Archived - Horizontal Audit of the Management Control Framework for Grants and Contributions 2011-2012 (Focus on Co-Management and Third Party Management)

Archived information

This Web page has been archived on the Web. Archived information is provided for reference, research or record keeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please contact us to request a format other than those available.

Date: November 2012

Project # 11-28

PDF Version (173 Kb, 27 Pages)

Table of contents

Acronyms

| AANDC |

Aboriginal Affairs and Northern Development Canada |

|---|---|

| ADM |

Assistant Deputy Minister |

| ADM PTP |

Policy on Transfer Payments Implementation Assistant Deputy Minister Steering Committee |

| AES |

Audit and Evaluation Sector |

| CIDM |

Comprehensive Integrated Document Management |

| CFO |

Chief Financial Officer |

| CSO |

Community Services Officer |

| DG IOC |

Director Generals Implementation and Operations Committee |

| DG PTP |

Director Generals Policy on Transfer Payments Working Group |

| DPMP |

Default Prevention and Management Policy |

| FN |

First Nation |

| FNITP |

First Nations and Inuit Transfer Payment |

| FSO |

Funding Services Officer |

| GA |

General Assessment |

| HQ |

Headquarters |

| MAP |

Management Action Plan |

| PTP |

Policy on Transfer Payments |

| RMP |

Remedial Management Plan |

| RO |

Regional Operations Sector |

| Sr. ADM |

Senior Assistant Deputy Minister |

| TPCOE |

Transfer Payment Centre of Expertise |

Executive Summary

Background

Grant and contribution programs are governed by the Treasury Board Policy on Transfer Payments and the supporting Directive on Transfer Payments. Under the Policy, grant and contribution programs must be managed with integrity, transparency and accountability, and in a manner that is sensitive to risks. They must also be citizen-focused, and designed and delivered to address government priorities in achieving results for Canadians.

The Horizontal Audit of the Management Control Framework for Grants and Contributions 2011-2012 (Focus on Co-Management and Third Party Management) was conducted on the basis that grants and contributions are financially material, and are critical in achieving Aboriginal Affairs and Northern Development Canada's (AANDC) mandate.

Due to the importance of grants and contributions for the Department, AANDC's Risk Based Audit Plan (RBAP) contains an annual standing audit of the Management Control Framework for Grants and Contributions. This framework represents the expectations of how grants and contributions are to be managed across the Department, and is a foundational piece used as the basis for compliance. This document provides a framework for how programs, transfer payments, and funding agreements are developed, managed, controlled, monitored, and reported on throughout AANDC. Each annual audit takes a risk-based approach to focus its scope on a specific aspect or component of the framework (and associated policies, directives, guidelines, etc). The 2011-2012 audit focused on default management, and more specifically on the management of funding agreements with recipients under the Co-Managed and Third Party Managed levels of intervention.

Under the Intervention Policy, Co-Management and Third-Party Management are two intervention mechanisms employed by AANDC to manage funding agreements with recipients (i.e. First Nations and Aboriginal Organizations) that have defaulted on terms and conditions of their funding agreements. Co-Management is a mechanism used when AANDC determines that a moderate level of intervention is warranted, characterized by the recipient's willingness to address/remedy the default and/or the difficulties that gave rise to the default, but lacks the capacity to do so. Third-Party Management is a mechanism used for higher level intervention where it is determined that there is a high risk to the funding provided under the agreement(s) or to the provision of programs and services, or the recipient is unwilling to address/remedy the default and/or the difficulties that gave rise to it.

Until May 2011, these mechanisms were governed at AANDC by the Funding Agreements: Intervention Policy dated April 1, 2007. This policy was repealed and replaced by AANDC's Policy 200: Default Prevention and Management (DPMP) issued under the authority of AANDC's Chief Financial Officer (CFO) in June 2011.

As of December 2011, there were 66 recipients under Co-management and 12 under Third-Party Management, representing total AANDC funding of $725M and $80M respectively.

Since the completion of the audit work, the Federal Court of Canada released a judgement (Attawapiskat First Nation v. Canada) in response to Attawapiskat First Nation's application for a judicial review of the decision of AANDC to appoint a Third-Party Manager (TPM) to the First Nation due to an alleged default under its Comprehensive Funding Agreement. On August 1st, 2012 the Federal Court released the judgement of the Honourable Mr. Justice Phelan, which stated that the appointment of the Third Party Manager on November 30, 2011 by the Department was contrary to law because it was an unreasonable remedy to address the key issue, which was the First Nation's lack of housing resources and equipmentFootnote 1.

Audit Objective and Scope

The objective of this audit was to assess the adequacy and effectiveness of the governance structure and controls in place for the administration and management of Co-Managed and Third-Party Managed funding agreements.

The scope of the audit included an examination of the governance structures and management controls that support:

- Implementation of policies which include roles, responsibilities and requirement for the Co-Managed and Third-Party Managed forms of intervention;

- Identification of recipients requiring these forms of intervention; and,

- Implementation and management of the intervention mechanisms, including: justification for the level of intervention and the processes for escalation and de-escalation thereof; management of the Co-Manager or Third-Party Manager selection process; agreement development; monitoring and reporting activities related to performance of the Co-Manager or Third-Party Manger; basis for payment of Third-Party Managers; and, monitoring and reporting on the progress of recipients under intervention

The audit scope covered the period from April 1, 2010 to December 31, 2011 and included fieldwork at Headquarters (National Capital Region) and site visits to four regional offices: Ontario North; Atlantic; Saskatchewan; and, Manitoba. A site visit to a northern region was not conducted due to the existence of very few recipients in Co-Management or Third-Party Management in those regions. During the audit scope period, there was only one recipient that spent time in one of those levels of intervention.

