Archived - Evaluation of Ministerial Loan Guarantees

Archived information

This Web page has been archived on the Web. Archived information is provided for reference, research or record keeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please contact us to request a format other than those available.

Date: June 2010

Project Number: 1570-7/07068

PDF Version (238 Kb, 57 Pages)

Table of Contents

- List of Acronyms

- Executive Summary

- 1. Introduction

- 2. Evaluation Methodology

- 3. Evaluation Findings - Relevance

- 4. Evaluation Findings - Clarity

- 5. Evaluation Findings - Design and Delivery

- 6. Evaluation Findings - Results

- 7. Evaluation Findings - Cost-Effectiveness

- 8. Evaluation Findings - Future Directions

- 9. Conclusions

- Appendix A - Evaluation Matrix

- Appendix B - Document List

- Appendix C - Profile of Key Informants

- Appendix D - Profile of Case Studies

List of Acronyms

Executive Summary

Introduction

The following report presents the findings of an evaluation undertaken by KPMG on behalf of Indian and Northern Affairs Canada (INAC), of Ministerial Loan Guarantees (MLGs) for the period 1996-97 to 2007-08.

In 1966, the Government of Canada began authorizing INAC to provide MLGs. MLGs provide a way of guaranteeing loans for individual or community housing projects on First Nations reserves. It is designed to provide financial security to the lender or mortgage insurer given that under Section 89(1) of the Indian Act, real property on a reserve cannot be seized by a non-Indian and most financial institutions.

This evaluation of MLGs is part of the overall evaluation of INAC's housing support in Canada's First Nations communities (reserves) to be completed in 2010.

The main objective of the Evaluation of Ministerial Loan Guarantees is to conduct a detailed study of MLGs for a timely, strategically focused, neutral, evidence-based report. The evaluation examines the relevance/rationale, design/delivery, success/impacts, and cost-effectiveness of MLGs. The scope of the evaluation is limited to the use of MLGs between 1996 and 2008 as a tool to access financing for housing in First Nations communities.

Evaluation Methodology

An evaluation matrix was developed, asking a series of questions designed to examine six areas of inquiry: relevance, clarity, results, cost-effectiveness, design and delivery, and future directions. These questions are answered throughout the findings sections of this report.

Methodology used:

- Documents reviewed included program reports and reporting guides, program terms and conditions and project documents, such as operational plans, strategic plans and performance measurement strategies, policy documents, and previous evaluations or studies;

- Statistical data from Statistics Canada and administrative data from INAC's Guaranteed Loan Management System, Housing and Infrastructure Asset Inventory, Basic Departmental Data and the 2008 Compendium of INAC Program Data were reviewed;

- Key informant interviews were conducted over the phone, and generally took 30 to 45 minutes. A total of 53 interviews took place, with stakeholders representing INAC (29); Canada Mortgage and Housing Corporation (CMHC) (seven); management and program/policy staff, financial institutions (five); and representatives from First Nations communities (12); and

- Five case studies were conducted to provide illustrative examples of the impact that MLGs have had on housing on reserve.

Evaluation Findings

Key findings from the evaluation are:

Relevance

MLG objectives are consistent with government priorities for housing in First Nations communities. It is a relevant tool, and is effective insofar as access to MLGs have allowed communities to produce approximately 26,000 new housing units between 1996-97 and 2007-08. Interview respondents estimated that existing alternatives to MLGs are accessible to approximately 15 percent of First Nations. According to document and policy review conducted, the absence of MLGs would leave most First Nations communities with no alternative to finance housing on reserve [Note 1] unless an alternative was developed. Such an absence would require CMHC to make administrative changes and to charge a prohibitive premium for loan insurance (unless changes were made to their legislation to allow for lower cost loan insurance).

Clarity

INAC does not currently measure whether or not MLG objectives are being achieved, nor has it set any performance targets or goals for MLGs. However, INAC interview respondents indicated that the Department does monitor usage of the MLG authority, in addition to collecting information and tracking performances measures relevant to housing outcomes. According to a review of statistics and trends, MLGs are relied upon by First Nations communities to ensure access to financing for housing projects on reserve. Statistics demonstrate [Note 2] that Canada's on-reserve population is young and growing, indicating that there will continue to be more pressure on bands to meet housing demands for its members into the future.

Design and Delivery

There is no evidence of, or requirement for, a logic model setting out the desired results for MLGs. The scope, objectives, and eligibility criteria for MLGs are generally clear in policy documents. While the overall process to obtain MLGs is consistent across Canada, there are slight regional variations. These variations are currently being addressed, notably with the creation of a new Operational Guide. The roles and responsibilities in the delivery of MLGs are documented [Note 3], and are generally understood and respected. Regions will be allocated a portion of the MLG authority to manage. Overall usage of the authority will be tracked in the new Guaranteed Loan Management Module. The risk exposure for the Government of Canada appears to be low, as interview respondents revealed loan defaults were unlikely, and historical default rates have been very low (approximately 0.6 percent for MLG backed financing, compared to a national average of 0.5 percent, according to research by Dominion Bond Rating Service). [Note 4].

Results

MLGs appear to be meeting their stated objectives of providing the necessary loan security to obtain financing and providing access to private funding for housing. Aside from some support to communities in completing applications, there is no evidence that MLGs have brought changes to capacity building. According to interview respondents, MLGs allow for better housing results as opposed to capital grants, because the amount of grants is unlikely to equal or surpass that of the MLG authority. The usage of MLGs appears to be heavily weighted on housing quantity outcomes with the vast majority of MLGs being used to support CMHC's Section 95 housing. There is some interview evidence to suggest that building more housing units, using MLGs, has contributed negatively through the creation of cash flow problems as a result of higher debt loads in some First Nations communities, and positively through increased economic development activity in other communities. There is little evidence to suggest that MLG defaults are a significant contributor to a community being placed in third-party management or co-management.

Cost-Effectiveness

The evidence obtained from an analysis of the progression of MLGs between 1996 and 2008 and key informant interviews show that MLGs have facilitated the construction of approximately 26,000 new housing units between 1996-97 and 2007-08. This outcome has come at a cost of less than $2 million per year in defaults, plus administrative costs.

Future Directions

There is limited interest in using MLGs for purposes outside of housing and under the current policy, they cannot be used for purposes other than housing on reserve.

1. Introduction

1.1 Ministerial Loan Guarantees

The following report presents the findings of an evaluation undertaken by KPMG on behalf of Indian and Northern Affairs Canada (INAC), of Ministerial Loan Guarantees (MLGs) for the period 1996-97 to 2007-08.

In 1966, the Government of Canada began authorizing INAC to provide MLGs. MLGs provide a way of guaranteeing loans for individual or community housing projects on First Nations reserves. It is designed to provide financial security to the lender or mortgage insurer given that under Section 89(1) of the Indian Act, real property on a reserve cannot be seized by a non-Indian and most financial institutions.

Government support for housing in First Nations communities is shared by INAC and the Canada Mortgage and Housing Corporation (CMHC). These organizations were used by the federal government to help eliminate the loan problem associated with seizure of reserve lands when, in 1966, Parliament began authorizing INAC to provide MLGs. MLGs provide a way of guaranteeing loans for individual or community housing projects on First Nations reserves. CMHC requires an MLG both for participation in the Section 95 social housing program and for shelter construction under the Shelter Enhancement Program. The INAC MLG is designed to provide financial security to the lender or mortgage insurer. INAC provides this guarantee through a system of contractual arrangements with the First Nations, CMHC and the lending institutions (banks). In the presence of an MLG, CMHC provides a loan insurance certificate, though does not charge insurance premiums, as it would for off-reserve homebuyers who make a minimum down payment of five percent towards the purchase price of a home under the National Housing Act (NHA). Rather, the Minister of Indian Affairs and Northern Development is ultimately responsible for any loan defaults where MLGs have been issued. In the event of a default, the Minister works with the First Nations in partnership to address repayment. [Note 5] The management of MLGs falls under the Community Infrastructure Program in INAC's Regional Operations Sector. [Note 6] There have been few changes in the initiative since the MLG was introduced in 1966. The conditions were last revised in 1999. [Note 7]

MLGs complement INAC housing support and CMHC housing programs by providing a tool for First Nations to access loans for housing on reserves. The policy objective of MLGs is to facilitate access to financing required for the construction, acquisition and/or renovation of on-reserve housing. A sub-objective is to enable and encourage lending to individuals in support of home ownership opportunities for on-reserve residents.

