs of Aboriginal entrepreneurs and communities in funding their projects and initiatives."Footnote 38

- 2012-13 targets were not met: Targets were not met in the 2012-13 according to the DPR, which had a slightly revised performance indicator of "[n]umber and value of Aboriginal business creation and expansion projects supported by Aboriginal Business Development Program." The target was 250 projects (with $15 million in expenditures) by March 31, 2013, and the actual result was 170 projects created and expanded with $12.3 million in expenditures.

- 2011-12 exceeded target: The 2011-12 DPR exceed targets of a revised performance indicator of "[s]urvival rate for Aboriginal businesses that receive a financial contribution from the Aboriginal Business Development Program." The target was 90 percent after one year and the actual result was 94 percent.

- 2010-11 exceeded target: The 2010-11 DPR also exceed its target of "Survival rates of businesses one year after receiving financial contribution from Aboriginal Business Development Program." The target was 90 percent and the actual result was 96 percent.

- 2009-10 exceeded target: The target of the "number of businesses created or expanded" was also exceeded according to the 2009-10 DPR. The target was 250 businesses created or expanded and the actual result was 317.

INAC measures the "viability" of Aboriginal businesses in terms of the repayment efficiency on loans. According to NACCA, the average AFI repayment efficiency rate increased from 92.3 percent in 2009 to 94.7 percent 2014.Footnote 39 This compares to a 97.8 percent repayment efficiency rate for Canadian business loans.Footnote 40

At the same time, NACCA produced annual Aboriginal Financial Portraits from 2008 to 2014, which offer information about the operation and performance of the AFI network, including the number of loans that were provided for the creation and/or expansion of Aboriginal businesses. According to these reports, loans provided to Aboriginal businesses by AFIs have steadily increased from 2009 to 2014, (see Figure 2). AFIs provided 1,252 loans in 2009, while a slight decrease is seen in 2010 to 1,242. By 2011, AFIs provided 1,307 loans, totalling $99.9 million. Specifically, 520 loans where for business start-up and the remaining 687 loans were for business expansion. They also supported 15,000 full-time equivalent employment and 3,100 small businesses.Footnote 41 In 2012, the number of loans increased to 1,395 worth $122 million. Five hundred and sixty-five of these loans were for business start-up and 755 loans were for business expansion.Footnote 42 In 2013, the number of loans decreased to 1,281 (worth $125.9 million), and 1,361 loans in 2014 (worth $110.3 million).Footnote 43 From 2009-14, AFIs provided an average 1,306 of loans to Aboriginal businesses.

Figure 2: Number of loans provided by AFIs, 2009-14

Text alternative for Figure 2 Number of loans provided by AFIs, 2009-14

This is a line graph with the x axis containing Fiscal years 2009 to 2014, and the y axis being the raw number of loans provided by AFIs. For 2009 there were 1,252; there were 1,242 for 2010; 1,307 for 2011; 1,395 for 2012; 1,281 for 2013; and 1,361 for 2014.

Based on the favourable outcome results reported in the DPRs, the high AFI repayment efficiency rates as indicated in the Aboriginal Financial Portraits, and the increase in the number of loans that were provided to Aboriginal businesses, the ultimate outcome of creations and/or expansion of Aboriginal businesses have shown positive results, particularly for 2009 to 2014.

5. Efficiency and Economy

Finding 8: Activities and expenditures under the Business Capital and Support Services sub-program are operating efficiently insofar as the new program delivery structure and the expenditures of contributions relative to total expenditures. Further, there is a demonstration of economy respecting the economic and potential social impacts relative to current expenditures.

5.1 Efficiency

As discussed in Section 1.2.4, total actual expenditures for the Business Capital and Support Services sub-program decreased by 36 percent between 2009-10 and 2014-15. As shown in Figure 3, however, while absolute expenditures in each spending category decreased in each year, contributions now represent a larger portion of total expenditures relative to salary, operations and maintenance, and employee benefits.

Figure 3

Text alternative for Figure 3 - Expenditures

This figure contains two stacked bar graphs. The first graph plots total expenditures in dollars on the y axis and fiscal year (from 2009 to 2014) on the x axis. Each bar represents the total expenditures, and is broken into four categories of expense: contributions, operations and maintenance, salary, and statutory employee benefits program. Over time the total expenditures drops from just under $60 million in 2009; to $55 million in 2010, 2011 and 2012; to approximately $41 million in 2013; to approximately $38 million in 2014. The expenditures decrease for all four categories, but the proportion varies by category, which is plotted on the second graph. The second graph plots the same data, but with all graphs representing the proportion of total spending per category in the y axis, totaling 100 percent in each year. Contributions as a relative percentage vary between approximately 82 and 90 percent over time, with 2013 and 2014 closer to 90 percent. The remaining three categories progressively decrease as a proportion of the total. Operations and maintenance decreases from approximately 5 percent to under 1 percent. Salary decreases from 10 percent to approximately 7 percent. Statutory employee benefits program is generally stable at about 2 to 3 percent.