Given that the new DPMP was introduced during the audit period in June 2011, the audit included an examination of management practices under both policies during the respective periods of applicability.

The audit scope included the administration of funding agreements under Co-Management and Third-Party Management placed in intervention for any of the reasons, or type of triggers, spelled out in the policies. Based on information contained in FNITP, the audit observed that during the scope period, the most common trigger for these levels of intervention was financial reasons. Numerous instances were noted where multiple triggers for intervention were identified, including financial and health and safety concerns. In many of these instances, the financial issues had led to health and safety concerns (e.g. the supply of heating oil had stopped due to payment arrears).

Statement of Conformance

This audit conforms with the Internal Auditing Standards for the Government of Canada, as supported by the results of the quality assurance and improvement program.

Observed Strengths

Throughout the audit fieldwork, the audit team observed examples of how controls are properly designed and are being applied effectively by management. This resulted in several positive findings as follows

- Regional management is actively involved in activities and exercises oversight of intervention and default management processes through governance committees used to review and discuss recipients' audited financial statements (e.g. Audit and Review Committee, Regional Operations Committee, Regional Intervention Committee, Audit and Accountability Committee, etc.);

- Activities to monitor compliance to the Intervention Policy and the DPMP are conducted at a national-level by the Transfer Payment Centre of Expertise (TPCOE);

- Approval decisions and Third-Party Management Agreements are executed by AANDC employees with appropriate delegated authority; and,

- Risk management practices, namely the General Assessment, are being used to inform the intervention/default prevention and management process.

In addition, the following practices were noted as leading practices in some of the regions visited:

- In the Atlantic region, detailed presentation decks are created, and presented to the Audit Review Committee (ARC) as part of the audited financial statement review process. These decks are quite detailed and cover both quantitative and qualitative factors, including: key financial statement information from the current and prior year, financial health ratios and trend analysis, items of risk from the financial statements, progress in capacity development, and recommendations;

- In the Atlantic region, detailed charts and trend analysis with numerous financial health indicators were used by management to highlight and discuss recipients that may enter intervention and act as an early warning system;

- In the Atlantic region, AANDC staff working with a specific recipient are grouped into what is referred to as a "Community Team". By having AANDC Program and Funding Service staff working more closely together on a regular basis, this allows for more effective and timely sharing of information about the recipient and provides early indication to possible default issues; and,

- The Saskatchewan Region has kept its Transfer Payment Management Regime document current. The Management Regime is a useful instructional guide which describes the roles and responsibilities and process steps for managing funding agreements, including steps with regards to intervention practices. All personnel involved in the management of funding agreements (development, release of funds, acknowledgement of reporting requirements) are expected to be familiar with the information included in the regime.

Conclusion

Generally, intervention and default prevention and management practices were found to be adequate in the regions examined; however, some areas for improvement were noted to strengthen management practices in the following areas: national governance structure for default prevention and management, capacity and competency of Funding Services Officers, design of the FNITP intervention module, use and consistency of performance information in FNITP, and policy implementation rollout.

Recommendations

The audit team identified areas where management practices and processes could be improved, resulting in five recommendations.

The Audit and Evaluation Sector recommends that:

- The Chief Financial Officer (CFO), in collaboration with the Senior Assistant Deputy Minister (Sr. ADM) of Regional Operations (RO), should review and clarify the national governance structure to provide proper oversight and implementation of the Default Prevention and Management Policy, including policy compliance and monitoring, conducting annual assessments of the application of the policy, and sharing leading practices across the regions.

- The Senior Assistant Deputy Minister (Sr. ADM) of Regional Operations (RO) should re-assess the Funding Services Officer (FSO) role, required competencies, and resource capacity to optimize the amount of time spent working with the recipients. In addition, FSOs should be provided training on the analysis of financial statement information and other mechanisms should be considered to provide FSOs with access to financial statement analysis subject matter expertise, as required.

- The Chief Financial Officer (CFO), in collaboration with the Senior Assistant Deputy Minister (Sr. ADM) of Regional Operations (RO), should work with the regions to define First Nations and Inuit Transfer Payment (FNITP) system business requirements specific to default prevention and management to improve FNITP design, usability, and reporting functionality in order to better address requirements of the Default Prevention and Management Policy.

- The Senior Assistant Deputy Minister (Sr. ADM) of Regional Operations (RO), in collaboration with the Chief Financial Officer (CFO), should determine what critical information is required to be captured by FSOs in FNITP, as the system of record, and reinforce the expectations regarding the use of FNITP to record intervention / default prevention and management performance information.

- The Chief Financial Officer (CFO), in collaboration with the Senior Assistant Deputy Minister (Sr. ADM) of Regional Operations (RO), should support the implementation of the Default Prevention and Management Policy (DPMP) by: finalizing the transition to using Expert Resources, including defining the selection and approval criteria; ensuring that formal performance evaluations of Third-Party Managers are conducted; formalizing a forum for regions to provide feedback on the performance of Third-Party Managers and Expert Resources; providing guidance and training to regions; finalizing the DPMP tools and rollout plan; and providing regular updates to senior management at Headquarters and in regions on progress status.

1. Introduction and Context

1.1 Intervention and Default Management

Grant and contribution programs are governed by the Treasury Board Policy on Transfer Payments and the supporting Directive on Transfer Payments. Under the policy, grant and contribution programs must be managed with integrity, transparency and accountability, and in a manner that is sensitive to risks. They must also be citizen-focused, and designed and delivered to address government priorities in achieving results for Canadians.

The Horizontal Audit of the Management Control Framework for Grants and Contributions 2011-2012 (Focus on Co-Management and Third Party Management) was conducted on the basis that grants and contributions are financially material, and are critical in achieving Aboriginal Affairs and Northern Development Canada's (AANDC) mandate.