To be eligible for funding from the 1996 Policy (see Section 1.3 for additional information about the Policy), First Nations communities need to have established a set of housing policies, housing programs, and a multi-year housing plan. First Nations are encouraged to include home ownership and other market-based housing options in addition to social housing in their multi-year housing plans. [Note 8] MLGs can support First Nation's housing plans by helping secure funds for social housing projects as well as by providing individuals with the security required to access a personal mortgage to finance a home purchase or renovation (though loans to individuals must also be backed by the band).

To be eligible for an MLG, bands must first obtain mortgage approval from a lender. The band must then submit a Band Council Resolution (BCR) to INAC that includes: a) certification that the loan will be for housing or housing improvements for Indians; b) an environmental site assessment has been carried out on the property and it confirms no contamination; and c) consent to the expenditure of band revenues to recover loan payments (e.g., in the case of default). For loans to individuals, additional conditions apply, including the band: a) to confirm that it is satisfied with the reputation and financial responsibility of the individual; and b) that it has received consent from the individual that upon default he/she will transfer any certificate of possession to the band and vacate the property. [Note 9]

These general criteria for eligibility are designed to reduce the risk of default of payment on loans, to minimize financial constraints on the Government and to prevent undue constraints on members of the First Nations and band councils. INAC's program directive and draft Operational Guide for MLGs outline the policy and procedures for approving and administering the loan guarantees.

The program operates under a revolving account authority. The MLG authority was last increased in 2008 from $1.7 to $2.2 billion, which is the total contingent liability. [Note 10]

The main objective of this evaluation is to conduct a detailed study of MLGs for a timely, strategically focused, neutral, evidence-based report. The evaluation examines the relevance/rationale, design/delivery, success/impacts, and cost-effectiveness of MLGs.

1.2 MLGs and the On-Reserve Housing Policy

In 1996, the Government of Canada introduced the On-Reserve Housing Policy to provide greater flexibility and more control to First Nations over their housing policies and programs. The Government's policy is designed to support First Nations in fulfilling their role of deciding how, where, and when housing funds are invested. INAC is primarily responsible for implementation of the policy, although CMHC provides a number of programs and products that support the policy. [Note 11] The Government's housing policy is meant to support more flexible funding arrangements, but was never designed to cover the full costs associated with on-reserve housing. While there is financial assistance, other contributions such as loan financing are essential for providing adequate housing on reserve, for example, for the construction of houses and ongoing maintenance of housing units.

The policy is based on four key principles: [Note 12]- Community control;

- Capacity development;

- Shared responsibility; and

- Better access to private capital.

The later two principles of the 1996 Policy emphasize the need for First Nations to actively seek other sources of financing, including private loan financing, to meet the housing needs of their community. MLGs are one such tool to seek these other sources of financing.

MLGs are widely used for First Nations housing projects. Approximately 80 percent of all FirstNations in Canada use MLGs for on-reserve housing (an estimated 490 out of 615 as of June 2009). As of September 2007, approximately one third of on-reserve housing in Canada (32,450 of the roughly 100,000 houses) used financing backed by an MLG. [Note 13]

At the end of fiscal year 2007-08, INAC had approximately 6,112 current housing loan guarantees for the construction, acquisition or renovation of on-reserve housing. The original guarantee amount of these loans was approximately $2.3 billion while the outstanding principal and interest was almost $1.5 billion. From 1996-97 to 2007-08 (the most recent year where full year's data is available), INAC issued an estimated 4,328 housing loan guarantees for the construction, renovation or acquisition of an estimated 22,311 houses. [Note 14]

1.3 MLG Progression from 1996 to 2008

Note: All the data in this section has been calculated from data provided by INAC. The MLG data is from regional reports generated from the Guaranteed Loan Management System (GLMS) for each fiscal year and the housing data is from the Housing and Infrastructure Asset Inventory, Basic Departmental Data and the 2008 Compendium of INAC Program Data.

Ministerial Loan Guarantees on reserve generally fall into one of three categories: [Note 15]

- Loans required to finance social housing (Section 95 housing) – Section 95, a CMHC on-reserve housing program, assists First Nations in the construction, purchase and rehabilitation, and administration of suitable, adequate and affordable rental housing on reserve. CMHC provides a subsidy to the project to assist with its financing and operation.

- Loans to support other First Nation managed housing projects (Section 10 housing) – this program assists band councils in accessing financing for the construction, purchase and/or renovation of single-family homes or multiple residential rental properties.

- Loans to individuals (home owner projects), through the band council (Section 10 housing) – this is similar to the Section 10 housing mentioned above, except it is to individuals who wish to construct or purchase their own home on reserve.

The most common type of loan is associated with CMHC's Section 95 housing. Table 1 below provides an overview of the three groupings of MLG loans by purpose during the period from 1996-97 to 2007-08.

| Loan Purpose | Number of Loans |

% of Total Number |

Amount Guaranteed |

Average Loan Amount |

Number of Units |

% of Total Units |

Average loan per Housing Unit |

|---|---|---|---|---|---|---|---|

| CMHC's Section 95 | 2,321 | 53.6 | $1,218,962,062.01 | $525,188.31 | 16,169 | 72.5 | $75,388.83 |

| Other Band Projects | 675 | 15.6 | $272,973,024.36 | $404,404.48 | 4,694 | 21.0 | $58,153.61 |

| Members | 1,332 | 30.8 | $104,265,491.39 | $78,277.40 | 1,448 | 6.5 | $72,006.55 |

| Total: 4,328 | Total: $1,596,200,577.76 |

Weighted Avg: $368,697.47 |

Total: 22,311 |

Weighted Average: $71,549.59 |

|||

As indicated, approximately 54 percent of loans and approximately 72.5 percent of housing units were associated with CMHC's Section 95 projects. This category also had the highest average loan amount at just over $525,000 (or approximately $75,000 for each housing unit that the loan covers). Other First Nation's projects accounted for approximately 16 percent of loans or 21 percent of housing units. Loans made to individual band members accounted for approximately 31 percent of total loans and 6.5 percent of housing units. Chart 1 below shows the progression of MLG units and average loan per unit amounts over the same period. Note that the spike in the number of MLGs corresponds to the investment in on-reserve housing made though Budget 2005.

This figure shows the progression of MLG units and average loan per unit amounts during 1996-2008.

Member trends are concentrated in the lower end of the graph. The lowest points are in the first three years, beginning at a little over 9 in 1996-97 and gradually increasing with its most significant growth in a one year period demonstrated in 1999-00 with 176 units. The most consistent period of time is between 2000-05 with the amount of units ranging between 131 and 150. The peak for the members charting is in 2005-06 with 219 units. The final two years featured in the graph demonstrate a slight decrease, with 2007-08 listing 116 units.

The line representing other bands demonstrates higher trends than the members. The beginning point in 1996-97 is 422 units. There is an increase that leads to three years of consistency where the number of units is approximately 600. This is followed by a decrease in the following two years, reaching 238 units in 2001-02 and gradually increasing to 364 units in 2003-04. Once again, a small dip occurs in 2004-05 to 150 units, but the trend experiences a significant increase to 494 units during 2005-06. By 2006-07 the rate is 140 units and the graph finishes off in 2007-08 with 265 units.

The line representing Section 95 features higher trends than both the members and other bands. The Section 95 line begins at 1125 in 1996-97 and gradually increases to 1339 by 1998-99. The graph demonstrates a marked decrease to 985 units in 1999-00 and remains consistently within the range of 1000 units until 2003-04. The lowest point for this group featured in the graph is 2004-05 with 834 units. There is an increase to 1018 by 2005-06, followed by a soar in rates to the peaking point of 3278 units. The final year of 2007-08 demonstrates a decrease to the second highest rate recorded of 2158 units.