In this context, the program can be generally viewed as operating efficiently from the point of view that contributions now account for 90 percent of total expenditures. Government-wide expenditure reductions as part of Budget 2012 (realised in 2013), and the transfer of program administration to NACCA in 2014, largely accounts for this ratio.

While transferring administration outside of government does not necessarily result in improved efficiency, interviewees were confident that programming will inevitably be more efficient when managed by an organisation with direct experience and knowledge of the market in which it operates, as opposed to a government department. While specific figures on cost savings are not calculable under the contribution system currently used for funding NACCA and AFIs, it is unlikely that a more cost-effective alternative exists, given their longstanding entrenchment in, and knowledge of, Aboriginal business.

5.2 Economy

While not all AFIs are generating a profit, they each contribute to Aboriginal participation in the economy, and ultimately contribute to self-sufficiency of individuals and communities where unemployment rates are high, and economic participation relatively low. Ultimately, self-sufficiency requires that Aboriginal individuals and communities have the means to generate their own economies, and have stronger alternatives to government funding. While likely indefinitely reliant on some level of government funding, AFIs provide a key access point for economic activity that according to all interviewees would not otherwise be realised, and which provides for meaningful opportunities that are self-determined by Aboriginal people and communities.

While direct measures of incremental impact of Business Capital and Support Services on income assistance or other social programs are not possible, the loans provided have been directly responsible for the creation of thousands of jobs among Aboriginal peoples, which undeniably has a considerable economic impact.

Further, should the portfolio of AFIs ever expand to include other types of financing, including mortgages, there is considerable potential for further individual and community self-sufficiency, and the potential to better address social and economic needs.

As discussed and recommended in Section 4.1, there is a need for the program to better articulate the incremental impacts of its investments in business capital in the AFI network and to understand it relative to other forms of economic and social investment with respect to value for money and economic and social benefit. NACCA conducted analysis in 2010 on the incremental cost per job by direct job creation program, which suggested that the cost per job created or maintained by an AFI loan advance was far lower than the incremental cost per job for other programs.Footnote 44 This type of analysis as a systematic measure of economy for INAC's investments could be an optimal measure of efficiency going forward.

6. Evaluation Findings – Other Issues

6.1 Communication

Finding 9: With the recent transition of program delivery to NACCA, there is a need for stronger communication between NACCA, AFIs and INAC regarding the program's operational structure and of the roles and responsibilities of all stakeholders.

There were two significant changes to program delivery over the past three years. The first transition occurred in 2012 when program delivery became the responsibility of 14 qualified Program Delivery Partners, and most recently in April 2015 when this responsibility was transferred to NACCA. During these periods of transition, most site visit and interview participants stressed the need for stronger communication between INAC, AFIs and NACCA. This was particularly necessary before and after the program's move to NACCA in order to have a clearer sense of program direction with respect to: (a) the roles and responsibilities of each stakeholder; and (b) the program's operational structure.

While many site visit and interview participants noted that communication between AFIs and INAC regional offices was sufficient (i.e. INAC regional officers would participate in AFI meetings, AFIs receiving responses from INAC to questions in a timely manner, etc.), specific guidance is desired on a number of items. This includes: INAC's roles and responsibilities now that program delivery has transitioned to NACCA; what would be the new roles and responsibilities of the Program Delivery Partners in comparison to NACCA; the provision of adequate tools to the Program Delivery Partners in an effort to facilitate the transition; sufficient communication from NACCA to the AFI network on how the organization would deliver the initiative (i.e. budget, staff, timelines, vision, etc.); and a general desire for more discussions between the AFIs (beyond their annual general meeting) to share lessons learned, best practices and other information that is desired from the network. The transition of program responsibility to NACCA is an opportunity for all players to convene and discuss the roles and responsibilities of all stakeholders and the initiative's operational structure moving forward. The new agreement with NACCA provides a good opportunity to strengthen this communication.

Recommendation 4: It is recommended INAC should:

- Ensure clarity of the respective roles and responsibilities with respect to Business Capital and Support Services; and

- Work with NACCA and the AFI network to strengthen communication in order to improve clarity of the program's operational structure and of the roles and responsibilities of all stakeholders.

6.2 Oversight

Finding 10: AFIs are essentially unregulated. While no specific concerns or occurrences related to their lack of regulation were raised, there will be a need to consider the implications of regulation and oversight where AFIs expand their portfolios into areas with existing regulations, such as insurance and mortgages.

Some key informants and site visit participants raised questions about the oversight of AFIs, given their position as lenders. This becomes even more pressing when considering the notion of portfolio expansion.

In Canada, the Office of the Superintendent of Financial Institutions supervises and regulates all deposit-taking institutions, insurance companies and private pension plans.Footnote 45 Their involvement in regulating financial institutions includes providing input into interpreting and developing regulations and legislations, while its supervisory activities pertain to examining the soundness and safety of federally regulated pension plans and financial institutions. AFIs are thus not under the purview of the Office of the Superintendent of Financial Institutions. Oversight of AFI activities lies with their board of directors and/or executive management.