Due to the importance of grants and contributions for the Department, AANDC's Risk Based Audit Plan (RBAP) contains an annual standing audit of the Management Control Framework for Grants and Contributions. This framework represents the expectations of how grants and contributions are to be managed across the Department, and is a foundational piece used as the basis for compliance. This document provides a framework for how programs, transfer payments, and funding agreements are developed, managed, controlled, monitored, and reported on throughout AANDC. Each annual audit takes a risk-based approach to focus its scope on a specific aspect or component of the framework (and associated policies, directives, guidelines, etc). The 2011-2012 audit focused on default management, and more specifically on the management of funding agreements with recipients under the Co-Managed and Third Party Managed levels of intervention.

Recipient managed, Co-Management, and Third-Party Management are three intervention mechanisms employed by AANDC to manage funding agreements with recipients that have defaulted on terms and conditions of their funding agreements. Recipient Managed is a mechanism where a recipient is required to draft a plan to address the issues causing the default, and work towards the implementation of the plan while reporting on progress. Co-Management is a mechanism used when AANDC determines that a moderate level of intervention is warranted, characterized by the recipient's willingness to address/remedy the default and/or the difficulties that gave rise to the default, but lacks the capacity to do so. Third-Party Management is a mechanism used for higher level intervention where it is determined that there is a high risk to the funding provided under the agreement(s) or to the provision of programs and services, or the recipient is unwilling to address/remedy the default and/or the difficulties that gave rise to it.

The effective management of defaults is of primary importance in ensuring that funds are spent as intended in providing continued, uninterrupted programs and services for the health, safety and well-being of recipients.

Until May 2011, these mechanisms were governed at AANDC by the Funding Agreements: Intervention Policy dated April 1, 2007. In June 2011, this policy was repealed and replaced by AANDC's Policy 200: Default Prevention and Management (DPMP) issued under the authority of AANDC's Chief Financial Officer (CFO).

As of December 2011, there were 66 recipients under Co-management and 12 under Third-Party Management, representing total AANDC funding of $725M and $80M respectively.

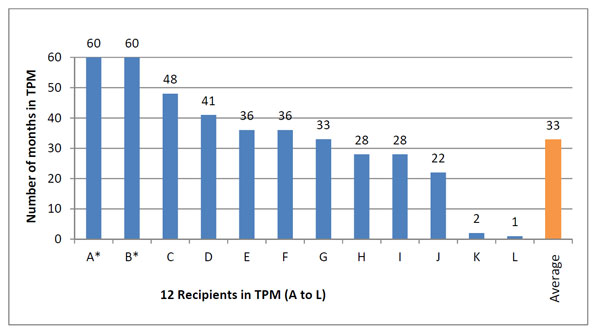

As illustrated by the graph below, the 12 recipients under Third-Party Management, have spent, on average, almost three of the last five years in this level of intervention.

Graph 1

There were 12 Recipients in Third-Party Management on December 31, 2011 Over the course of the 5 preceding years (January 1, 2007 to December 31, 2011), the average number of months that those Recipients spent in TPM is 33.

*Note: Recipients A & B have remained in TPM for significantly longer than the 5 years depicted in this graph.

Description of Graph 1

Recipients in Third-Party Management

This graph illustrates the number of months that the 12 Recipients spent in Third Party Management between January 1, 2007 and December 31, 2011.

- Recipients A and B spent more than 60 months;

- Recipient C spent 48 months;

- Recipient D spent 41 months;

- Recipients E and F spent 36 months;

- Recipient G spent 33 months;

- Recipients H and I spent 28 months;

- Recipient J spent 22 months;

- Recipient K spent two months;

- and Recipient L spent one month.

The average time spent in Third Party Management for these 12 recipients was 33 months.

Since the completion of the audit work, the Federal Court of Canada released a judgement (Attawapiskat First Nation v. Canada) in response to Attawapiskat First Nation's application for a judicial review of the decision of AANDC to appoint a Third-Party Manager (TPM) to the First Nation due to an alleged default under its Comprehensive Funding Agreement. The position of Attawapiskat First Nation was that the Minister erred in choosing to appoint a TPM as a remedy to the housing crisis, while the position of the Department was that the appointment of the TPM was a reasonable and necessary remedy in light of the FN's lack of capacity to address the crisis. On August 1st, 2012 the Federal Court released the judgement of the Honourable Mr. Justice Phelan, which stated that the appointment of the Third Party Manager on November 30, 2011 by the Department was contrary to law. This judgment was based on his conclusion that the Department's decision to appoint a TPM, which is essentially a financial management remedy, was unreasonable because it did not address the key issue, which was the First Nation's lack of housing resources and equipment.Footnote 2

1.2 Relevant Policies

1.2.1 Funding Agreements: Intervention Policy

AANDC's Intervention Policy was in place from April 1, 2007 to May 31, 2011 and was designed to ensure the ongoing delivery of programs and services, and to maintain accountability while defaults under funding agreements are addressed by recipients (i.e. First Nations, Aboriginal Organizations). The purpose of the Intervention Policy was to set out the framework for intervention by the Minister in the event of a default under the terms and conditions of a funding agreement signed by AANDC.

The policy contained four possible triggers for intervention: 1) the terms and conditions of the funding agreement are not met by the recipient; 2) the recipient's auditor issues a denial/disclaimer of opinion or an adverse opinion on the recipient's financial statements; 3) the recipient has incurred a cumulative operating deficit (net amount of annual surpluses and deficits) equivalent to eight percent (8%) or more of its annual operating revenues; and, 4) the health, safety or welfare of the recipient's members is being compromised. There are three levels of intervention: Recipient-Managed, Co-Managed and Third-Party Managed. This audit only examined the Co-Managed and Third-Party Managed levels of intervention.