The graph also features the average loan values per unit, correlating with the tracking of the three groups' unit rates. The loan values gradually increase as the chart progresses with the exception of 1999-00 and 2004-05. The beginning value in 1996-97 is listed at $50,624 and is noted as $60,023 in 1998-99 before experiencing its first decrease to $58,508. The following year, 2000-01, the increasing trend continues with average values documented at $64,263. The gradual increase continues until 2003-04 with average loans of $78,086, followed by the final decrease in the chart in 2004-05 to $76,058. The following year in 2005-06, the average loan value increases to $76,058. In 2006-07, the rate is $84,464 leading into the highest loan rate recorded in 2007-08 of $90,187.

MLG loans can be used for three different types of "housing projects":

- Construction of new houses;

- Renovation of existing houses; or

- Purchase/acquisition of a house.

The vast majority of loans are used for the purpose of constructing new houses. From 1996-97 to 2007-08, approximately 92 percent of loans were used for the construction of new houses. The remaining loans were split between renovation projects (approximately three percent) and housing purchases (approximately four percent). Table 2 also shows the different average loan amounts for the three types of projects, with renovation projects having the smallest average amount (at approximately $23,381 for each housing unit) compared to loans for construction projects (at approximately $73,720 per housing unit).

| Loan Purpose | Number of Loans |

% of Total Number |

Amount Guaranteed |

Average Loan Amount |

Number of Units |

% of Total Units |

Average loan per Housing Unit |

|---|---|---|---|---|---|---|---|

| Construction | 3,738 | 86.4 | $1,526,884,564.02 | $408,476.34 | 20,712 | 92.8 | $73.719.80 |

| Renovation | 314 | 7.3 | $16,460,476.67 | $52,421.90 | 704 | 3.2 | $23,381.36 |

| Purchase | 276 | 6.4 | $52,855,537.07 | $191,505.57 | 895 | 4.0 | $59,056.47 |

| Total: 4,328 | Total: $1,596,200,577.76 |

Weighted Avg: $369,006.72 |

Total: 22,311 |

Weighted Average: $71,522.43 |

|||

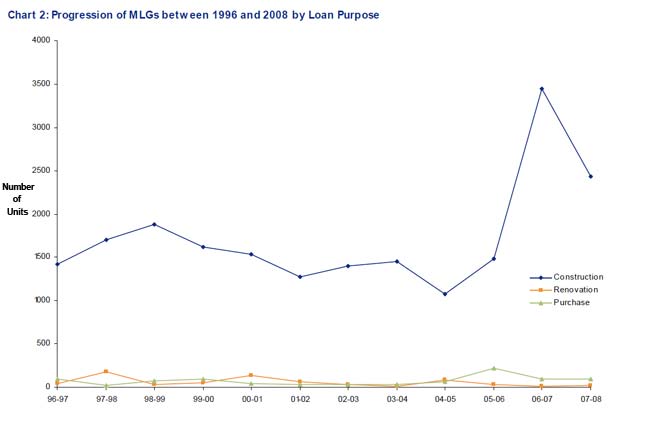

Chart 2 below shows the progression of MLG units by loan purpose over the same period. As noted on the previous graph, the spike in new construction corresponds to the investment made in on-reserve housing through Budget 2005.

This figure is a graph indicating the progression of MLG units by loan purpose between 1996 and 2008. The three separate lines represent construction, renovation and purchase. The number of units is indicated on the y axis and each year within the determined range is indicated along the y axis.

The renovation and purchase rates featured in the graph are consistently featured in the lower portion of the graph. The number of units renovated peaks in 1997-98, at approximately 200 units, dipping back down over the next two intervals. During 2000-01, the renovation rate increases to approximately 125 units. It decreases for the next three years, hitting its lowest point in 2003-04, which is later echoed in 2006-07. The highest point for renovations after the three year decrease is in 2004-05 with the graph reaching 125 units.

The purchase rates remain consistently low with a slight increase in 1998-99 and 1999-2000. The lowest point in purchase rates remains constant during 2001-2004 with approximately no sales recorded. The highest point for purchases noted in the graph is during 2005-06, with approximately 200 units purchased.

The construction rates are significantly higher throughout the graph without any plateaus. The approximate rate of constructed homes progresses as follows: 1400 units (1996-97), 1700 (1997-98), 1875 (1998-99), 1625 (1999-2000), 1500 (2000-01), 1250 (2001-02), 1400 (2002-03), 1475 (2003-04), 1100 (2004-05), 1500 (2005-06), 3400 (2006-07) and 2400 during 2007-08.

Table 3 provides an indication of the usage of MLGs against the total housing projects that have been undertaken on reserve since 1996-97. It compares the units covered by MLG loans (for construction and renovation projects as shown in Table 2) to the new housing units and units renovated since 1996-97.

| Construction Projects | |

| Number of New Housing Units | 26,073 |

|---|---|

| Number of New Housing Units covered by MLG Construction Loans | 20,712 |

| Percentage of New Housing Units covered by MLG Loan | 79.4% |

| Renovation Projects | |

| Number of Renovated Housing Units | 38,550 |

| Number of Renovated Housing Units | 704 |

| Percentage of renovated Housing Units covered by MLG Loan | 1.8% |

As indicated, approximately 26,000 new housing units have been constructed on reserve between 1996-97 and 2007-08 and almost 80 percent of these new housing units were financed through an MLG backed loan. The ratio for units renovated is significantly smaller. Of the approximately 38,500 units renovated since 1996-97, less than two percent used financing backed by an MLG renovation loan.

2. Evaluation Methodology

2.1 Evaluation Scope and Timing

This evaluation of MLGs is part of the overall evaluation of INAC's housing support in Canada's First Nations communities (reserves) to be completed in 2010. While this larger evaluation is primarily focused on INAC's on-reserve housing support and initiatives, it also includes some data and lines of evidence on CMHC programming.

The scope of the evaluation is limited to the use of MLGs between 1996 and 2008 as a tool to access financing for housing in First Nations communities. While MLGs have been used as a tool to provide security for mortgage loans since 1966, the scope of this evaluation is limited to provide analysis on this instrument with respect to the areas of inquiry since the development of the 1996 Policy for On-Reserve Housing.

INAC and CMHC have a number of policy instruments and programs that comprise the Government of Canada's support for on-reserve housing, including social housing. While all these programs and initiatives interact, and have an impact on each other (e.g., MLGs are required for loans made to finance CMHC's Section 95 projects), the scope of this evaluation is solely on MLGs, and the role they play in financing on-reserve housing. For example, when considering issues pertaining to future options, the evaluation considers future options and strategies for First Nations to access loans for housing on reserves.

2.2 Evaluation Issues and Questions

An evaluation matrix was developed, asking a series of questions designed to examine six areas of inquiry: relevance, clarity, results, cost-effectiveness, design and delivery, and future directions. These evaluation questions are answered throughout the findings sections of this report. Each section of the report related to evaluation findings reviews the key findings of the research, the evidence that supports those findings, conclusions, and associated recommendations, if any.

Relevance

- Are the MLG objectives consistent with Government of Canada priorities and the Department's strategic objectives for housing in First Nations communities?

- To what extent are MLGs still relevant? What are the alternative mechanisms to MLGs to provide loan security for on-reserve housing, including through partnerships, or other existing mortgage insurance tools? Are there alternatives to MLG's for forgivable loans? Are MLGs an effective way to provide access to funding for housing for First Nations?

- What interest from First Nations is there in offering this government initiative to First Nation band councils and their members living on reserve?

- What effect would the absence of MLGs have on First Nation band councils and their members living on reserve?

- What is the rationale for having INAC deliver MLGs as opposed to another delivery agent?

Clarity

- To what extent can fulfilment of these objectives be measured?

- Do the qualitative and quantitative statistics provide an indication of the scope and progression of MLG performance during this period? Where appropriate, do these sources provide estimates of the ability of MLGs to deal with expected First Nation demographic pressures?

Results

- To what extent are MLGs meeting stated objectives? From the viewpoint of the comprehensive approach taken by the Government of Canada since 1996, to what extent can they be said to have brought about changes in housing in First Nations communities, in particular access to private funding and capacity building?

- Does the fact that MLGs allow for loans, which have long-term portfolio agreements lead to better housing results as opposed to other mechanisms (e.g. capital grants)?

- Could the use of MLGs lead to unexpected consequences or unexpected positive/negative results (e.g. First Nation financial position)?

- To what extent has MLG defaults and arrears contributed to a First Nation being placed in Third-Party Management or Co-Management?

Cost-Effectiveness

- Are the results obtained by MLGs justifiable and viable from the perspective of the costs incurred for their implementation?

Design and Delivery

- What are the scope, objectives and eligibility criteria for MLGs? Are these elements clearly defined? Is there a logic model setting out the desired results for the MLGs?

- How uniform has MLG implementation been across Canada, e.g., in terms of processes, costs and client satisfaction? What regional variations, if any, exist? Have MLGs been approved for projects other than houses? If so, what impact have these projects had on the Government of Canada's default exposure? First Nation default exposure?

- What are the roles and responsibilities of INAC, CMHC, First Nation band councils and First Nation members living on reserve with respect to MLGs? Are they clearly outlined, understood and respected?

- Is MLG authority being managed with due diligence, including by regional offices? Is information on MLG performance measurement (success) being compiled systematically and adequately?

- What is the Government of Canada's exposure with respect to a MLG? What are the recovery rates for defaults, and what is the impact on the consolidated revenue fund? Why, in some cases, is the Government of Canada unable to recover funds when there has been a default on the loan?

Future Directions

- What lessons can be drawn from the MLG evaluation? What are the strengths and weaknesses?

- What risks/obstacles to success are involved in MLG delivery?

- What recommendations, options, alternatives, possible strategies or changes should be considered to improve MLG delivery? (e.g., should MLGs be available to individuals or through an alternate mechanism?)

- Could the use of MLGs be expanded to meet future First Nation priority needs (other than housing)?

2.3 Evaluation Methodology

2.3.1 Data Sources

The evidence that supports the evaluation was generated from a document review, a review of administrative data, secondary data, key informant interviews, and case studies. The data collection methods for each of the sources were outlined in a methodology report that was submitted as part of the preparatory phase of the evaluation.

- Document Review, Administrative and Secondary Data Analysis:

This data source involved the review of documents and administrative data pertaining to MLGs. This included program reports and reporting guides, program terms and conditions and project documents, such as operational plans, strategic plans and performance measurement strategies, and previous evaluations or studies. The documents were categorized into documentation pertaining to MLGs and pertaining to on-reserve housing, including documents from INAC, CMHC, Office of the Auditor General of Canada, Statistics Canada and other research papers. A complete listing of the documents reviewed is presented in Appendix B.

Administrative data related to MLGs and on-reserve housing inventory were gathered and calculated specifically for this study from data provided by INAC. The MLG data is from regional reports generated from the GLMS for each fiscal year and the housing data is from the Housing and Infrastructure Asset Inventory, Basic Departmental Data and the 2008 Compendium of INAC Program Data.

- Key Informant Interviews:

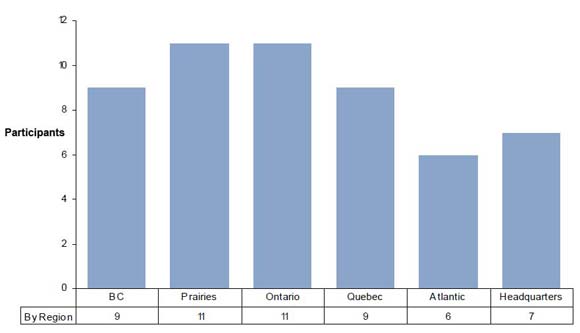

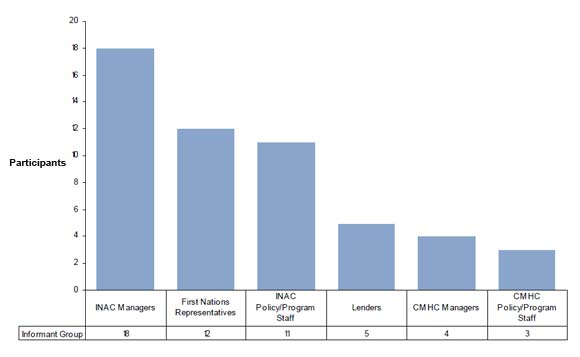

Sixty key informants were identified for the evaluation based on a list provided by INAC, in consultation with the Advisory Committee, and preliminary consultations. Key informants include representatives from the following categories (number of interviewees is in parentheses):

- INAC managers (18);

- INAC policy and program staff (11);

- CMHC managers (4);

- CMHC policy and program staff (3);

- Financial institutions (5); and

- First Nations representatives, individuals and organizations (12).

Six interview guides were developed based on the evaluation questions and circulated to participants prior to interviews. These questions were used to guide the discussions, and were supplemented with follow-up questions to probe into issues in more detail as appropriate.

Interviews were conducted over the phone and generally took 30 to 45 minutes. A total of 53 interviews took place (excluding interviews that were conducted as part of the case studies). A profile of the key informants that were interviewed is shown in Appendix C.

- Case Studies:

Case studies provided illustrative examples of the impact that MLGs have had on housing on reserve:

- In determining case study subjects, the aim was to have regional representation across the country and a variety of community sizes and proximity to urban centres. With respect to economic diversities, a collection of case study communities along a success continuum were selected. These ranged from a community that is economically well-off, to one that is currently third-party managed, and those in-between. The consultant worked with INAC and First Nation members of the Advisory Committee, to determine which subjects would be most appropriate illustrations along the continuum.

Profiles of each case study subject and the methodology used for each is outlined in Appendix D. Note that all interviews, which were conducted as part of the case studies were in addition to, and thus, separate from key informant interviews.

2.3.2 Limitations

There were some limitations on the data collected from the three main sources:

- There was limited documentation that focussed specifically on MLGs. The review thus, also looked at documentation related to on-reserve housing more generally. These sources were reviewed for any specific references on MLGs, and to provide information on how MLGs contribute to the 1996 On-Reserve Housing Policy as well as to provide context on other INAC activities and other financing programs, for example, those delivered by CMHC.

- Key informants selected for this study were selected based on the recommendations of the Advisory Committee with respect to persons who would be most knowledgeable about MLGs and First Nation housing issues. Therefore, the selection is inherently biased as no formal selection procedure was used. The plan for the evaluation was to interview 60 key informants, and 53 interviews were conducted with informants representing all the identified groups. Every effort was made to schedule interviews, and repeated attempts were made to secure participation (e.g., by phone and email requests). Those that were not interviewed either did not respond to interview requests, or declined to participate. Most of the interviews that were not completed were with First Nations representatives.

- The case study sites chosen were a convenience sample, recommended by First Nation housing technicians from across the country. While selection criteria were applied, there was no methodological rigor in the approach that would have generated a random sample.

- The sources that informed each of the subject case studies varied. The amount of information and documentation that communities were willing or able to share regarding their housing program and their financial situation varied amongst the subjects. In some cases, documentation was not available due to a lack of staff continuity and changes in information systems over the years. The same was true for interview participants – some in each community were unavailable to participate. End user interviews were only applicable in communities, which had individuals that had taken advantage of individual home ownership MLGs.

- Administrative data was only available up to 2007-08, and consequently, information for 2008-09 and 2009-10 were not included in this report.

3. Evaluation Findings - Relevance

This section presents the findings of the evaluation questions related to the relevance of MLGs. Under this area of inquiry, the evaluation sought to understand if MLG objectives are consistent with government objectives for housing, how relevant they are to First Nation band councils, what alternative mechanisms exist to MLGs for obtaining housing loan security, and which delivery agent is best positioned to deliver the MLG tool to its users.

The following sections outline the key findings as they relate to relevance.

3.1 MLG Objectives

MLG objectives are consistent with Government of Canada priorities with respect to on-reserve housing in that they assist First Nations in providing suitable, adequate, and affordable housing. They also support First Nations in fulfilling a role of deciding how, where, and when housing funds are invested by helping to provide access to private capital, which is one of the major priorities of the 1996 Housing Policy.