The Intervention Policy was intended to permit the delivery of programs and services and maintain accountability while problem situations were being addressed and to put the onus on the recipient to correct the problem situations. The Intervention Policy was designed to support timely intervention and consistency in regional operations, to facilitate ongoing monitoring of intervention and to improve the effectiveness of intervention. The aim of the Intervention Policy was to encourage recipients in default to enhance their capacity to provide programs and services, and to provide for an exit strategy where a lesser form, or no form of intervention was required.

1.2.2 Default Prevention and Management Policy

The Default Prevention and Management Policy (DPMP) repealed and replaced the Aboriginal Affairs and Northern Development Canada (AANDC) Funding Agreements: Intervention Policy and was issued under the authority of AANDC's Chief Financial Officer (CFO). The DPMP was effective as of June 1, 2011.

The DPMP is based on the implementation of the Treasury Board's Policy on Transfer Payments (2008), setting out the policy framework for AANDC default prevention and management activities based on risk management and assessment to assist recipients in being proactive in addressing program and/or financial management and capacity challenges.

The objectives of the DPMP are to:

- Support community capacity development so that communities continue to increase their ability to self-manage and prevent default and default recurrence;

- Assist recipients, where possible, in preventing defaults of funding agreements, to assist recipients, where possible, in their timely management and remediation of defaults;

- Maintain continuity in the delivery of departmentally funded programs and services to Aboriginal communities while the recipient is in default; and,

- Meet the requirements for departmental accountability, transparency, and effective internal control in the management of departmental transfer payment programs.

Under the DPMP, the Chief Financial Officer (CFO) is responsible for:

- Providing oversight on the implementation of the policy including investigating and acting when significant issues arise regarding policy compliance and monitoring to certify that appropriate remedial actions are taken to address these issues;

- Supporting the implementation of the policy by providing guidance, training, internal service standards and bringing to the Deputy Minister's attention, any significant difficulties or gaps in performance; and,

- Conducting annual assessments of the application of the policy, and provide an annual report for the Department's Operations Committee review, which would include a status report of all recipients in intervention.

The Regional Operations (RO) Sector is responsible for ensuring the strategies for capacity development and sustainability in the delivery of programs and services are implemented to meet the requirements of the policy.

Assistant Deputy Ministers are accountable to the Deputy Minister for ensuring that appropriate capacity is in place to implement the requirements of this policy.

The Regional Director Generals are responsible for:

- Ensuring appropriate oversight of default management decisions in their regions/directorates, and for ensuring staff compliance with the policy; and,

- Ensuring effective management of recipient defaults for funding agreements that they administer including a minimum yearly review of recipients in default by a Regional Operations Committee, and regular updating of those recipients' status in FNITP, the Department's reporting system.

As compared to the previous Intervention Policy, there is greater emphasis in the DPMP on maintaining relationships with the recipient, default prevention, capacity development and sustainability. There are five principal default management actions included in the DPMP: initiate monitored self-correction; withhold funds intended for services deemed non-essential; require Management Action Plan (MAP) / Expert Resource support; Third-Party Funding Agreement Management; and terminate agreement. The intervention level of Co-Managed is no longer applicable under the DPMP and has been replaced by Expert Resource support.

2. Audit Objective and Scope

2.1 Audit Objective

The objective of this audit was to assess the adequacy and effectiveness of the governance structure and controls in place for the administration and management of Co-Managed and Third-Party Managed funding agreements.

The audit objective was supported by detailed audit criteria developed in alignment with Treasury Board of Canada Secretariat's Core Management Controls. See Appendix A for the list of detailed audit criteria for this audit.

2.2 Audit Scope

The scope of the audit included an examination of the governance structures and management controls that support:

- Implementation of policies which include roles, responsibilities and requirements for Co-Managed and Third-Party Managed agreements;

- Identification of recipients requiring these forms of intervention; and,

- Implementation and management of the intervention mechanisms, including: justification for the level of intervention and the processes for escalation and de-escalation thereof; management of the Co-Manager or Third-Party Manager selection process; agreement development; monitoring and reporting activities related to performance of the Third-Party Manager or Co-Manager; basis for payment of Third-Party Managers; and, monitoring and reporting on the progress of recipients under intervention.

The audit scope covered the period from April 1, 2010 to December 31, 2011.

Audit fieldwork was conducted at Headquarters (National Capital Region) and site visits to four regional offices: Ontario North; Atlantic; Saskatchewan; and, Manitoba. A site visit to a northern region was not conducted due to the existence of very few recipients in Co-Management or Third-Party Management in those regions. During the audit scope period, there was only one recipient that spent time in one of those levels of intervention.

Given the new DPMP was introduced during the audit period in June 2011, the audit included an examination of management practices under both policies during their respective periods of applicability.

The audit scope included the administration of funding agreements under Co-Management and Third-Party Management placed in intervention for any of the reasons, or type of triggers, spelled out in the policies. Based on information contained in FNITP, the audit observed that during the scope period, the most common trigger for these levels of intervention was financial reasons. Numerous instances were noted where multiple triggers for intervention were identified, including financial and health and safety concerns. In many of these instances, the financial issues had led to health and safety concerns (e.g. the supply of heating oil had stopped due to payment arrears).

3. Approach and Methodology

The Horizontal Audit of the Management Control Framework for Grants and Contributions 2011-2012 (Focus on Co-Management and Third-Party Management) was planned and conducted to be in accordance with the Internal Auditing Standards for the Government of Canada as set out in the Treasury Board Policy on Internal Audit.

Sufficient and appropriate audit procedures have been conducted and evidence gathered to support the audit conclusion provided and contained in this report.