The review of government policy documents and documents describing the MLG's objectives showed that the Government of Canada's policy for on-reserve housing is largely based on the 1996 On-Reserve Housing Policy. The Policy is based on four key principles: community control; capacity development; shared responsibility; and access to private capital. [Note 16] To opt-in to the 1996 Policy, communities develop housing policies, programs, and multi-year housing plans that are specific to their community's needs. [Note 17]

The Government of Canada invests approximately $272 million annually through INAC and CMHC to assist First Nations communities in meeting on-reserve housing needs using a number of programs [Note 18], as well as other one-time funding announcements such as Budget 2005 (which included incentives to promote personal home ownership on reserve), [Note 19] and most recently in 2009, through Canada's Economic Action Plan. The Government of Canada outlines its On-Reserve Housing Policy in a number of documents.

Because reserve land is set aside for use exclusively by a band, there have been few opportunities for Chief and councils to access private capital due to the inability to provide loan security. One of the key principles of the 1996 Policy is to provide access to this private capital to allow communities to pursue other avenues to finance housing projects.

In key informant interviews, the vast majority of INAC representatives noted that the objective of MLGs is to provide collateral given that the Indian Act prohibits seizure by a non-Indian and secures financing for housing loans for First Nations communities. MLGs were also viewed as a tool to provide access to loans and mortgages for on-reserve housing, which allows First Nations communities to expand their housing stock. Nearly all interviewees from CMHC identified the same objective, focusing on the role of MLG as the security that replaces title, providing security in case of default to allow on-reserve lending. About half of the First Nations representatives also said the objective was generally defined as providing loan security to financial institutions and to ensure lenders will be reimbursed in case of default on the loan. The other half echoed this objective but with a somewhat different emphasis, noting the necessity of MLGs given the Indian Act and how MLGs enable First Nations to leverage capital for housing loans. Eighty percent of the lenders also identified these objectives.

A recent report on MLGs completed for INAC also identified its objective as "to facilitate access to financing required for the construction, acquisition and/or renovation of on-reserve housing. A sub-objective is to enable and encourage lending to individuals in support of home ownership opportunities for on-reserve residents through legislative and traditional property rights mechanisms." [Note 20]

3.2 Utilization of MLGs

Approximately 26,000 new housing units were constructed on reserve between 1996-97 and 2007-08 using MLGs, and there has been a need to increase the authority as recently as 2008. However, the level of up-take varies across regions.

As discussed earlier, under Section 89 of the Indian Act, "the real and personal property of an Indian or a Band situated on a reserve is not subject to charge, pledge, mortgage, attachment, levy, seizure, distress or execution in favour or at the instance of any person other than an Indian or a Band," [Note 21] and as such, in order to acquire loan financing, some form of a guarantee of payment in case of default is required by lenders. In addition, bands must be eligible for and receive an MLG in order to be eligible for the CMHC on-reserve non-profit housing program (Section 95), [Note 22] thus, there are clear policy and legislative directives that maintain the relevance of MLGs for on-reserve housing.

The relevance and efficacy of MLGs is also evidenced by the fact that communities have made such regular use of the tool that the authority for MLGs has steadily increased since its adoption in the late 1960's, more so in the last 10 years. In 1999, the authority was raised from $1.2 billion to $1.7 billion, and as recently as October 2008, it was raised yet again to $2.2 billion. [Note 23]

There is currently a very wide up-take of MLGs among First Nations communities, as many communities have few accessible options other than to use this tool in order to expand their housing program, as discussed in Section 3.3 below. Bands can also encourage individuals to participate in individual home ownership through a Section 10 loan and associated MLG to take pressure off wait lists for social and band-owned housing.

The analysis of the progression of MLGs between 1996 and 2008 has shown a significant increase in usage, with little sign of slowing down. From 1996-97 to 2007-08 (the most recent year where complete data is available), approximately 26,000 new housing units have been constructed, of which 22,311 are backed by MLGs, almost 80 percent. [Note 24] More than one-third of on-reserve housing units have active MLGs, [Note 25] and approximately 80 percent of First Nations communities currently have MLG backed mortgages. [Note 26]

There are, however, regional variations in terms of use of MLGs and the type of projects associated with MLGs. The next three tables present some regional data on MLGs to provide a more detailed look at the use of MLGs across the country. [Note 27]

Table 4 provides a regional summary of the 4,328 MLGs that were issued over the period of 1996-97 to 2007-08. As indicated, the two regions with the highest number of loans backed by MLGs and the number of units covered by these loans are British Columbia (B.C.) and Quebec. This is not adjusted for population. The average loan value for each housing unit covered varied from a high of almost $98,000 in the Yukon to a low of approximately $58,000 in Quebec.

| Region | Number of Loans |

Amount Guarenteed |

Average Loan Amount |

Number of Units covered by MLG Loans |

Average Loan value per housing unit |

|---|---|---|---|---|---|

| ATLANTIC | 565 | $108,252,122.92 | $191,596.68 | 1,654 | $65,448.68 |

| QUEBEC | 878 | $213,684,677.22 | $243,376.63 | 3,666 | $58,288.24 |

| ONTARIO | 487 | $248,942,548.87 | $511,175.67 | 2,892 | $86,079.72 |

| MANITOBA | 334 | $282,875,784.42 | $846,933.49 | 3,522 | $80,316.80 |

| SASKATCHEWAN | 490 | $210,522,286.21 | $429,637.32 | 3,431 | $61,358.87 |

| ALBERTA | 549 | $226,903,570.31 | $413,303.41 | 3,222 | $70,423.21 |

| YUKON | 36 | $12,191,136.02 | $338,642.67 | 125 | $97,529.09 |

| BRITISH COLUMBIA | 989 | $292,828,451.79 | $296,085.39 | 3,799 | $77,080.40 |

| National | 4,328 | $1,596,200,577.76 | $368,807.90 | 22,311 | $71,543.21 |

The next two tables present MLGs in terms of the purpose of the loan and type of housing project associated with the loan.

Table 5 provides a breakdown based on the purpose of the loan - for CMHC's Section 95, other band projects or individual band members. The unit of measure that is used for the comparison is the number of housing units covered by the loans. As discussed in the introduction, loans are most commonly used for the purposes of CMHC's Section 95 housing projects. Should CMHC change their criteria for the Section 95 program to not require MLGs, the demand for MLGs and the growth in their usage would most likely show a very different pattern.

Approximately 72.5 percent of housing units that were subject to an MLG loan for the period of 1996-97 to 2007-08 were associated with CMHC's Section 95 Program. There are regional variations from this national average.

| Region | Loans for Section 95 | Loans for Other Band projects |

Loans for Members | ||||

|---|---|---|---|---|---|---|---|

| Number of Units Covered by the Loans |

% of Total Units in the Region |

Number of Units Covered by the Loans |

% of Total Units in the Region |

Number of Units Covered by the Loans |

% of Total Units in the Region |

Total Units for all three loan types |

|

| ATLANTIC | 1,171 | 70.8% | 326 | 19.7% | 157 | 9.5% | 1,654 |

| QUEBEC | 1,639 | 44.7% | 1,589 | 43.3% | 438 | 11.9% | 3,666 |

| ONTARIO | 2,544 | 88.0% | 157 | 5.4% | 191 | 6.6% | 2,892 |

| MANITOBA | 2,994 | 85.0% | 521 | 14.8% | 7 | 0.2% | 3,522 |

| SASKATCHEWAN | 3,230 | 94.1% | 191 | 5.6% | 10 | 0.3% | 3,431 |

| ALBERTA | 2,314 | 71.8% | 704 | 21.8% | 204 | 6.3% | 3,222 |

| YUKON | 120 | 96.0% | 4 | 3.2% | 1 | 0.8% | 125 |

| BRITISH COLUMBIA | 2,157 | 56.8% | 1,202 | 31.6% | 440 | 11.6% | 3,799 |

| National | 16,169 | 72.5% | 4,694 | 21.0% | 1,448 | 6.5% | 22,311 |

The use of individual loans for members is more common in Quebec and B.C. (approximately 12 percent of housing units in both regions compared to the national average of 6.5 percent). These two regions also had a higher proportion of other band sponsored projects. On the other hand, in the Yukon and Saskatchewan, the vast majority of MLGs were used for the purposes of CMHC's Section 95 program (or approximately 96 percent and 94 percent respectively in terms of units covered by the loans).