The principal audit techniques used included:

- Interviews with key regional management personnel and selected staff in HQ (Transfer Payment Centre of Expertise, Regional Operations);

- Documentation reviews including contribution funding agreements, co-management agreements, management control framework (e.g. Management Control Framework for Grants and Contributions), policies (e.g. Intervention Policy, Policy 200: Default Prevention and Management) and directives (e.g. Directive 205 Default Prevention and Management, Directive 210 Third Party Funding Agreement Management, etc.);

- Performance of on-site visits to four regional offices to review documentation, conduct interviews and conduct transaction testing of supporting documentation retained in FNITP and CIDM;

- Performance of an analysis of regional management practices to determine if there are any "leading practices" that could be shared across the department; and,

- Conduct of follow-up testing activities, on a sample basis, depending on the risks identified.

The approach used to address the audit objective included the development of audit criteria against which observations and conclusions were drawn. The audit criteria developed for this audit are included in Appendix A.

4. Conclusion

Generally, intervention and default prevention and management practices were found to be adequate in the regions examined; however, some areas for improvement were noted to strengthen management practices in the following areas: national governance structure for default prevention and management, capacity and competency of Funding Services Officers, design of the FNITP intervention module, use and consistency of performance information in FNITP, and policy implementation rollout.

5. Observations and Recommendations

Based on a combination of the evidence gathered through the examination of documentation, analysis and interviews, each audit criterion was assessed by the audit team and a conclusion for each audit criterion was determined. Where a significant difference between the audit criterion and the observed practice was found, the risk of the gap was evaluated and used to develop a conclusion and to document recommendations for improvement initiatives.

Observations include leading practices and management practices considered to be adequate as well as those requiring improvement. Accompanying the observations of management areas identified for improvement are recommendations for corrective actions.

Observed Strengths

Throughout the audit fieldwork, the audit team observed examples of leading practices. This resulted in several positive findings which are listed below:

- In Atlantic, detailed presentation decks are created, and presented to the Audit Review Committee (ARC) as part of the audited financial statement review process. These decks are quite detailed and cover both quantitative and qualitative factors, including: key financial statement information from the current and prior year, financial health ratios and trend analysis, items of risk from the financial statements, progress in capacity development, and recommendations;

- In Atlantic, detailed charts and trend analysis with numerous financial health indicators were used by management to highlight and discuss recipients that may enter intervention and act as an early warning system.

- In Atlantic, AANDC staff working with a specific recipient are grouped into a what is referred to asa "Community Team". By having AANDC Program and Funding Service staff working more closely together on a regular basis, this allows for more effective and timely sharing of information about the recipient and provides early indication to possible default issues; and,

- In Saskatchewan, the region has kept its Transfer Payment Management Regime document current. The Management Regime is a useful instructional guide which describes the roles and responsibilities and process steps for managing funding agreements, including steps with regards to intervention practices. All personnel involved in the management of funding agreements (development, release of funds, acknowledgement of reporting requirements) are expected to be familiar with the information included in the regime.

5.1 Governance and Strategic Direction

5.1.1 Governance / Management Oversight

An effective national governance structure or mechanism must be established and management must be actively involved and exercise ongoing oversight in order to ensure adequate governance over recipients in default prevention and management. A clearly communicated and well understood mandate that includes roles with respect to DPMP governance, risk management and control is important in ensuring sufficient oversight and consistent direction regarding DPMP processes. Furthermore, activities should be conducted on a regular and structured basis to assess whether AANDC employees are complying with policies and procedures.

As per the DPMP, the CFO is responsible for providing oversight on the implementation of the policy (including investigating and acting when significant issues arise regarding policy compliance and monitoring), supporting the implementation (by providing guidance, training, etc.), and conducting annual assessments of the application of the policy and an annual report. The Senior Assistant Deputy Minister of Regional Operations is responsible for ensuring strategies for capacity development and sustainability in the delivery of programs and services are implemented to meet the requirements of the policy.

Within the regions, governance committees are in place, where regular discussion and decision making of intervention and default management issues occurs. Regions do not, however, currently conduct activities to monitor AANDC employee compliance to the Intervention Policy or DPMP. The audit noted that there are multiple national governance committees in place (e.g. OPS Committee, Director Generals Implementation and Operations Committee (DG IOC), Policy on Transfer Payments Implementation ADM Steering Committee (ADM PTP) and Director Generals Policy on Transfer Payments Working Group (DG PTP)) where exceptions and significant issues of default prevention and management are discussed; however, there was no evidence of a formal governance practice for providing regular ongoing oversight of default prevention and management, including a review of regional practices used to ensure compliance to the DPMP (i.e. updates on progress, analysis and discussion of implementation issues, etc.).

Lastly, during the rollout of the DPMP, the audit found that there was no governance committee directly responsible for discussion and oversight, and several interviewees noted that this gap contributed to confusion in the regions concerning the role and responsibilities of the Transfer Payment Centre of Expertise (TPCOE) and the Regional Operations (RO) Sector. Interviewees also noted that the similarities between DG IOC and the PTP management committees cause confusion and the differences in the roles of the committees are not always well understood.

Recommendation:

1. The Chief Financial Officer (CFO), in collaboration with the Senior Assistant Deputy Minister (Sr. ADM) of Regional Operations (RO), should review and clarify the national governance structure to provide proper oversight and implementation of the Default Prevention and Management Policy, including policy compliance and monitoring, conducting annual assessments of the application of the policy, and sharing leading practices across the regions.

5.2 People

5.2.1 Funding Services Officer Capacity and Competency

Successful implementation of default prevention and management is dependent on the sufficiency of AANDC resource capacity, competencies and capabilities to effectively deliver and manage AANDC default prevention and management responsibilities.