Table 6 provides a similar breakdown based on the type of housing project - construction, renovation or purchase. Again, there are regional variations from the national average, most notably for the regions of Quebec and Alberta. Both regions had a lower proportion of loans used for construction. In the case of Quebec, a greater ratio of loans were applied to renovation projects (8.5 percent compared to the national average of 3.2 percent), while in Alberta more loans were used for purchasing houses (11.5 percent compared to the national average of 4.0 percent).

| Region | Loans for Construction | Loans for Renovation | Loans for Purchase | ||||

|---|---|---|---|---|---|---|---|

| Number of Units Covered by the Loans |

% of Total Unitsin the Region |

Number of Units Covered by the Loans |

% of Total Units in the Region |

Number of Units Covered by the Loans |

% of Total Units in the Region |

Total Units for all three loan types |

|

| ATLANTIC | 1,585 | 95.8% | 42 | 2.5% | 27 | 1.6% | 1,654 |

| QUEBEC | 3,247 | 88.6% | 312 | 8.5% | 107 | 2.9% | 3,666 |

| ONTARIO | 2,854 | 98.7% | 9 | 0.3% | 29 | 1.0% | 2,892 |

| MANITOBA | 3,169 | 90.0% | 76 | 2.2% | 277 | 7.9% | 3,522 |

| SASKATCHEWAN | 3,311 | 96.5% | 49 | 1.4% | 71 | 2.1% | 3,431 |

| ALBERTA | 2,660 | 82.6% | 192 | 6.0% | 370 | 11.5% | 3,222 |

| YUKON | 121 | 96.8% | 0 | 0.0% | 4 | 3.2% | 125 |

| BRITISH COLUMBIA | 3,765 | 99.1% | 24 | 0.6% | 10 | 0.3% | 3,799 |

| National | 20,712 | 92.8% | 704 | 3.2% | 895 | 4.0% | 22,311 |

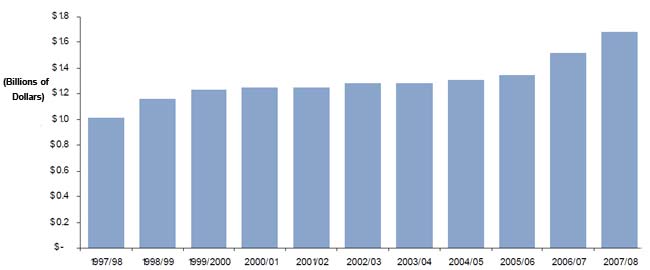

Usage of the MLG authority, as discussed earlier, has been increasing steadily between 1997 and 2008, culminating with the need to retroactively increase the MLG authority in 2008 when the contingent liability was inadvertently exceeded. Chart 3 shows the increase in contingent liability over that period.

Chart 3: Contingent Liability

Source: Guaranteed Loan Management System, 2009

This figure shows the increase in contingent liability from 1997-2008.

Each year is segmented along the horizontal x axis. The vertical y axis denotes the unit of measurement in billions of dollars.

The 1997/98 contingent liability rate is listed at $10 billion. The 1998/99 rate is approximately $11.5 billion. The 1999/2000 column indicates $12.25 billion. Both the 2000/01 and 2001/02 are listed at $12.5 billion. The columns indicating 2002/03 and 2003/04 increased to $12.75 billion. The 2004/05 rate is $13 billion. The 2005/06 rate increases to $13.5 billion. The 2006/07 rate is approximately $15.25 billion. The final column illustrating the 2007/08 contingent liability rate is listed at approximately $17 billion.

3.3 Alternatives to MLGs

There are alternatives to MLGs for obtaining loan financing, including the First Nation Market Housing Fund, CMHC mortgage insurance, grants, revolving loan funds, and leveraging existing relationships with financial institutions, however the cost and/or eligibility criteria for most alternatives to MLGs can make them prohibitive and consequently, inaccessible to many communities.

Through a review of documents and key informant interviews, a number of existing alternative tools to financing new on-reserve housing were identified, including:

- On-Reserve Homeownership Loan Insurance Pilot Product without Ministerial Loan Guarantee (CMHC Program): The First Nation sets up a trust (minimum $150,000) to provide security on the loan. The pilot program has been operating for five or six years, however, there are less than five communities that have accessed the program.

- First Nation Market Housing Fund: Similar to the pilot program (above), the idea of this fund is to replicate off-reserve lending, thus, requiring mortgage insurance. The band needs to qualify for the fund, however, and to date, only six Fist Nations have qualified [Note 28]. This fund is run by an independent entity made up of nine trustees of government, lenders, and First Nations, although CMHC manages the day-to-day activities of the fund.

- CMHC mortgage insurance: (same as off reserve), but this cost would vary by community and in some cases, the premium would likely be prohibitive.

- Grants for social housing: To have any effect, this would involve a large amount of capital funding that may not be practical.

- Revolving loan funds: This is currently being successfully implemented in a few communities but a stream of revenue is required to make it viable, for example, rent.

- Conventional lending: Institutions, such as RBC, BMO and Caisse Populaire, are active in lending to First Nations for housing loans with First Nation bands they have good working relationships with in the past.

While there are a number of alternatives to MLGs identified, it is clear that these alternatives are for the most part not accessible. While respondents noted some of the existing options, it became clear from the responses that the options available to a community depend on the community's financial and economic situation (i.e., those that are well-off financially have more options). Nearly all INAC respondents estimated that only 10-15 percent of First Nations communities might have the ability to take advantage of those options, while the remainder relies on MLGs to access financing for on-reserve housing. The responses from First Nations representatives were consistent with that point of view. Nearly all First Nations respondents stated that the criteria for these programs are very stringent and out of reach for most communities. They believed that these programs are only available for between 5-15 percent of communities, depending on the region. Similarly, nearly all interviewees indicated that those communities that are in a good financial position can get financing on their own with lending institutions.

This was also clear in four of the five case studies (the fifth is in third-party management and is ineligible for MLGs). Two of the case study communities relied on MLGs for both CMHC's Section 95 and band housing units. One community had recently embarked on a housing plan after years of stagnation, and MLGs are an integral part of it.

The fourth community had stopped building band housing (social or band-owned), and instead relied on the MLG tool to encourage its members to purchase or build their own homes on reserve. While informants recognized the value in bands encouraging individual home ownership by obtaining MLGs on their members' behalf, this community made it the central theme of their housing strategy. Over the last four years, 27 individual home ownership projects have been completed.

Accessible alternatives to the use of MLG's would reduce the reliance of First Nations communities on this tool and may facilitate a move away from social housing as the only financially viable option for increasing the number of homes on reserve.

3.4 The Absence of MLGs Would Have an Impact on First Nations Communities

Documents and information obtained from key informant interviews and case studies indicate that the absence of MLGs would have negative impacts on First Nations communities' ability to finance on-reserve housing. Since lending transactions for housing require mortgage insurance in order to be in line with the National Housing Act, CMHC does issue a mortgage insurance certificate for all transactions backed by an MLG without collecting a premium. CMHC uses the MLG as insurance, eliminating the need to charge premiums. In the absence of the MLG, CMHC would have no meaningful security, and would have to charge an insurance premium significantly in excess of what is changed off reserve to compensate for the high-risk, or tight underwriting criteria unless changes were made to the program to allow for lower insurance premiums. This would essentially restrict access to these loans, leaving most communities with no alternative to finance housing on reserve as they are generally ineligible for most other financing tools and programs. [Note 29] It is believed that the number of new units would decrease and overcrowding rates may rise. These concerns were also mentioned by key informants from INAC and CMHC during interviews.

Over half of the key informants representing First Nations felt that without MLGs, there would be very limited options to obtain housing on reserve. Some of these respondents described such a situation as a "disaster", as there are no other accessible options. They felt that the number of new units would decrease and there would be a lot less social housing as funding would depend solely on such housing grants that exist. More than 20 percent of those First Nations respondents felt that larger communities that have other options would be able to maintain their housing program by using those options, while smaller communities with access to fewer resources would suffer the most.

Evidence of the latter statement was also seen through the case studies that were conducted:

- Four of the five communities profiled were located in either remote or rural areas, and interviewees from all four of those communities felt they had no other options other than to utilize MLGs;

- Three of the five communities had populations fewer than 1,000 residents on reserve, and all three of them felt they had no other options other than to utilize MLGs; and

- Three of the five communities either were now or recently working under a Remedial Management Plan (RMP) with a co-manager or under third-party management, and all three felt they had no other options other than to utilize MLGs if they qualified. Communities under third-party management are not eligible but may have used MLGs in the past before they were in a third-party management situation.

3.5 INAC as the MLG Delivery Agent

While government support for housing on reserve is shared between INAC and CMHC, there is no consensus amongst INAC interviewees on who would be the best delivery agent for MLGs between INAC and CMHC, while there was consensus amongst CMHC interviewees that INAC is the best delivery agent for MLGs.

The most recent policy proposal that secured an increase in the MLG authority clearly stated that the responsibility for supporting on-reserve housing overall from the Canadian Government is shared between INAC and CMHC. However, there were differing opinions regarding whether INAC should remain the primary delivery agent for MLGs.

One-third of the total INAC respondents believed that INAC is the appropriate delivery agent for MLGs. Since it is a ministerial guarantee, these respondents believed that the delivery agent must be INAC, especially since the information needed for reviewing applications, such as financial audits, are the responsibility of INAC. Of those respondents, some also mentioned that CMHC would not be appropriate since they are a lender for most MLG backed loans, which could result in a conflict of interest. They felt INAC is best situated because the Department has day-to-day knowledge of First Nations and how they manage their funds.

Another one-third of INAC respondents believe CMHC would be a better delivery agent. They felt that the agency administers housing programs on behalf of the Government, and they are the housing experts. Loans would be guaranteed by the Minister responsible for CMHC. Some of these respondents linked this to accountability. Since most MLG backed loans are for CMHC programming, they viewed it as CMHC using most of INAC's MLG authority, resulting in misplaced accountability. Another respondent from this group of respondents also believed this would allow CMHC to take more ownership of the issue and develop other options, such as a mortgage insurance program (without MLGs) or determine how to improve accessibility to MLGs.

The last third of INAC respondents were unsure on the most appropriate delivery agent. As noted by one respondent, the issue is a complicated one because while CMHC are experts on housing, INAC are the experts on First Nations communities. Only one INAC respondent suggested that eventually, First Nations organizations should deliver the service.

While there were mixed views among the INAC representatives, all CMHC representatives agreed that INAC should be the delivery agent for MLGs. They stated that INAC is the federal lead on housing on reserve and is responsible for the Indian Act, and that INAC is the one providing the guarantee and CMHC does not have all the financial information to take on such responsibilities.

3.6 Conclusions

MLG objectives are consistent with government priorities for housing in First Nations communities. It is a relevant tool, as it is currently required for communities to obtain a CMHC Section 95 social housing subsidy. It is being utilized as is evidenced by the need to continuously increase the authority amount. They are effective insofar as access to MLGs have allowed communities to produce approximately 26,000 new housing units between 1996-97 and 2007-08 that may not exist otherwise. While some alternatives to MLGs do exist, these depend heavily on the financial strength of the community, and as such, these are only alternatives for approximately 15 percent of bands, resulting in a high level of interest in, and utilization of, MLGs. Reliance on MLGs may decrease if other viable final alternatives were developed. Currently, the absence of MLGs would essentially stop the expansion of housing programs in most First Nations communities, particularly those that are smaller, in rural or remote areas, or are experiencing financial difficulties. It would also require CMHC to not only make administrative changes to their programs, but would require them to charge a prohibitive premium for loan insurance or a change in legislation. INAC is the lead for many on-reserve policies, and has a minister that can provide the authority to provide guarantees. There is insufficient evidence to suggest a new delivery agent would be appropriate.

4. Evaluation Findings - Clarity

This section presents the findings of the evaluation questions related to the clarity of MLGs. Under this area of inquiry, the evaluation sought to understand the extent to which the fulfillment of MLG objectives can be measured, and whether there is data to indicate the scope and progression of MLGs between 1996 and 2008.

The following sections outline the key findings as they relate to clarity.

4.1 Measurement of MLG Objectives

There are no documented performance measures or metrics for MLGs, although housing in general has various metrics from various sources and groups, related to housing adequacy and housing servicing. Tracking of the MLG authority through the GLMS (now Guaranteed Loan Management Module (GLMM) is the only measurement of MLGs that formally takes place.

There was no documented evidence of performance measures specifically for MLGs. However, there is evidence of performance measures related to housing as a whole. Logic models and associated performance measures have been developed for each of the Department's five strategic outcomes. For the Community Infrastructure Program, one of the three expected results is "improved First Nations housing". Two performance indicators have been established to measure this result: 1) Percentage of First Nation-reported adequate houses for each First Nations community; and 2) Number of First Nations eligible for access to the First Nation Market Housing Fund. [Note 30]

INAC has also developed indicators for the performance measurement framework for the Capital Facilities and Maintenance Program (CFM). Two indicators are established for Housing and Housing Servicing: 1) Percent of First Nation-reported 'adequate' houses per First Nation community; and 2) Housing Servicing: a) percent of houses with water service, and b) percent of houses with sewage service. High-level strategic indicators to link the results achieved by the CFM Program within INAC's broader objectives have also been developed. One of these indicators is an increase in private ownership of housing in First Nations communities. [Note 31]

In interviews, about 40 percent of the INAC respondents identified the MLG authority as the only formal measurement of MLGs, and this measurement is through the GLMS, which captures information related to MLGs, including the number and value of loans, their repayment schedules, the number of units, and loan purposes, as well the Government of Canada's contingent liability. GLMS is essentially a database that does little else except monitor the authority, that is, it is generally not able to assist in making management decisions. Interviewees reported that a new version of GLMS is being developed, and it is expected that it should provide more flexibility to provide more accurate and more detailed information (this new version, the GLMM, became operational in May 2010). The authority is now monitored on a monthly basis, though in the past it was tracked annually.

Another 40 percent of INAC respondents noted that the loan payment schedules and level of arrears could measure the effectiveness of MLGs. They felt that from a financial perspective, the measure of success of MLGs should be the default rate, although it is unclear how the default rate provides an indication of MLGs meeting their overall objective.

Less than 20 percent of INAC respondents identified the tracking of the number of units that are built using MLGs as a measure of outcomes. However, none of these respondents were aware if this data is cross referenced with housing statistics to try to actually gauge the impact MLGs are having on housing specifically. It was reported, for example, that INAC has some indicators on on-reserve housing, but does not track MLG versus non-MLG backed housing. While there is merit in doing this type of analysis, making a connection to a policy outcome is a difficult task, given that MLGs are a tool and not a program.

Nearly all INAC respondents identified the GLMS as the primary tool for assessing the authority. About one third of those respondents who were most familiar with the GLMS, also responded that the MLG authority will be monitored more stringently now through the new version of GLMS. Going forward, regions will receive a notional target for spending, and anything over this target will need Headquarters approval. In fact, a large part of redeveloping the GLMS system is to monitor the MLG authority. The system will have new controls and forecasting capabilities. For example, information will be entered at the application stage, therefore, allowing for a better idea of the take-up at the application stage. Discussions are still ongoing about forecasting and the process to allocate targets to regions, and reporting guidelines for the regions.

4.2 MLGs have Progressed Significantly between 1996 and 2008

Available statistics show that MLGs have been heavily relied upon for housing financing purposes by First Nations communities, and the on-reserve default rate is comparable to the default rate of mortgages off reserve. With Canada's First Nations population growing significantly, these statistics provide some indication of the ability of MLGs to deal with demographic changes.

A review of documents and reports, and data from Statistics Canada and the GLMS system revealed evidence related to the progression of MLG performance since 1996.

Aboriginal populations in Canada continue to grow significantly. The First Nations population in Canada increased 29 percent between 1996 and 2006, compared to eight percent for the non-Aboriginal population. The population is also relatively young, with 48 percent of the Aboriginal population consisting of those under 24 years old, compared with 31 percent of the non-Aboriginal population. [Note 32] In addition to a rapidly growing population, demographic pressures facing First Nations include the reinstatement of registered Indian status for many First Nation citizens through Bill C-31. [Note 33] A 2006 review prepared by INAC on First Nation infrastructure requirements identified four major drivers facing present and future First Nation infrastructure needs, one of which was the high population growth on reserve. [Note 34] It is estimated that roughly $820 million in capital is required, through public and private funding support, to accommodate the anticipated growth of the population. [Note 35]

As discussed in Section 3.2, the analysis of MLG progression between 1996 and 2008 shows that it is heavily relied upon for financing purposes. Not only has the contingent liability been steadily growing since 1996, but so have the amounts guaranteed per loan (53 percent), and the MLG amount per unit (81 percent). [Note 36] This could be for a number of reasons, including inflation, increasing construction costs and changes to design and building materials. Either way, they show increasing costs to providing housing on reserve, and thus, an increasing demand for financing options.

With regard to default rates, the data has also shown that default rates for MLG backed mortgages have historically been comparable to off-reserve mortgage default rates. The 2008 Policy proposal for the MLG authority increase cited a historical default rate of approximately 0.6 percent for MLG backed financing, compared to a national average of 0.5 percent, according to research by Dominion Bond Rating Service. [Note 37] In addition, INAC keeps a reserve for losses to pay for guarantees when loans do indeed default. The reserve is budgeted each year at $2 million, but the average amount used to pay for defaults annually since 1996 is $736,106, with the full $2 million only having been used once since 1996. [Note 38]

While MLG usage as a whole remains high, it is highly concentrated on CMHC's Section 95 or band-owned housing. Only 6.5 percent of the units built that were backed by MLGs are for personal home ownership loans, and only three percent were for renovations.

4.5 Conclusions

INAC tracks usage of the MLG authority but does not currently measure whether or not MLG objectives are being achieved, nor has it set any performance targets or goals. However, INAC does collect and track relevant information, such as the proportion of new units covered by MLGs, suggesting that fulfillment of MLG objectives can be measured, but not without a complete performance management plan. According to a review of statistics, administrative data and trends, MLGs are relied upon by First Nations communities to ensure access to financing for housing projects on reserve. The vast majority of the loans are to access CMHC's Section 95 housing loan and subsidy. With a growing and young on-reserve population, there will continue to be more pressure on bands to meet housing demands for its members into the future.

5. Evaluation Findings - Design and Delivery

This section presents the findings of the evaluation questions related to the design and delivery of MLGs. Under this area of inquiry, the evaluation sought to understand the scope and objectives for MLGs, the consistency of their implementation across all regions, the clarity of roles and responsibilities of stakeholders, the due diligence that goes into managing the MLG authority, and the resulting risk exposure for the Government of Canada.

The following sections outline the key findings as they relate to design and delivery.

5.1 Logic Model and Process

Given the fact that MLGs are a tool to facilitate broader housing objectives, it does not have a defined logic model. However, a new Operational Guide is being developed for processing of MLGs to ensure consistent processes across regions, which outlines the conditions under which First Nations communities are eligible for MLGs, and the associated timelines.

As discussed earlier in Section 3.1, the policy objective of the MLG is to facilitate access to financing required for the construction, acquisition and/or renovation of on-reserve housing. [Note 39]

As discussed in the introduction, housing loan guarantees on reserve are generally broken down into three groupings: 1) Loans required to finance social housing; 2) Loans to support other First Nation managed housing projects; and 3) Loans to individuals (home owner projects), through the band council. The majority of the guaranteed loans are associated with CMHC programs, most notably Section 95. [Note 40]

A high-level overview of the process to obtain an MLG is as follows, as outlined by key informants and document reviews:

- Band council secures financing for a housing project with a lender;

- Band council must then submit a BCR, along with other documentation to INAC for approval, including site plans, housing plans, specifications, cost estimates, environmental assessments, etc.;

- INAC then determines eligibility for the MLG and issues a guarantee certificate;

- The band works with a lender to finalize loan details, and with CMHC to obtain a mortgage insurance certificate (as required by the National Housing Act);

- In case of default, INAC works to recover defaults from the band council, whether the loan is for a band mortgage or an individual's mortgage that has been sponsored by the band; and

- For CMHC's Section 95 Program, INAC provides a preliminary list of those communities that are eligible for MLGs to CMHC, so they can allocate units among those eligible prior to the BCR stage.

The number of people who need to sign-off varies in each region, however, these regional differences should be phased out as the new GLMM is rolled out. The new GLMM is intended to automate much of the process, as it will interface with other INAC information systems.

A draft Operational Guide is being developed to outline business processes and roles for administering MLGs. This includes steps and processes for: application and approval, renewing loan term, transferring/assigning of a guaranteed loan, retiring a guaranteed loan, notification of loan default, claim to Minister for payment, renewing an MLG when borrowers separate/divorce and selling of a house. [Note 41] The new Operational Guide, which includes a toolkit, is intended to streamline the process and documentation requirements.

First Nations under third-party management are not eligible for MLGs. If they have been experiencing an operating deficit, they may get an MLG if they have successfully been operating under a RMP. [Note 42] First Nations that have not submitted proper financial reports, or have arrears on any existing guarantees may also not be eligible for MLGs. [Note 43]

There were concerns expressed from First Nation respondents in key informant interviews with respect to the time it takes to get through the MLG process. While nearly all First Nations indicated that the process was relatively clear, when it came to timing, as well as the amount of paperwork involved, there were more concerns. Timelines appear to vary by region. One respondent indicated it can take three to six months but it was not clear why there is a difference. A respondent from another region noted it was a huge administrative exercise and it can be up to eight weeks to receive an MLG certificate, although this process is improving. A respondent from yet another region indicated it can take approximately three weeks once final paperwork is submitted. This is consistent with concerns that were raised during the preliminary interviews with INAC staff.

5.2 Consistency of Implementation

MLGs have been implemented consistently across the country with some minor variations at the regional level, although timing of the MLG cycle can be an issue for some communities with respect to construction season. Since 1996, there is little evidence of MLGs approved for projects other than housing.

Generally, all INAC key informants from across regions described a relatively similar implementation process for MLGs. Once the First Nation community obtains agreement on financing from the lender, they apply to INAC for the MLG. The INAC housing officer (or equivalent) reviews the application for completeness and eligibility. If anything is missing or incomplete, the officer works with the community to complete necessary documentation for the submission. The Funding Services Officer (or equivalent) reviews the file to ensure financial viability of the band, including any existing defaults, arrears, missing reports or intervention that is currently happening, before sign-off is done, and the MLG certificate is issued. As discussed earlier in Section 5.1, the number of people who need to sign-off varies in each region.

When asked to describe the MLG process, the response from CMHC representatives identified minor variations within regions. For example, in the B.C. region, they indicated the MLG process is timely and there is very good communication with INAC. CMHC and INAC work closely together from the beginning of the project. For example, a conditional loan letter is taken to INAC to start the MLG process, and generally, CMHC receives the MLG six weeks later. In Alberta, they indicated that the scope and eligibility are generally clear, though some individuals may not be clear on the process. A CHMC representative from Quebec had the opposite view, where the process to apply for an MLG was clear, but the eligibility criteria that are applied are not clear at all. At a minimum, regional practices must comply with the Department's housing policy, the MLG authority terms and conditions, and the program directive. [Note 44]

These variations may be attributable to the fact that MLG oversight had been decentralized to regional offices, with no coordination or regular monitoring by Headquarter. [Note 45] However, these regional differences should be phased out with the implementation of the new MLG procedures manual, and the roll-out of the new GLMM, which will automate some parts of the process, for example, the review conducted currently by funding services officers will fully automate.

Issues related to timing discussed in Section 5.1 not only create a sense of unpredictability surrounding the eligibility of MLGs, but they can also affect housing project schedules. Construction seasons vary across the country. However, at its broadest level, building projects are essentially at a standstill from early winter to late spring, making the timing of the approvals process important. These timeline variations have in the past caused two of the case study communities to delay the completion of projects.

More than 80 percent of INAC respondents provided consistent responses in terms of MLGs being for housing purposes only. There were very few exceptions to this. One exception in the past has been for emergency shelter programs (such as Project Haven), but very few of those are still active. In Quebec, there were applications for other types of projects such as old age homes and community service buildings, but none were approved.

Interviews with key informants, and case study subjects often commented that due to a lack of continuity and capacity on reserve, it is common for INAC staff to consistently request more information to complete MLG applications from bands, further lengthening timelines.

5.3 Roles and Responsibilities