With respect to assigned responsibilities, capacity and competencies, interviewees noted that the analysis conducted to determine the regional resource levels for Funding Services Officers (FSO) is limited to quantitative metrics (e.g. operating budget per FSO etc.). In determining and assessing the required FSO resource levels for regions, full consideration is not given by Headquarters to additional qualitative factors in (e.g. degree of difficulty in working with the recipient, willingness of the recipient to participate, and specific reasons for intervention). As such, the audit noted that there are variances between regions in the FSO workload and responsibilities in assisting recipients. Regions, however, do apply qualitative factors in assigning responsibilities to FSOs.

In addition, the audit found that FSO job descriptions and competency profiles are not always up-to-date and the roles and responsibilities of the FSO vary across the regions. Interviewees noted that given the significance and frequency of the relations between the FSO and the recipient, it would be beneficial to allow the FSO to provide a more strategic role to aid in recipient community development, including the amount of time spent with the recipient.

Several FSOs interviewed also noted that their role requires conducting an in-depth analytical review and interpretation of annual audited financial statements. These financial statements and their associated management letters from external auditors provide valuable insight into potential default prevention issues or risk exposures. As well, FSOs review and interpret financial reports submitted by recipients on a quarterly or monthly basis. Proper analysis and interpretation of these documents requires trained analysis or subject matter expertise which was found to be absent among many of the FSOs interviewed. FSOs interviewed generally do not have access to individuals or resources with the required experienced training in financial statement interpretation.

Recommendation:

2. The Senior Assistant Deputy Minister (Sr. ADM) of Regional Operations (RO) should re-assess the Funding Services Officer (FSO) role, required competencies, and resource capacity to optimize the amount of time spent working with the recipients. In addition, FSOs should be provided training on the analysis of financial statement information, and other mechanisms should be considered to provide FSOs with access to financial statement analysis subject matter expertise, as required.

5.2.2 FNITP Intervention Module Design

It is important that systems and processes track, accumulate and report intervention and default prevention and management information in a consistent, efficient, effective and timely manner for decision-making purposes. Furthermore, it is paramount that the design of systems used for decision making is user-friendly and reliable to allow for consistent, efficient, and effective processes.

During the audit, several issues were noted with respect to the First Nations and Inuit Transfer Payment (FNITP) system intervention module, which is the Department's primary information system used to processes, track, accumulate and report information on intervention and default prevention and management. Notable concerns include:

- There are inconsistencies in how FSOs and regions are utilizing FNITP features in the intervention module. Not all users are making use of the available features, and it was not clear to users if all of the available features are necessary.

- Unavailability of some data and limited ability exists in FNITP to provide a national view or to be able to conduct trend analysis. For example, the FNITP intervention status report can report different results, depending on the stage of intervention which is recorded in FNITP. Another example noted was in a Statistical Analysis presentation made to the Operations Committee in October 2011, where performance review data of audit opinions for 29 recipients (19%) was reported as "unavailable in the system", reducing the usability and usefulness of such reports made at a national level;

- Questionable data integrity existed after FNITP upgrades, for example, after a regular system update was made to FNITP, the system reverted to old formatting. Limited and insufficient FNITP design was also noted with respect to intervention reporting capabilities; and,

- FNITP limitations are being overcome in some regions by developing monitoring reports outside of FNITP, which creates 'black book' record keeping and these reports are not accessible nationally. An example of such limitations includes drop down lists which require binary selections which are not always applicable. Additionally, FNITP still refers to the 8% cumulative ratio as a key determinant in evaluating performance, even though the DPMP replaced this ratio as a trigger for default with a broader review of all financial information to determine financial position.

Recommendation:

3. The Chief Financial Officer (CFO), in collaboration with the Senior Assistant Deputy Minister (Sr. ADM) of Regional Operations (RO), should work with the regions to define First Nations and Inuit Transfer Payment (FNITP) system business requirements specific to default prevention and management to improve FNITP design, usability, and reporting functionality in order to better address requirements of the Default Prevention and Management Policy.

5.2.3 Intervention Information in FNITP

In addition to having a proper system design, it is important that systems be used to track, accumulate and report intervention and default prevention and management information in a consistent, effective and timely manner for decision-making purposes. Consistent accumulation of intervention information is important in ensuring the usefulness of the system and its reporting capabilities.

The expectation is that all key documentation is retained by AANDC employees in FNITP, including but not limited to trip reports, performance reviews, and correspondence. Documentation is required to be maintained in FNITP in the event that Headquarters requires access to review documents to better understand historical events and address issues or significant events. The audit noted that while practices are in place to ensure financial information from audited financial statements is entered correctly in FNITP, intervention information is not being captured and reported in FNITP in a similar timely, useful, and complete manner. Notable issues include:

- There are differences in how FSOs and regions store intervention correspondence and trip reports. Some reports are stored in FNITP, while others are stored in the Department's document management system, Comprehensive Integrated Document Management (CIDM), while yet others are recorded informally in field books or kept in hard copy;

- Although escalation / de-escalation decisions are being documented, audit testing did not always find sufficient rationale in the FNITP system to support these escalation / de-escalation decisions;

- Completeness and quality of Performance Reviews in FNITP varies by region and by FSO. The FNITP Intervention module does not enforce the completion of these performance reviews on a regular basis. Instances were noted where an FSO attached a paper-based performance review to the recipient quarterly update, rather than imputing the information directly into the Performance Review tab, which does not allow for system based reporting of this review; and,

- Recipient reporting of activities and performance results in FNITP is not always sufficient to demonstrate that progress is being made in addressing the default issues. As an example, recipient quarterly reports do not always contain descriptions of activities undertaken or completed and are limited to financial updates.

Recommendation:

4. The Senior Assistant Deputy Minister (Sr. ADM) of Regional Operations (RO), in collaboration with the Chief Financial Officer (CFO), should determine what critical information is required to be captured by FSOs in FNITP, as the system of record, and reinforce the expectations regarding the use of FNITP to record intervention / default prevention and management performance information.

5.2.4 DPMP Implementation Rollout

With the introduction of the DPMP, it is very important that adequate tools and training are provided to employees in a timely manner in order to enable them to carry out their roles and responsibilities and in ensuring clear interpretations and timely adherence to the policy.

The Default Prevention and Management Policy (DPMP) became effective in June 2011 and replaced the former policy in place (the Intervention Policy). In rolling out the DPMP, the CFO was responsible for supporting the implementation by providing guidance and training and the Senior Assistant Deputy Minister of Regional Operations (RO) was responsible for ensuring the strategies for capacity development and sustainability in the delivery of programs and services were implemented to meet the requirements of the policy.

The audit noted that in rolling out the implementation of the DPMP, tools and training were not adequately provided to employees to enable them to carry out their roles and responsibilities in implementing the DPMP. Specifically, while draft guidebooks and tools (such as the Default Assessment Workbook, Management Action Plan Workbook, and General Assessment Ratio Analysis Guidelines) were piloted by regions and the regions were provided with an opportunity to consult on improvements, these tools have not yet been finalized. Interviewees noted that not having finalized tools or definitions has made it difficult for regions to explain terms and conditions in the funding agreements to recipients. National initiatives are now underway to provide training and improve the coordination and communication mechanisms between HQ and regions (e.g. Default Management Working Group).

With the DPMP, the concept of an expert resource pool, from which an expert is hired by the recipient, was introduced to replace the term Co-Manager from the Intervention Policy. As per the DPMP, access to an expert resource pool is listed as one of the main tools and resources that may be used to implement the policy and is defined as: "a pool of specialized individuals and organizations that are engaged by a recipient to aid in default prevention, default management, and sustainability. The recipient may be asked to engage an expert from this pool as part of the default management process". Interviewees noted that tools for specific items in the DPMP have not yet been fully defined. In particular, at the time of the audit, the transition of replacing Co-Managers with the "pool of expert resources" was very much in a conceptual stage, despite the policy being in effect. Interviewees indicated that there was little guidance on how the regions could start to implement the process. In addition, the approach to how the expert resources would be screened and selected, how First Nations would utilize the pool, and how the expert's performance would be monitored and evaluated has not been clarified, finalized and communicated.

Lastly, appointment of a Third Party Manager is obtained through a pre-qualification process through the federal MERX process. The MERX Canadian Public Tenders service is a supplier to the government which hosts an online site that connects organizations to buyers in the federal and provincial sectors to assist in bidding on Canadian public-sector contracts.

The CFO is responsible for providing the list of pre-qualified Third-Party Funding Agreement Managers and the Regional Director Generals are responsible for ensuring that the selection of Third-Party Managers is in accordance with the DPMP. Regional interviewees noted concerns with the quality of some of the pre-qualified Third-Party Managers and indicated that they were not aware they could provide feedback on the performance of Third Party Managers in the next revision of the list of pre-qualified Third-Party Funding Agreement Managers. Additionally, the audit noted that formal performance evaluations of Third-Party Managers were not being performed regularly or consistently. Evaluation of Third-Party Managers' performance is essential not only to ensure that they are satisfying the conditions of their contracts with AANDC, but also that they are actively working towards the eventual de-escalation of the recipient out of Third-Party intervention.

Recommendation:

5. The Chief Financial Officer (CFO), in collaboration with the Senior Assistant Deputy Minister (Sr. ADM) of Regional Operations (RO), should support the implementation of the Default Prevention and Management Policy (DPMP) by: finalizing the transition to using Expert Resources, including defining the selection and approval criteria; ensuring that formal performance evaluations of Third-Party Managers are conducted; formalizing a forum for regions to provide feedback on the performance of Third-Party Managers and Expert Resources; providing guidance and training to regions; finalizing the DPMP tools and rollout plan; and, providing regular updates to senior management at Headquarters and in regions on progress status.

5.3 Stewardship and Accountability

It is important that adequate due diligence be exercised in the assessment and implementation of Co-Management and Third-Party Management agreements.

The audit noted that adequate due diligence is exercised in the assessment and the implementation of Co-Management and Third-Party Management agreements and while some regions have logistical challenges that restrict their ability to regularly visit the recipient, monitoring practices are adequate to ensure that risks are identified and managed. Regional management and staff were also found to be effectively working to ensure Remedial Management Plans are in place, complete, and updated as required. Lastly, intervention and default prevention and management decisions are evidenced through Regional governance management committees and decisions on intervention and default levels are communicated to recipients.

Recommendation:

No recommendations were identified in this area.

5.4 Risk Management

The audit noted that risk management practices are sufficient for identifying and assessing risks related to intervention implemented by Headquarters and Regional Offices. The General Assessment is a risk management tool completed annually by the Funding Services Officer that includes the assessment of risks related to default and intervention for each recipient. The tool is in its second year of use and is completed in FNITP. Information on the recipient is kept and used to inform the subsequent years' risk assessment. In all regions, governance committees (e.g. Regional Operations Committee or General Assessment Committee) meet to discuss the General Assessment results and to ensure consistency in scoring. The results of the General Assessment are then shared with the recipient. During the year, regions use other informal practices to assess risks (e.g. in-person meetings, phone calls from community members).

Recommendation

No recommendations were identified in this area.

6. Management Action Plan

| Recommendations | Management Response/ Actions |

Responsible Manager (Title) |

Planned Implementation Date |

|---|---|---|---|

| 1. The Chief Financial Officer (CFO), in collaboration with the Senior Assistant Deputy Minister (Sr. ADM) of Regional Operations (RO), should review and clarify the national governance structure to provide proper oversight and implementation of the Default Prevention and Management Policy (DPMP), including policy compliance and monitoring, conducting annual assessments of the application of the policy, and sharing leading practices across the regions. |

|

|

April 2013 |

| 2. The Senior Assistant Deputy Minister (Sr. ADM) of Regional Operations (RO) should re-assess the Funding Services Officer (FSO) role, required competencies, and resource capacity to optimize the amount of time spent working with the recipients. In addition, FSOs should be provided training on the analysis of financial statement information and other mechanisms should be considered to provide FSOs with access to financial statement analysis subject matter expertise, as required. | RO, with assistance from CFO and input from Programs and AES, will review the Funding Services Officer role, responsibilities and competencies. CFO will also develop financial statement analysis and related training to be offered as part of the TPCOE training calendar. |

|

July 2014 |

| 3. The Chief Financial Officer (CFO), in collaboration with the Senior Assistant Deputy Minister (Sr. ADM) of Regional Operations (RO), should work with the regions to define First Nations and Inuit Transfer Payment (FNITP) system business requirements specific to default prevention and management to improve FNITP design, usability, and reporting functionality in order to better address requirements of the Default Prevention and Management Policy. | The CFO, with input from SADM RO, program sectors and Working Groups, (FNITP WG) will lead in setting priorities for the development of FNITP system related requirements. Priorities will be examined in light of the FNITP/SAP project and potential coding freezes for FNITP. A system's release schedule will be developed accordingly. |

|

June 2013 |

| 4. The Senior Assistant Deputy Minister (Sr. ADM) of Regional Operations (RO), in collaboration with the Chief Financial Officer (CFO), should determine what critical information is required to be captured by FSOs in FNITP, as the system of record, and reinforce the expectations regarding the use of FNITP to record intervention / default prevention and management performance information. | SADM RO with the assistance of the CFO will identify information management requirements and communicate these to regions and programs through communications and training tools as appropriate. CFO will also explore the feasibility of implementing an FNITP usage and flag significant information gaps in FNITP with respect to interventions. |

|

November 2013 |

| 5. The Chief Financial Officer (CFO), in collaboration with the Senior Assistant Deputy Minister (Sr. ADM) of Regional Operations (RO), should support the implementation of the Default Prevention and Management Policy (DPMP) by: finalizing the transition to using Expert Resources, including defining the selection and approval criteria; ensuring that formal performance evaluations of Third-Party Managers are conducted; formalizing a forum for regions to provide feedback on the performance of Third-Party Managers and Expert Resources; providing guidance and training to regions; finalizing the DPMP tools and rollout plan, and providing regular updates to senior management at Headquarters and in regions on progress status. | The transition to using Expert Resources is underway; an Expert Resource Framework has been developed and will be fully implemented by the end of FY 2013-14. A TPM evaluation checklist will be developed for use by regions. The RO Director of Funding Services Working Group and Associate Regional Director General Forum will serve as RO fora for regions to provide feedback on the performance of TPMs, Expert Resources and other DPMP implementation plans and reports. CFO Office and RO Funding Services Directors are supporting a DPMP Technical Working Group that has been providing regional input and leadership on various DPMP products including training. A DPMP Train-the-trainers session was held May 30-31, 2012 with participation from all regions. Further training is to be scheduled to continue supporting the implementation and use of the revised toolkit. CFO Office and RO developed instructor and participant training materials, which are available to regional trainers via the TP Training Network. The Management Action Plan workbook is being prepared for posting on AANDC's internet site in order to be put into day-to-day use. The Default Assessment Tool (DAT) and Logic Model will be put into use this fiscal year. The entire DPMP toolkit has been reviewed by Legal Services, CFO and RO staff and changes have been made to several documents. RDGs (through their DPMP WG representatives) and the Senior Director, TPCOE, will provide feedback on revised documents by the end of December 2012. Once approved by the CFO, toolkit documents will be posted on Intranet/Internet sites as appropriate. CFO and Regions will review all tools in Q1, 2013-2014. The CFO will continue to provide updates to Departmental Operations Committee as required by the current policies and directives. |

|

June 2013 |

Appendix A: Audit Criteria

The audit objective is linked to audit criteria developed in alignment with Core Management Controls. Additional audit criteria were developed to address specific risks identified in the planning phase.

Audit Criteria

Governance and Strategic Direction

1.1 Effective governance structure/ mechanisms are established and management is actively involved and exercises oversight of intervention processes.

1.2 The oversight body (or bodies) has a clearly communicated mandate that includes roles with respect to intervention governance, risk management and control.

1.3 There is adequate AANDC governance and oversight over First Nations in intervention.

People

2.1 There is sufficient AANDC resource capacity and capabilities to effectively deliver and manage intervention responsibilities.

2.2 Information systems and processes track, accumulate and report intervention information in a consistent, efficient, effective and timely manner for decision making purposes.

2.3 Adequate tools and training are provided to employees to enable them to carry out their roles and responsibilities related to intervention.

Stewardship

3.1 Adequate due diligence is exercised in the assessment and the implementation of co-management and third-party management agreements.

3.2 Financial and performance information is captured and reported in a timely, useful, accurate and complete manner, and reported information is reviewed and approved by AANDC.

3.3 Monitoring practices are adequate to ensure:

- Risks are identified and managed;

- Remedial Management Plans are in place and updated as required; and,

- Reporting of activities and performance results is accurate.

3.4 Compliance activities are conducted on a regular and structured basis to assess whether recipients, program officers, and regional AANDC officers are complying with program policies and procedures.

Accountability

4.1 Approval decisions and co-management agreements and third-party management agreements are executed in a timely manner by AANDC individuals with appropriate delegated authority.

Risk Management

5.1 Risk management practices sufficient for identifying and assessing risks related to intervention has been implemented by Headquarters and Regional Offices.

"Page details"

- Date modified: